Favorite Loss On Disposal Of Fixed Assets Income Statement Presentation

Let me explain the treatment step by step.

Loss on disposal of fixed assets income statement presentation. The company also experiences a loss if a fixed asset that still has a book value is discarded and nothing is received in return. One other effect is the Gain Loss on Disposition is also a NON-CASH transaction that appears on the Income Statement and increases or decreases taxable income. An asset when disposed is written off from the balance sheet.

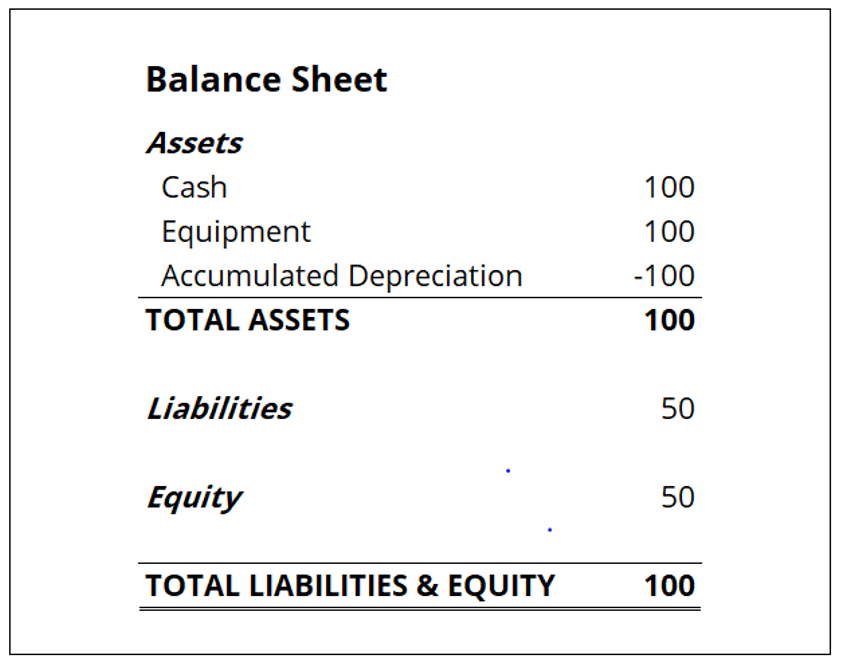

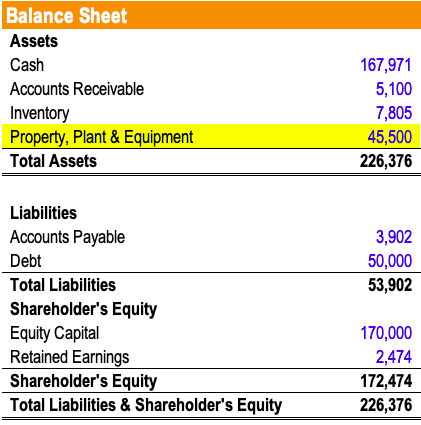

Asset Disposal on Financial Statements. If the component of an entity includes a noncontrolling interest the pretax profit or loss or change in net assets for a not-for-profit entity attributable. Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet recording receipt of cash and recognizing any resulting gain or loss in income statement.

Profits or losses on disposal of fixed assets are included in the profit and loss account. Similar to Depreciation Expense it is a non-cash transaction which over-states or under-states Net Income Before Taxes NBIT. A company may need to de-recognize a fixed asset either upon sale.

Thus there was a loss on the sale. Remove the asset from the balance sheet Credit Fixed Asset. The gain or loss is calculated as the net disposal proceeds minus the assets carrying value.

The book value of the assets is adjusted up-to the date at which the asset is disposed. The asset disposal results in a direct effect on the companys financial statements. Calculate the accumulated depreciation of the plant asset up-to the date of disposal.

The disposal of fixed assets account is an income statement account and is being used to hold all gains losses and write offs of fixed assets as they are disposed of. The account is usually labeled GainLoss on Asset Disposal. This means that it does not affect the companys operating income or operating margin.