Nice Unrealised Profit Journal Entry

Foreign currency transaction.

Unrealised profit journal entry. It is also called unrealized gain or revenue. Therefore profit attributable to NCI is 16000 x 10 300 1300. NICs share is 10 x 3000 300.

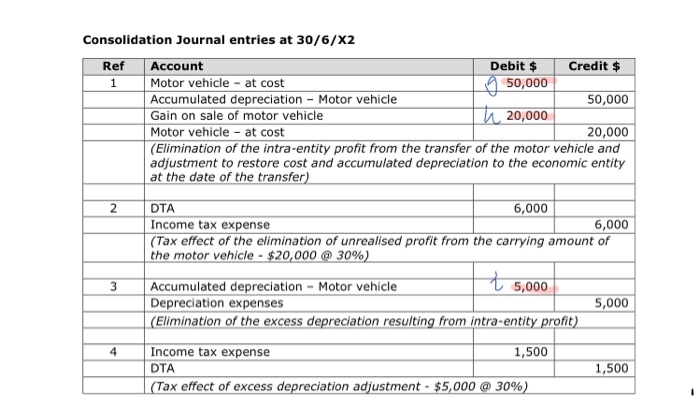

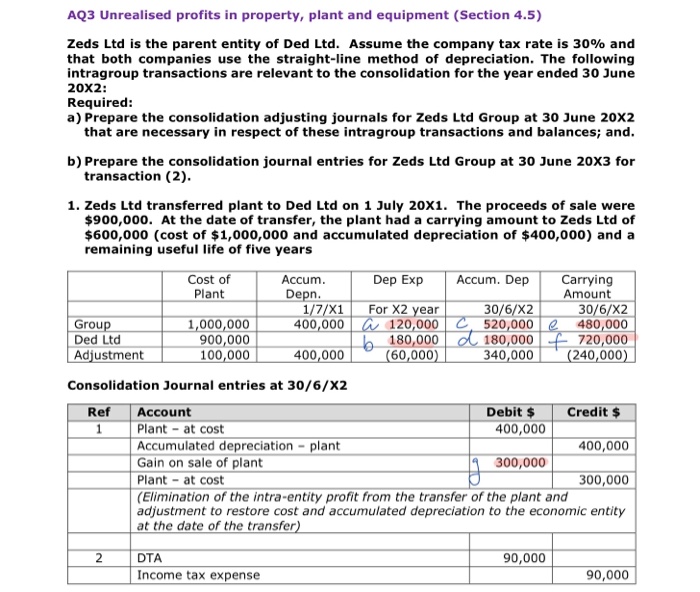

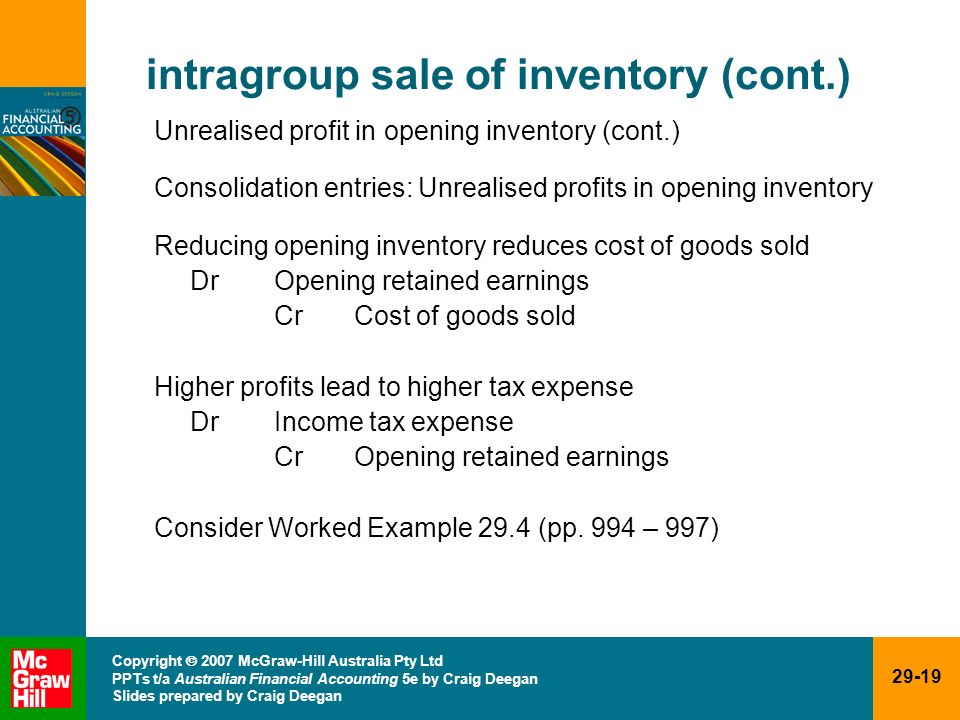

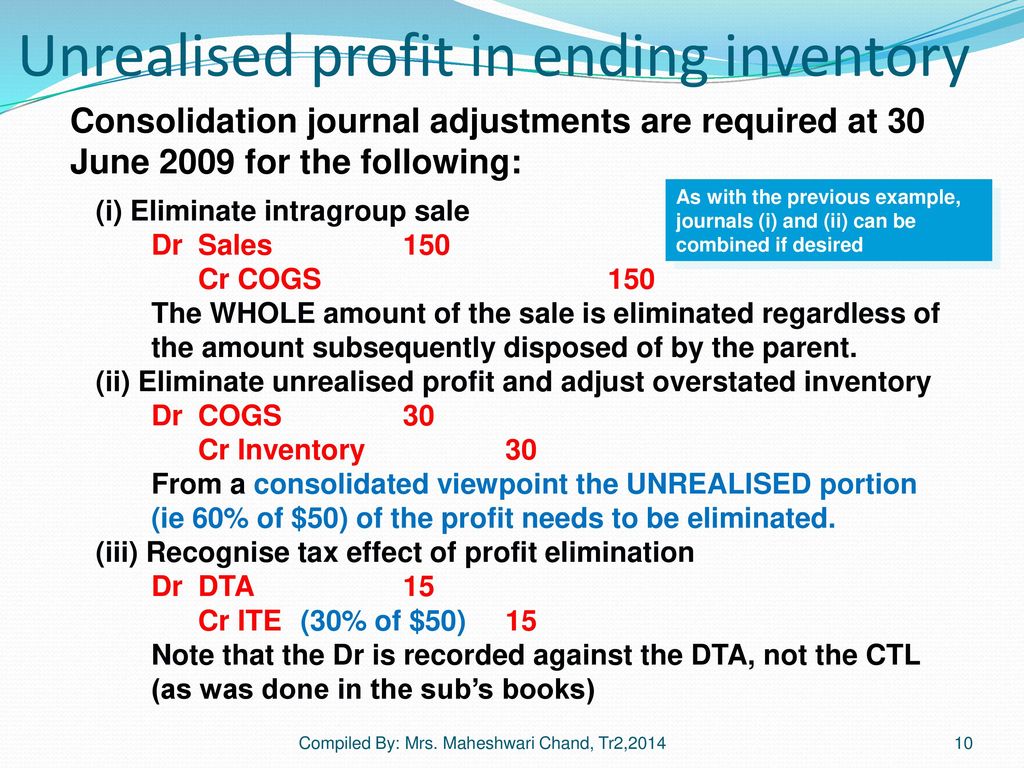

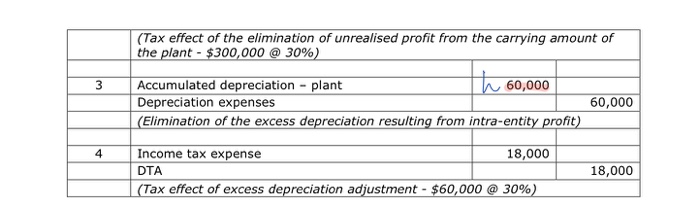

To record an unrealised gain or loss. In the final part of the question the asset is sold for 4500. Unrealised Profit Consolidated Journal - Details DR CR Sales 2100000 Purchases 2100000 to eliminate 13m 08m intra-group sales transactions Retained Profits opening 50000 COGS - Opening Inventory 50000 eliminate unrealised profit in Hs opening inventory COGS - Closing Inventory expense 100000 Inventory asset account 100000 eliminate unreaslised profit.

