Fabulous Unrealized Profit In Inventory

Dear Experts I have a question regarding this kind of elimination and I would be grateful if you could help me with it.

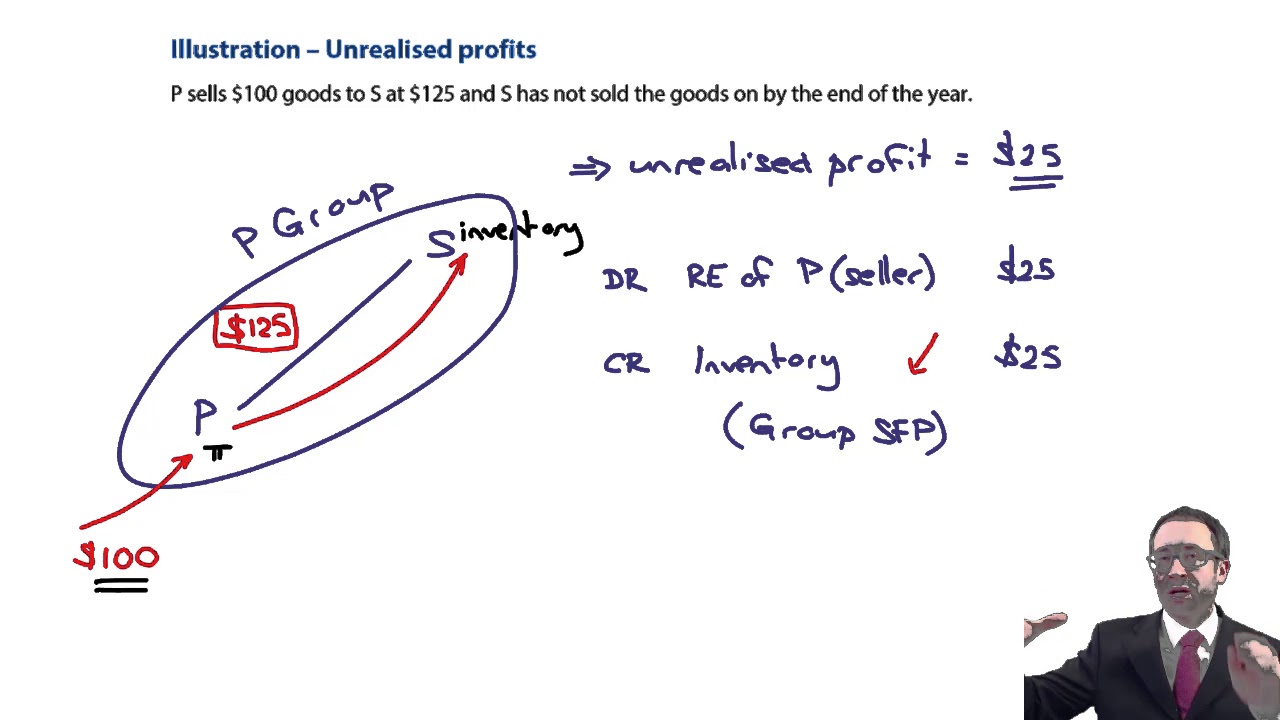

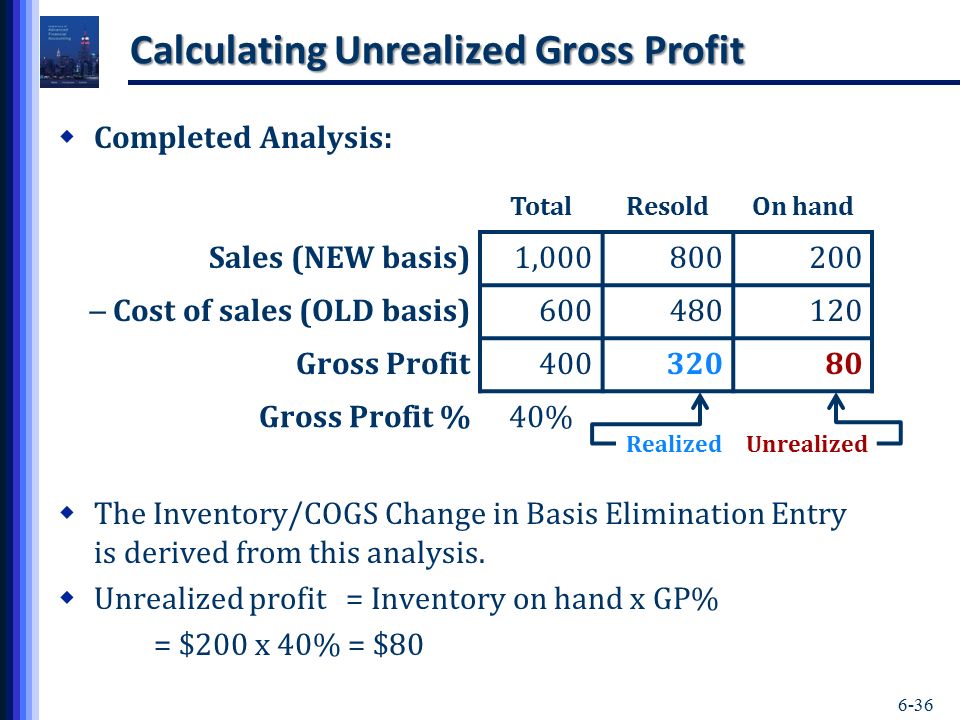

Unrealized profit in inventory. Despite the previous elimination unrealized gross profits created by such sales can still exist in the accounting records at year-end. In the balance sheet the total PUP is deducted from the inventory of. If margin was 20 on sales assume sales as 100 which will mean profit is 20 and cost is 80.

Is that handled in ECC system itself via custom program and then move it to Consolidation system or Is there any possibilities to handle in BPC consolidation system via business. No not all transactions require an adjustment entry for the Non-Controlling Interest NCI or Minority Interest calculation. Unrealized Gross ProfitYear of Transfer Year 1.

