Fabulous Receivable Turnover Interpretation

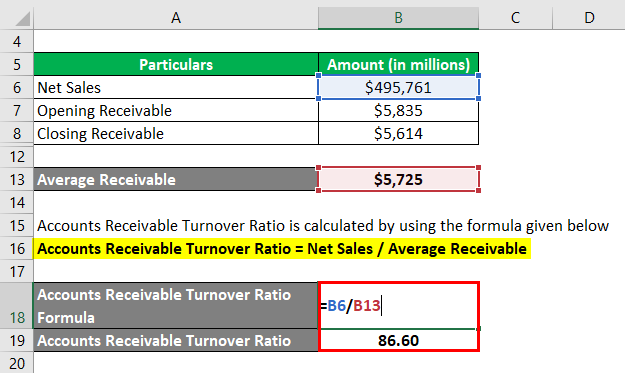

In financial modeling the accounts receivable turnover ratio is used to make balance sheet forecasts.

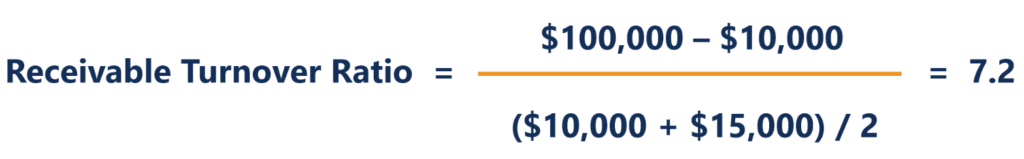

Receivable turnover interpretation. Accounts Receivable Turnover Days Average Collection Period an activity ratio measuring how many days per year averagely needed by a company to collect its receivables. The higher ratio is more favorable to business. In the given example 8000025000 32 Accounts Receivables Turnover ratio Interpretation of accounts receivable turnover ratio.