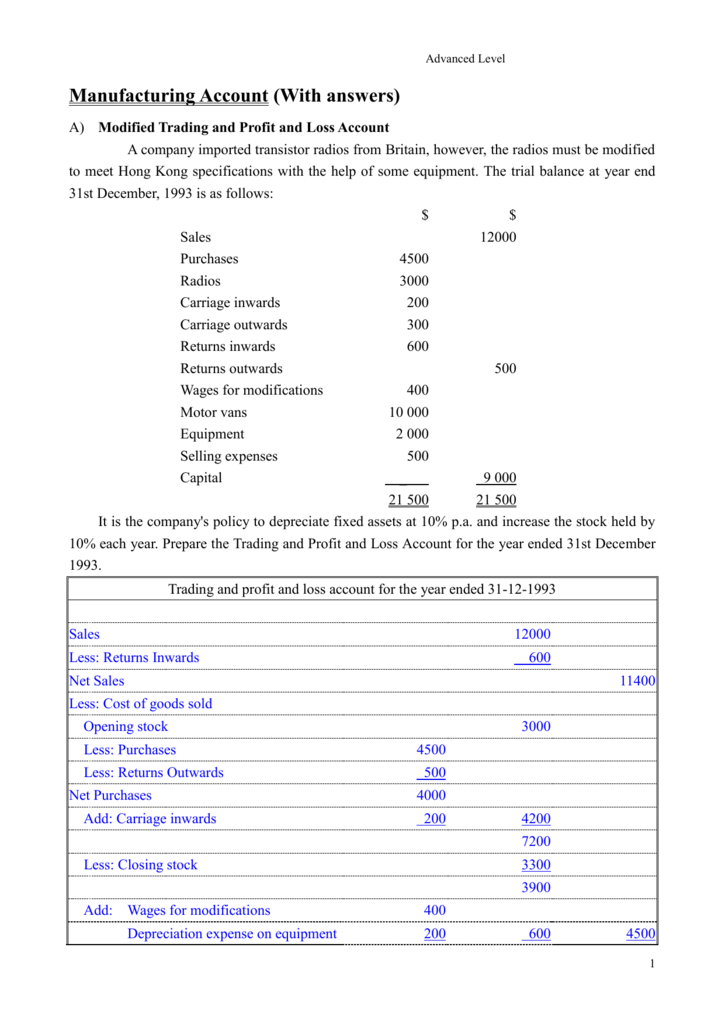

If we see that today our share rate is Rs. After the transaction the other party to the transaction for two-company structures this is the parent must have on hand an asset eg. Use mark-up or margin to calculate how much of that value represents profit earned by the selling company.

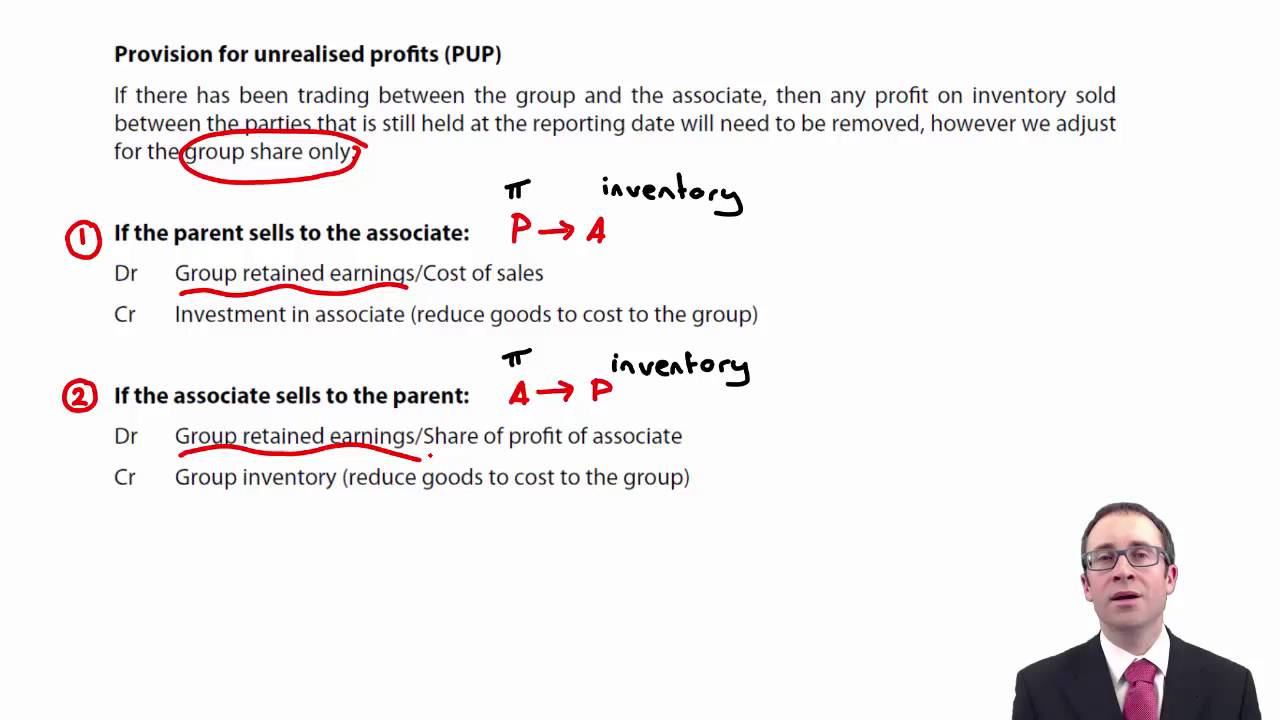

In the balance sheet the total PUP is deducted from the inventory of. B Unrealised profit on inventories is 54000 ie. Elimination entries allow the presentation of all account balances as if the parent and.

Unrealized profit or losses refer to profits or losses that have occurred on paper but the relevant transactions have not been completed. Its 21 - you recognise initially 50. Adjustment for unrealised profit in inventory Determine the value of closing inventory which has been purchased from the other company in the group.

Profit margin included in the closing inventory is 650. Foreign Currency Transaction Journal Entry 1 To reflect to sale of the goods the following transaction is now posted in the reporting currency USD of the business. 500 but we have bought it one day ago at the rate of Rs.