Formidable Treatment Of Income Tax Paid In Cash Flow Statement

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

By contrast the indirect method starts with net operating profit and then puts through some adjustments to arrive at the cash flows from operating activities balance.

Treatment of income tax paid in cash flow statement. If you paid 30000 during the last quarter and accrued a total 42000 tax. Similarly if the starting point profit is above interest and tax in the income statement then interest and tax cash flows will need to be deducted if they are to be treated as operating cash flows. Taxation from CF Statement.

The statement will determine pre-tax income and subtract any tax payments. The current years provision for tax represents the amount of tax provided for the current year. Calculate the tax paid.

Exercise calculating the tax paid. Income and Cash Flow Statements The income statement or profit and loss statement also lists expenses related to taxes. A deferred tax asset arises when the carrying value of an asset is less than its tax base or carrying value of any liability is more than its tax base creating a deductible temporary difference.

Past trends show that it is normally Question 4 or 5 and is 60. Provision or Tax. The first method is if you start the Cash flow statement with Profit before tax then deduct the Provision for taxTaxes paid from Operating cash flow after working capital changes.

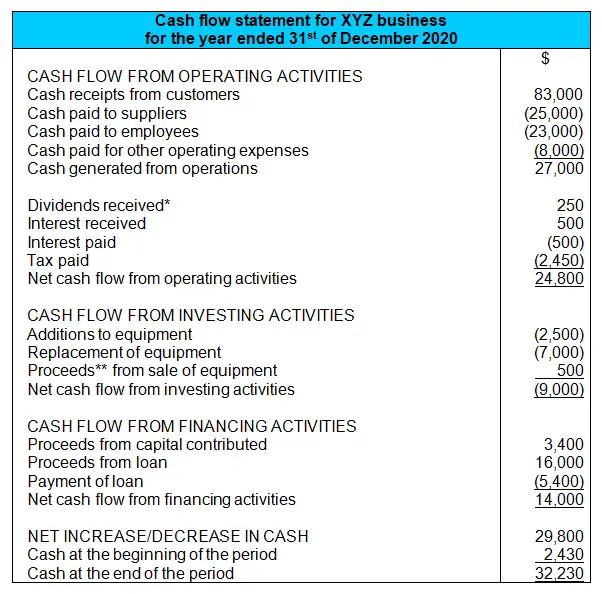

It is beneficial to postpone payment of taxes into the future as opposed to paying taxes today. The direct method of accounting for cash flows from operating activities starts from scratch and records all cash receipts and payments that are related to operating activities. During the year the tax charged in the statement of profit or loss was 100.

The amount of taxes your company paid for the accounting period goes on the cash flow statement. Treatment Of treatment of advance tax in cash flow statement Many cash flow items have a direct counterpart that is an accrual item on the income. Previous Tax Charge 2008 47162.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)