Looking Good Pan Card 26as Statement

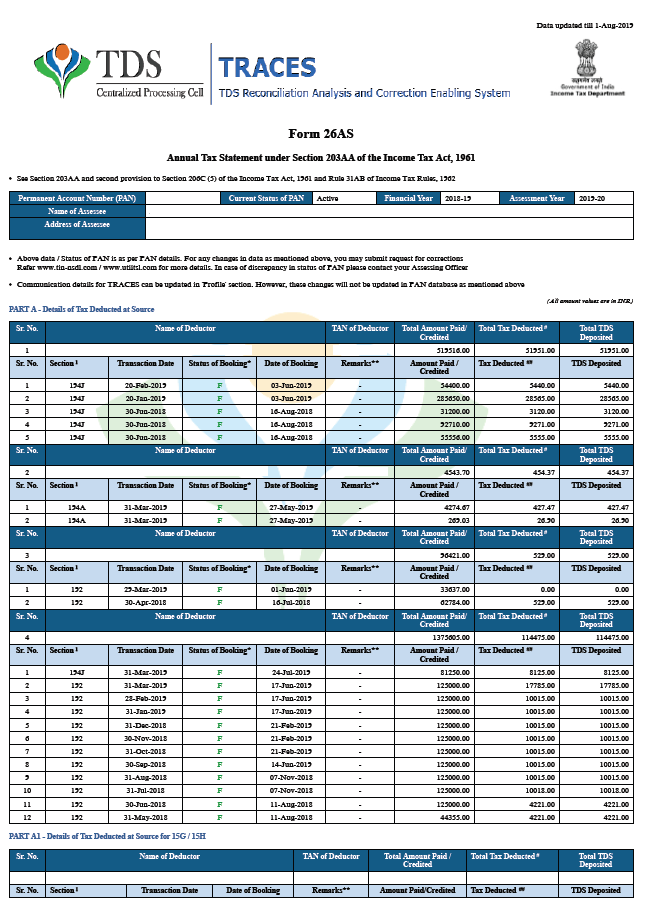

Form 26AS is a very essential document for filing IT return.

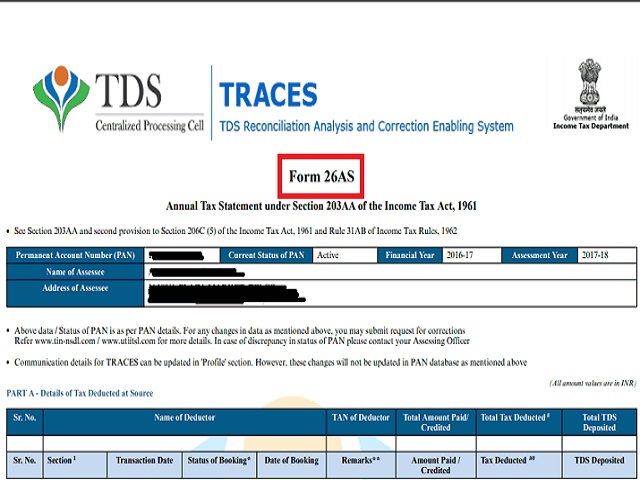

Pan card 26as statement. B Tax collected at source TCS. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal. With notification dated 28 May 2020 the CBDT brought such Annual Information Statement within the ambit of Form 26AS thereby introducing some new elements in Form 26AS.

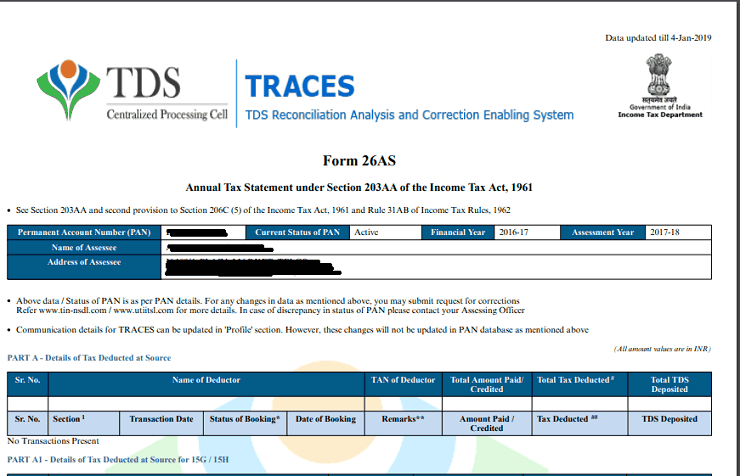

It is imperative for the taxpayers to check their Form 26AS while filing Income Tax returns to ensure that correct amount of Tax was deducted at source under correct PAN card details and paid to the. PAN-PAN Hurry-File your AY 20-21 ITR before Mar 31st 2021 last date. It comprises of the taxes collected by the collectors the amount of Advance taxes that had been paid by the.

This annual 26AS statement is managed by the Income Tax department of the government of India. Form 26AS also known as an annual statement is a consolidated tax statement which has all taxes related information in association with the taxpayer PAN cardIt tells the details of taxes deducted from a salary of an employee by deductors revealing the information about taxes. Deductor logs in to TRACES.

