Matchless Comparative Ratio Analysis Daily Cashier Balance Sheet

14 Comparative Balance Sheet AnalysisA comparative analysis is one of the widely used tools to analyze financial statements.

Comparative ratio analysis daily cashier balance sheet. The ratio gives an investor an easy way to compare one companys earnings with those of other companies. Ratio 10 Receivables turnover ratio. To prepare a common-sized balance sheet divide all balance sheet line items by total assets.

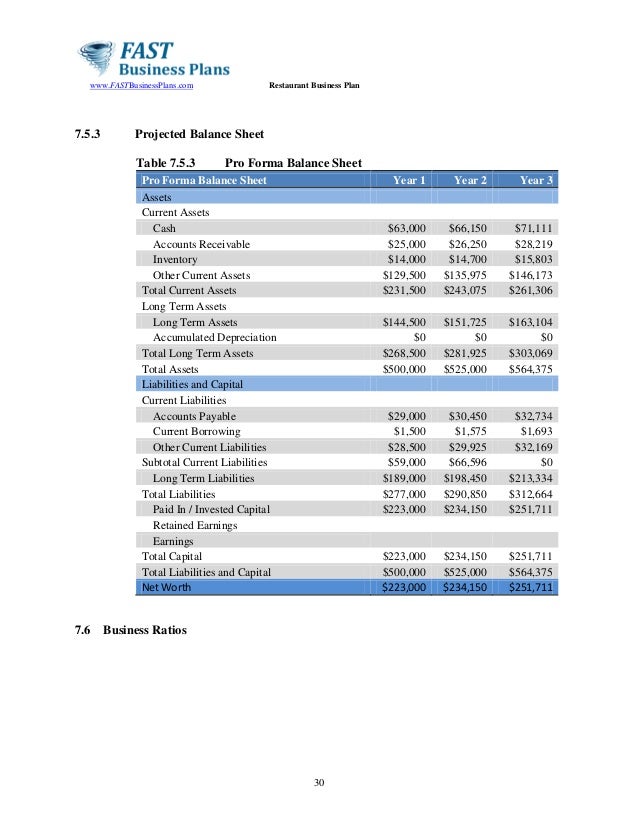

Using the companies from the above example suppose ABC has a PE ratio. Balance of inventory on the balance sheet. A comparative balance sheet presents side by side information about an entitys assets liabilities and shareholders equity as of multiple points in time.

Ratio 11 Days sales in receivables average collection period Ratio 12 Inventory turnover ratio. There are three types of ratios derived from the balance sheet. From the following particulars found in the Trading Profit and Loss Account of A Company Ltd work out the operation ratio of the business concern.

FINANCIAL RATIO TREND ANALYSIS SUMMARY In general a thorough financial analysis of any business would include a study of the following financial information. A summary of both the historical and the adjusted economicnormalized balance sheets over the period being analyzed detailing each balance sheet line item1 2. All you need to do is to enter data from your financial statements and the template will automatically calculate the ratios.

Similarly a common-sized income statement is prepared by dividing each line item by sales. Solvency ratios show the ability to pay off debts. Start studying chapter 5 intermediate accounting.

Liquidity ratios demonstrate the ability to turn assets into cash quickly. Specifically we will discuss the following. For example products sold for 1000.