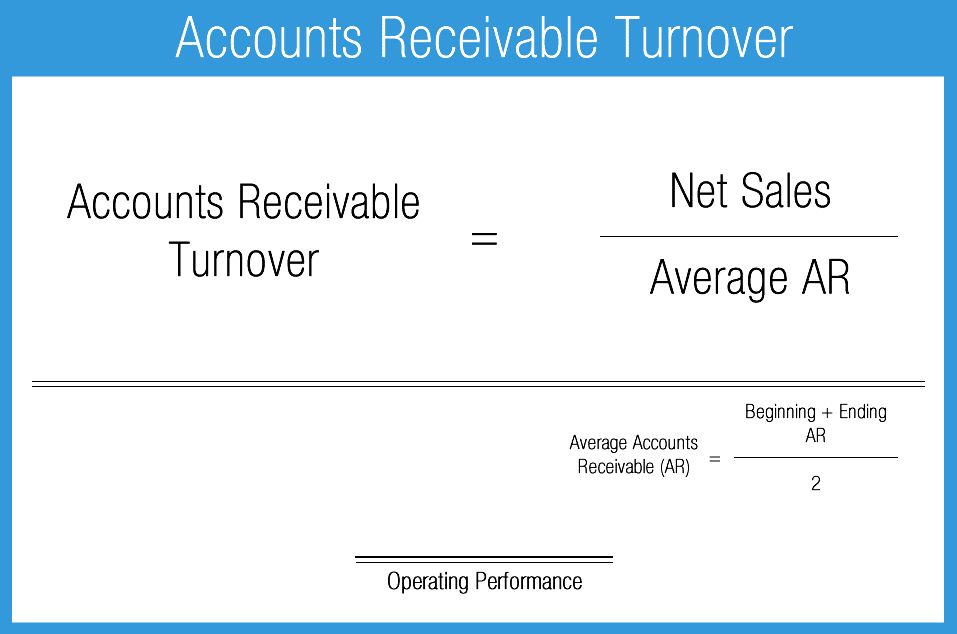

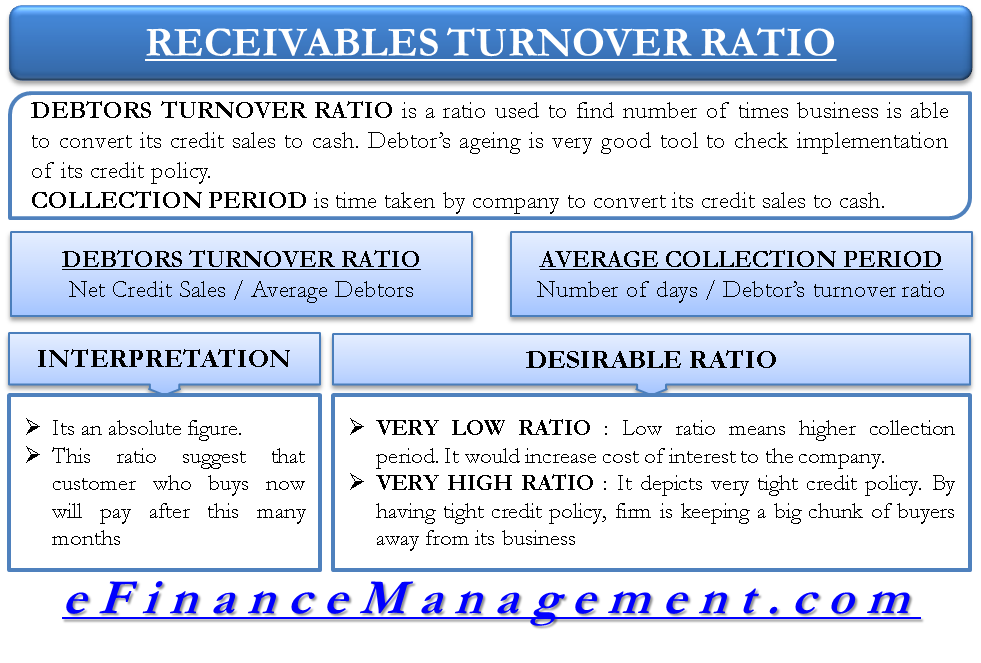

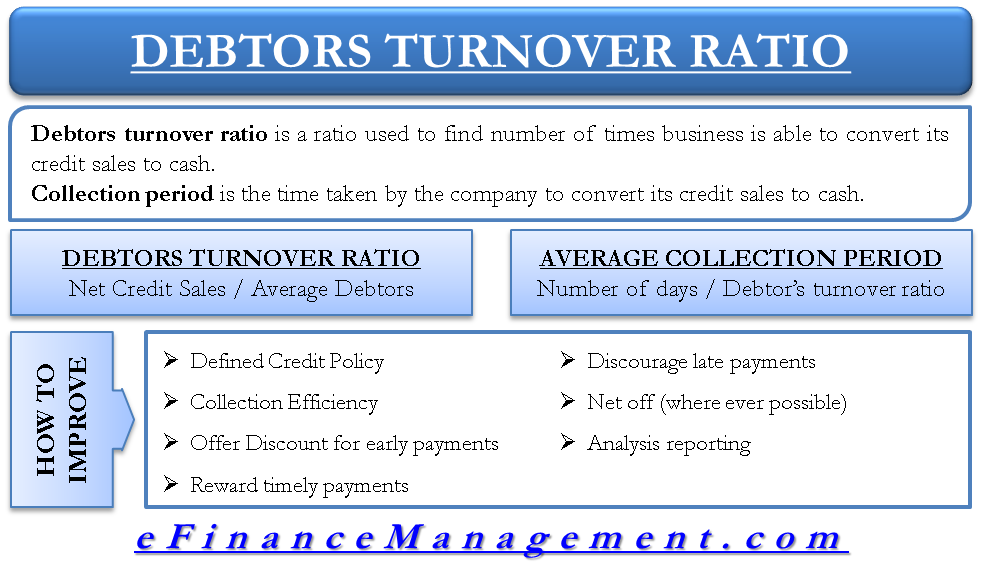

This ratio throws light on the effectiveness of the business in utilizing its working capital blocked in debtors. It is also known as receivables turnover ratio. Receivables turnover ratio also known as debtors turnover ratio is computed by dividing the net credit sales during a period by average receivables.

Accounts receivable turnover ratio simply measures how many times the receivables are collected during a particular period. It is also known as the Debtors Turnover ratio and we use it. In other words this indicator measures the efficiency of the firms collaboration with clients and it shows how long on average the companys clients pay their bills.