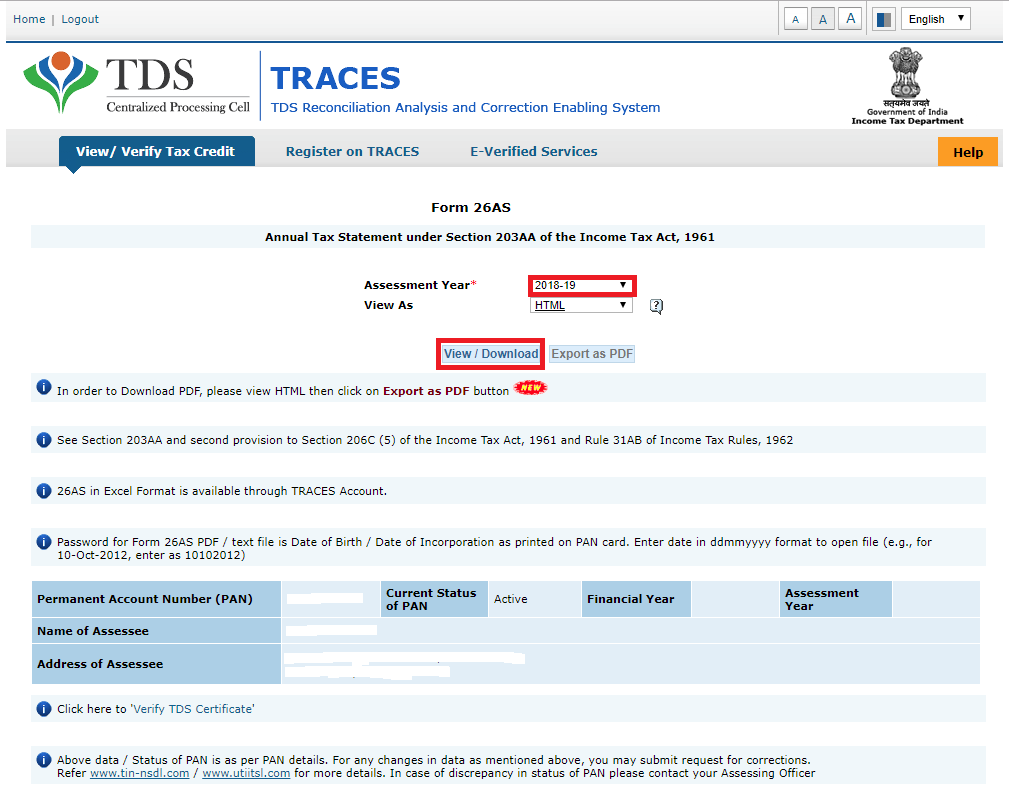

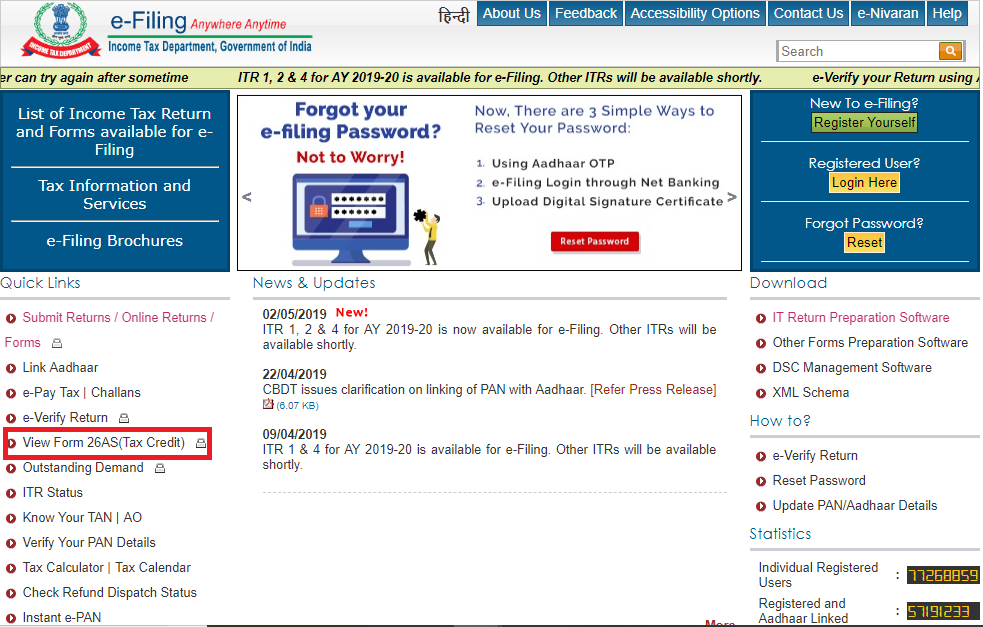

In short if youve paid any taxes your salary the income tax department has this information in their income tax 26 AS. One can access form 26AS from the income tax website by using their PAN Permanent Account Number. Click on View Form 26AS.

This has been effectuated via omission of Rule 31AB for Old Form 26AS and the introduction of new Rule 114-I under Income Tax Rules 1962 Rules. The file which is password protected can be opened by the Date of Birth as per the PAN card. Go to the My Account menu click View Form 26AS Tax Credit link.

Select Year and PDF format. Form 26AS is a consolidated tax statement issued under Rule 31 AB of Income Tax Rules to PAN holdersâ ie the taxpayers. This feature is available for only those valid PANs for which TDS TCS statement has been previously filed by the deductor.