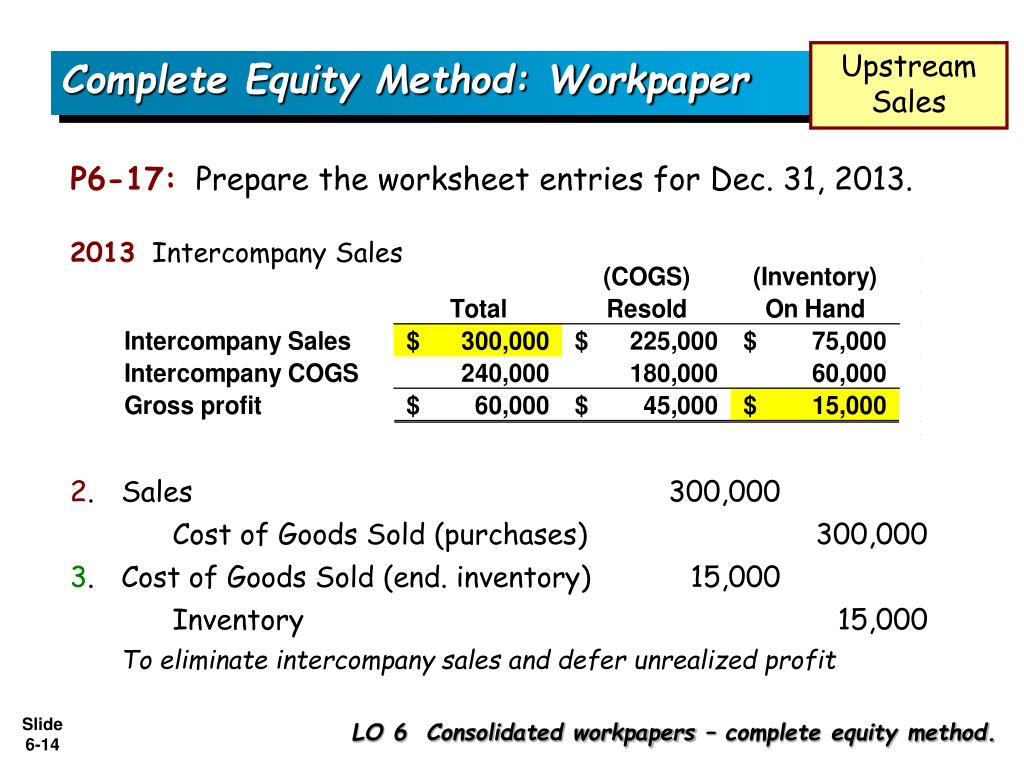

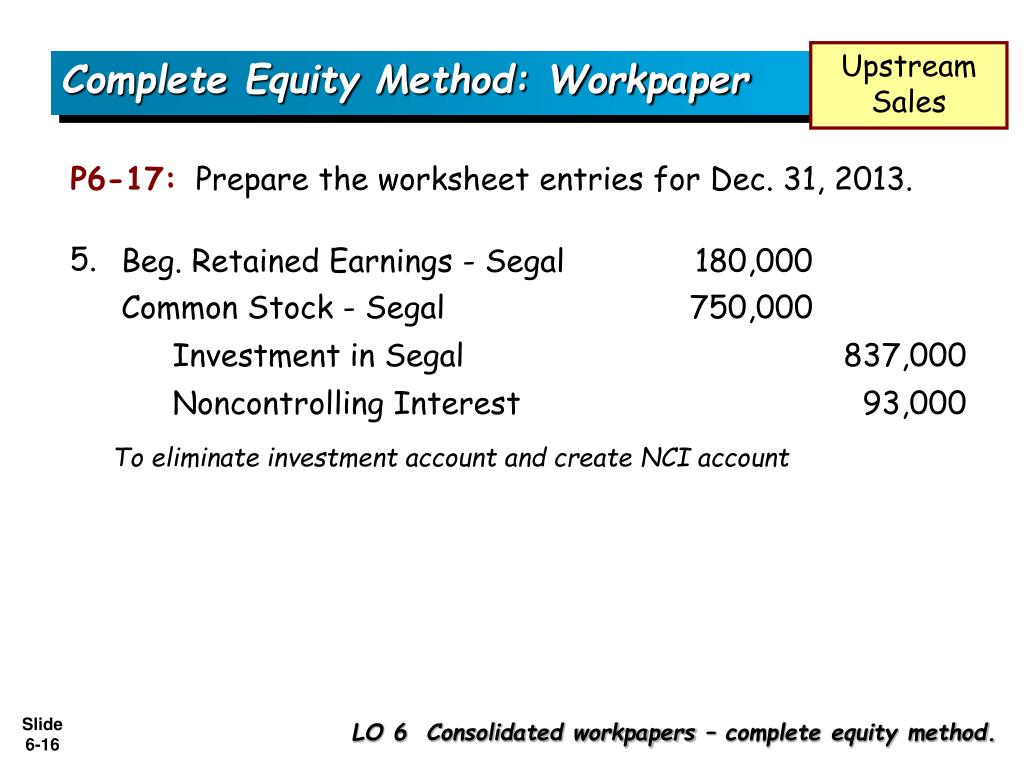

Consolidation - Unrealized profit on Inventory. In addition the unrealized profit on any unsold inventory involved in these transfers must be eliminated in preparing the financial statements for the current period. Removal of the salepurchase is often just the first in a series of consolidation entries necessitated by inventory transfers.

Unrealized profits on closing and opening inventory. Eliminating the above intercompany transactions. Same Assuming a FIFO inventory cost flow intercompany profit in inventories excluded from consolidated net income in one period will be realized by ____ in the next period.

When accounting for the unrealised profit with associates My understanding is that on the consolidated statement of financial position for the parent. The accounting adjusting entries for NCI require for those transactions which have. An entry is thus required to reverse the unrealized profit and the overstatement in closing inventory.

The unrealised profit ie. Unrealized profit in inventory. Unrealized profits are basically the profits that were included in the cost of inventory when such inventory was sold by one company of the group to another but this inventory.