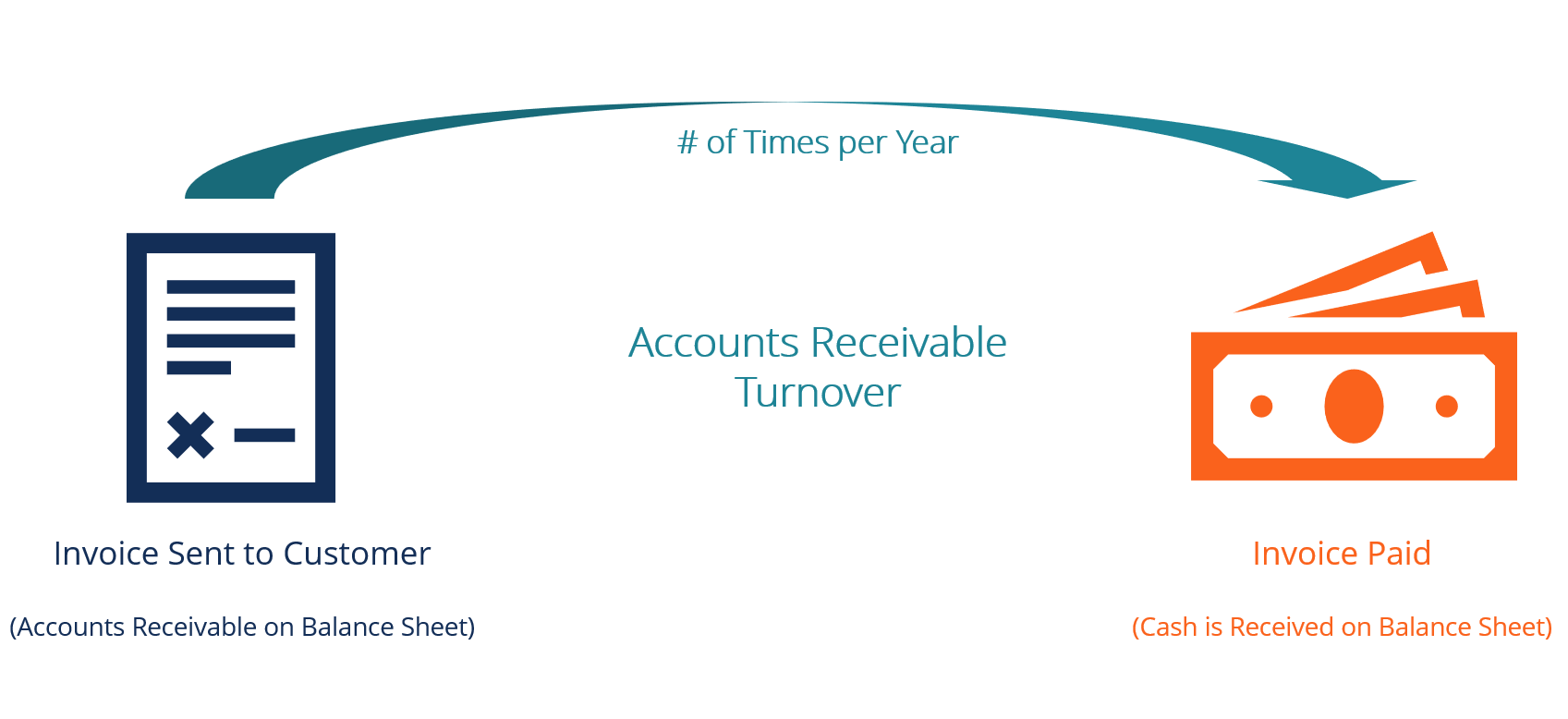

Accounts receivable turnover is an efficiency ratio or activity ratio that measures how many times a business can turn its accounts receivable into cash during a period. Its absolutely a good thing because if you are able to convert your receivables. This ratio is expressed in times.

In addition express it in the following ways. The accounts receivable turnover ratio also known as the debtors turnover ratio is an efficiency ratio Financial Ratios Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company that measures how efficiently a company is collecting revenue and by extension how efficiently it is using its assets. Interpretation and Analysis of Receivable Turnover Ratio The higher receivable turnover ratio implies that the higher frequency of converting the receivables into cash which is of the curtain.

It is also called the receivables turnover ratio the accounts receivable turnover or the debtors turnover ratio. The higher the turnover the faster the business is collecting its receivables. It is also known as the Debtors Turnover ratio and we use it to gauge how effectively the company manages credits they extend to customers and collection.