Looking Good Statement Of Retained Earnings Equation

Beginning retained earnings net income - dividends ending retained earnings.

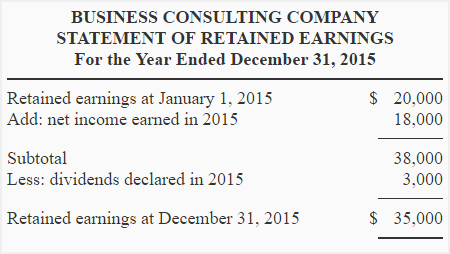

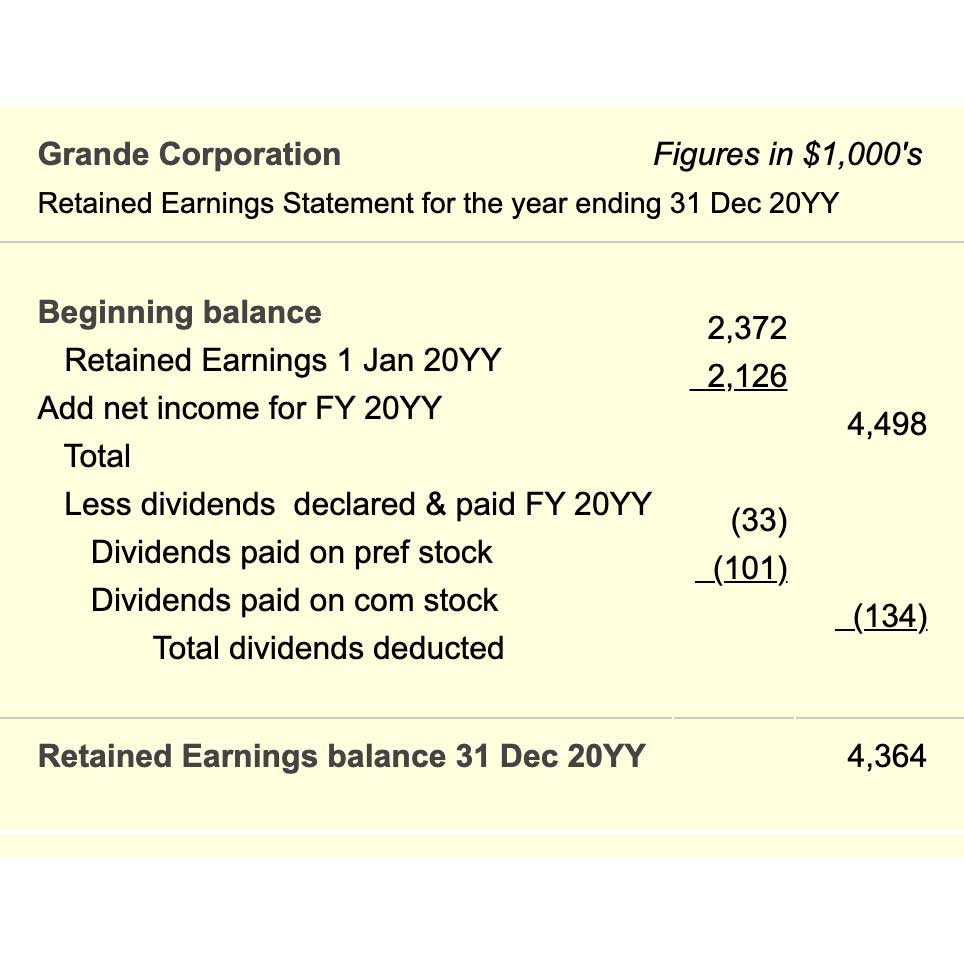

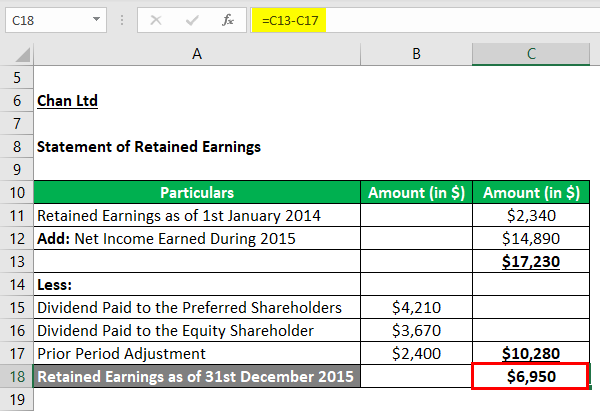

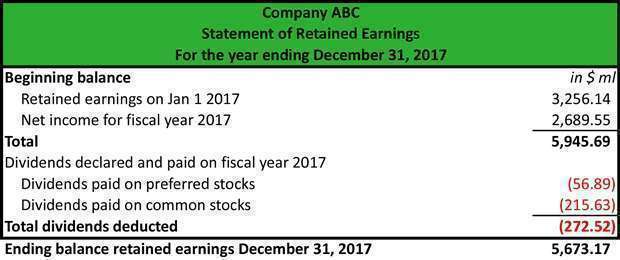

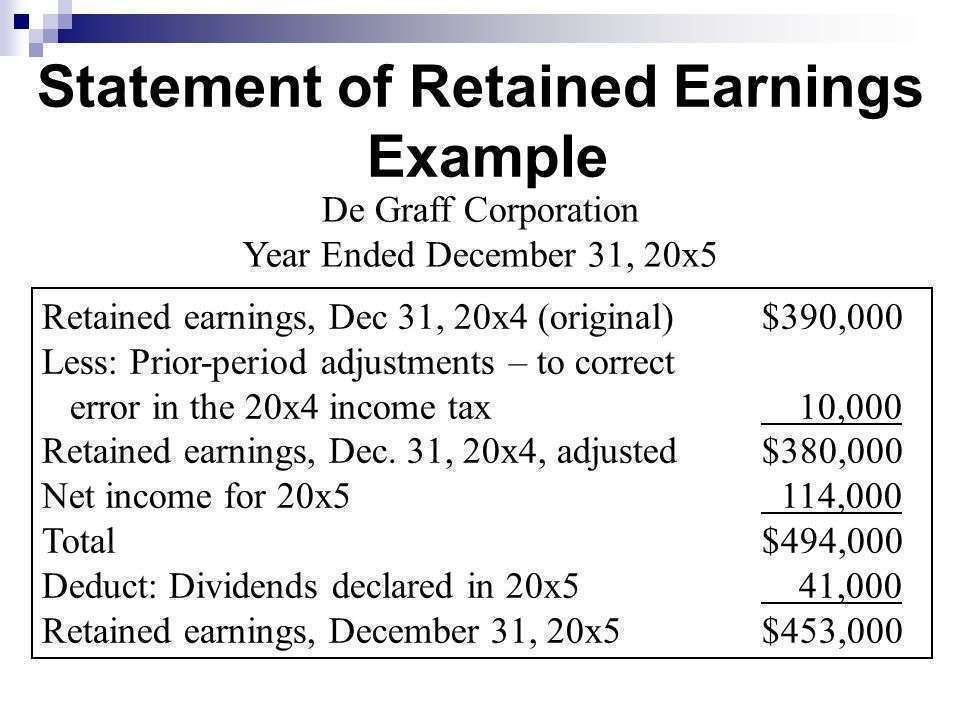

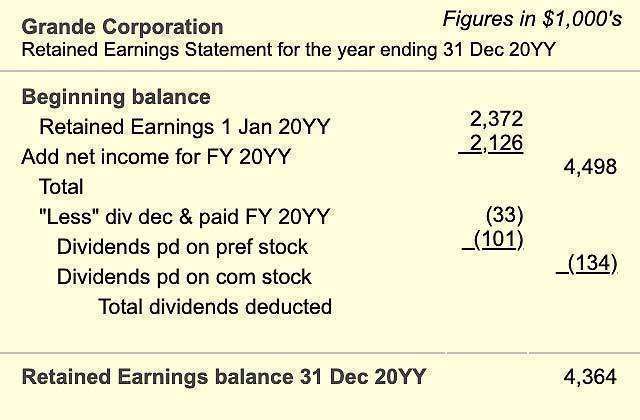

Statement of retained earnings equation. At the end of the current year the company has 1550000 of retained earnings on hand. In other words retained earnings are cumulative net income minus cumulative dividends paid to shareholders. Let us consider an example to better understand how to calculate retained earnings.

