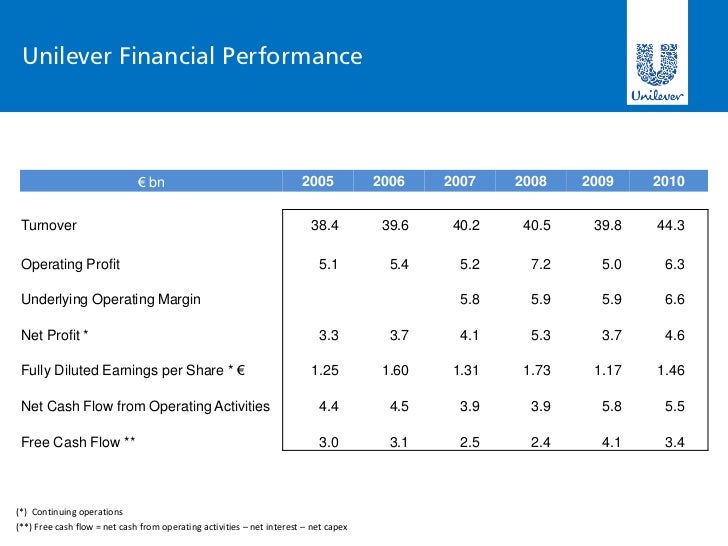

Out Of This World Unilever Financial Performance

Unilevers success over the last 130 years and its future success are shaped by the strengths that give us competitive advantage.

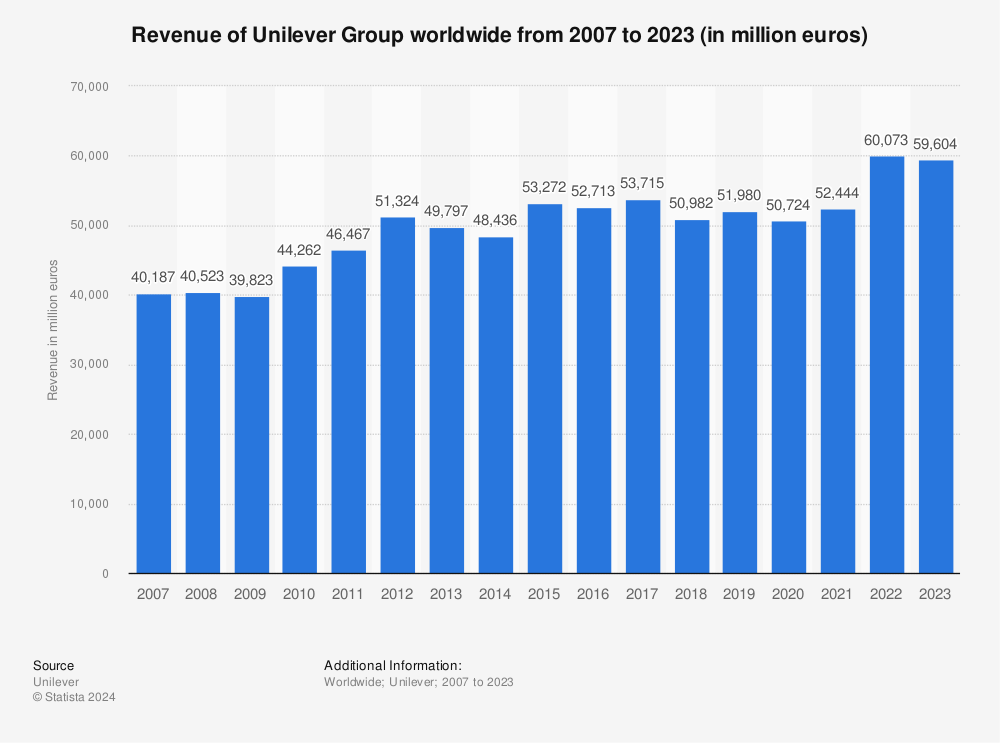

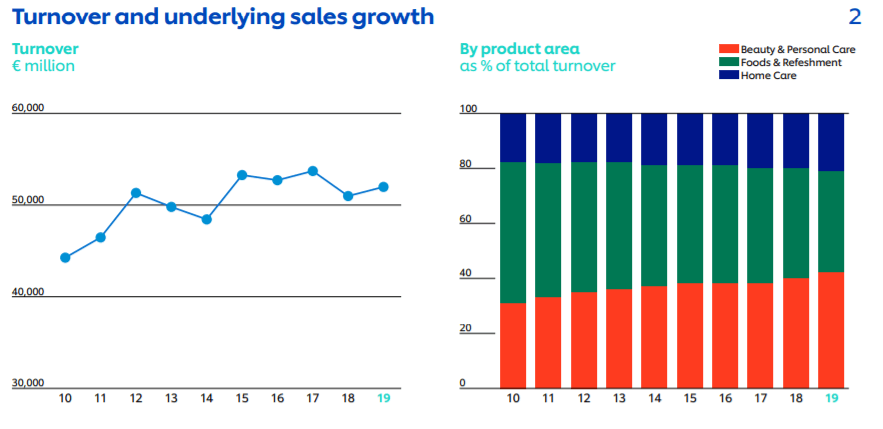

Unilever financial performance. Unilever plc is a diversified personal product 42 of 2020 sales by value home care 20 and packaged-food 38 company. The firms brands include Knorr soups and sauces Hellmanns mayonnaise Lipton teas Axe and Dove skin products and the TRESemme hair-care brand. Before the investment analysis of financial performance may be an elementary want of each investor.

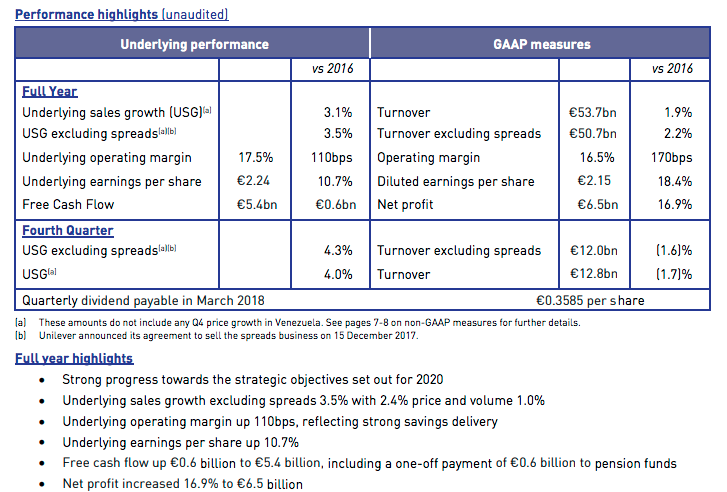

Overview of Unilever Group its business operations and environment as a whole. Introduction The following assessment will give an inside of the financial performance of the. It was impacted by investment in brands and input cost inflation according to the company.

Thus it is essential for the companys operations management to address concerns in these strategic decision areas to maintain high productivity. This research paper examines the financial performance of Hindustan unilever limited HUL using ratio analyze such as Liquidity Profitability Activity and Solvency position. November 26 2015 Words.

Business model drives superior performance consistently delivering financial results in the top third of our industry. HUL is that the one the oldest company within the Asian nation. The largest product segment of the Unilever Group is their personal care segment which generated approximately 211 billion Euros in revenue in 2020.

Financial performance helps to measure the overall performance of the company. The firm has been acquisitive in recent years and high-profile purchases. To analyze the financial performance of the company.

Its aid of financial health of any company within the world. The Financial Performance Of Unilever Plc Finance Essay Published. But Unilevers operating margin fell 100 basis points to 188.