Looking Good Accounting For Divestiture Of A Subsidiary

Assume that Dunlop sells the balance of.

Accounting for divestiture of a subsidiary. Instead the consolidated statement of financial position will contain only assets and liabilities of a parent. Reduce debt position the subsidiary for an eventual change in control and more. Analyzed and weighed before you get to closing.

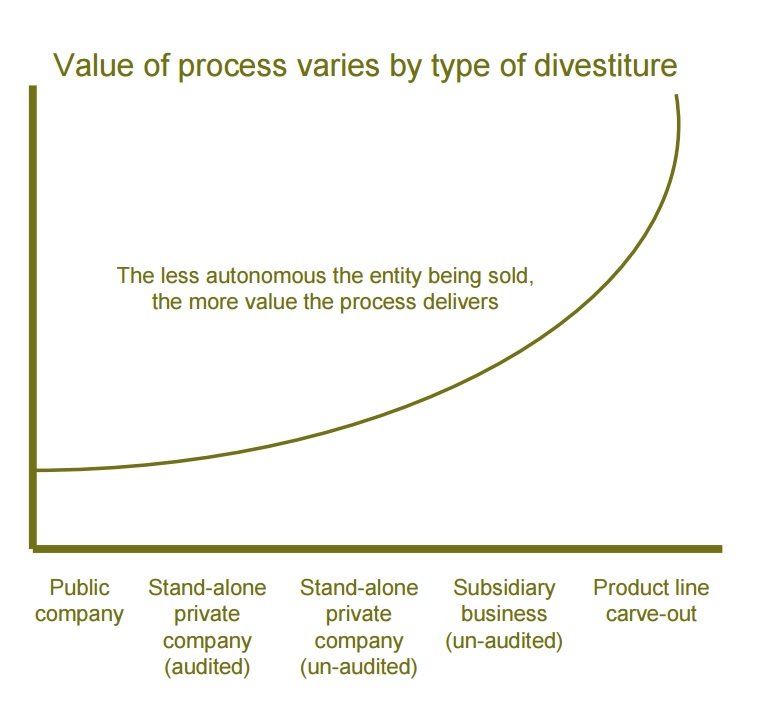

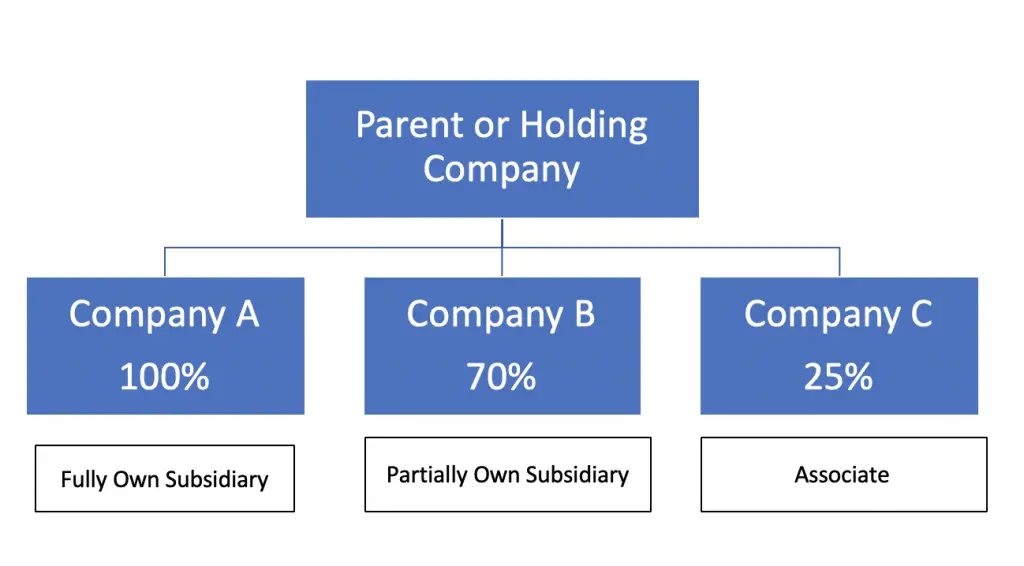

Financial information in preparation for a sale spin-off or divestiture of the carve-out entity The carve-out entity may consist of all or part of an individual subsidiary multiple subsidiaries or even an individual segment or multiple segments. Accounting for the spin-off of a subsidiary Facts. A partial or full disposal can happen depending on the reason why management opted to sell or liquidate its business resources.

Accounting for Spin-Offs From the announcement of the spin-off until the date it is completed the parent accounts for the disposition of its subsidiary in a single line item on its balance sheet called Net Assets of Discontinued Operations or similar. While the accounting procedures for investiture are relatively uncomplicated similar procedures for recording. A Company disposes of a business through the distribution of a subsidiarys stock to the Companys shareholders on a pro rata basis in a transaction that is referred to as a spin-off.

To do this debit Cash and credit Intercorporate Investment. Accounting for Divestiture of a Subsidiary or Other Business Operation Facts. This method requires that many line items in the financial statements of.

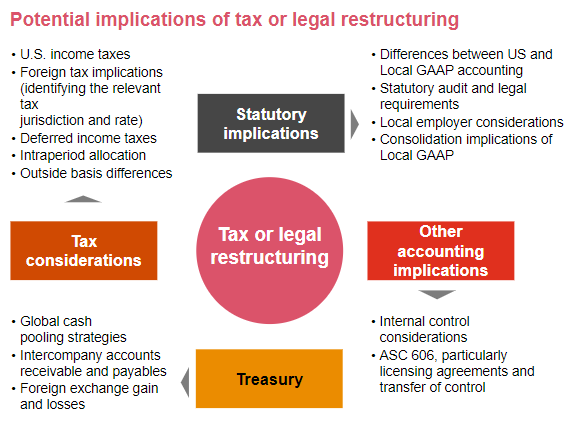

Several accounting tasks must be completed before the divestiture can take place. In contrast an entity is required to account for a decrease in its ownership interest of a subsidiary that does not result in a change of control of the subsidiary. For example one metric that needs to be calculated is the portion of the divested companys debt that needs to be allocated to the parent company and other third parties.

Accounting Treatment of Disposals of Subsidiary and Associates Disposals of group companies or associates has been relatively less tested area in exams despite the fact that the treatment and quite critical and requires thorough understanding and practice. This is very easy to perform because you will simply not make any aggregation of assets and liabilities of a parent and of a subsidiary. Company X transferred certain operations including several subsidiaries to a group of former employees who had been responsible for managing those operations.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)