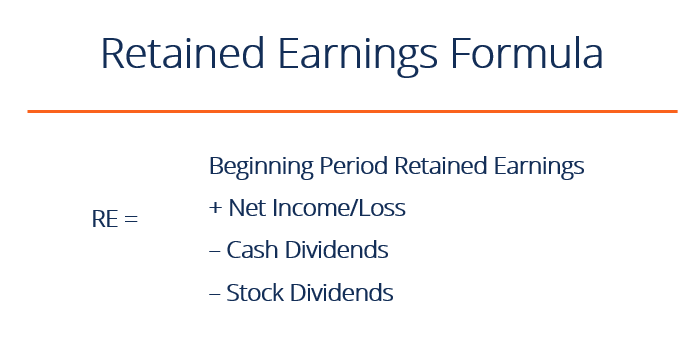

Its retained earnings calculation is. What is the Retained Earnings Formula. Retained earnings equation The result from the sale andor provision of services may be positive or negative.

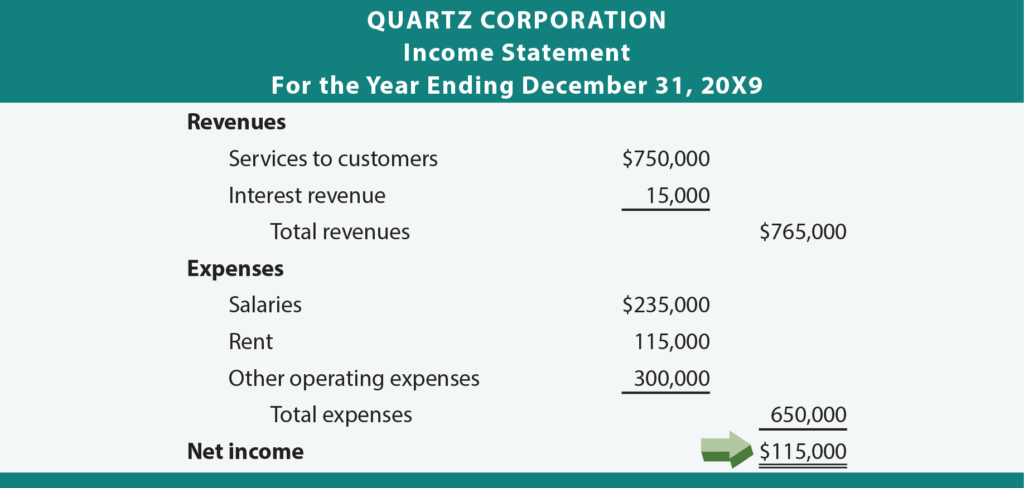

Given Beginning Period Retained Earnings 0. Income - Dividends Retained earnings can be calculated using the balance sheet. Terms Similar to the Retained Earnings Formula.

Earnings textBeginning Retained Earnings New. So the calculation of Retained Earnings equation will be as follows. 1200000 Beginning retained earnings 500000 Net income - 150000 Dividends 1550000 Ending retained earnings.

RE Beginning Period RE Net IncomeLoss Cash Dividends Stock Dividends. Net Income from the Income Statement 70000. Companies also maintain a summary report known as the statement of retained earnings.

How to calculate retained earnings. The retained earnings formula is also known as the retained earnings equation and the. Your accounting software will handle this calculation for you when it generates your companys balance sheet statement of retained earnings and other financial statements.