Ideal Consolidated Accounts Balance Sheet As Per Schedule 3 Of Companies Act 2013

Schedule III also provides for the instructions for prepation of Consolidated Financial Statements to be filed by holding companies in corporating the financial statements of its.

Consolidated accounts balance sheet as per schedule 3 of companies act 2013. Original content -Current maturities of long-term debt. 240 In relation to company includes. Schedule III -Format Of Balance Sheet -Format Of The Profit And Loss Account COMPANIES ACT 2013 By CA Piyali Parashari CA CWA B Com Hons 2.

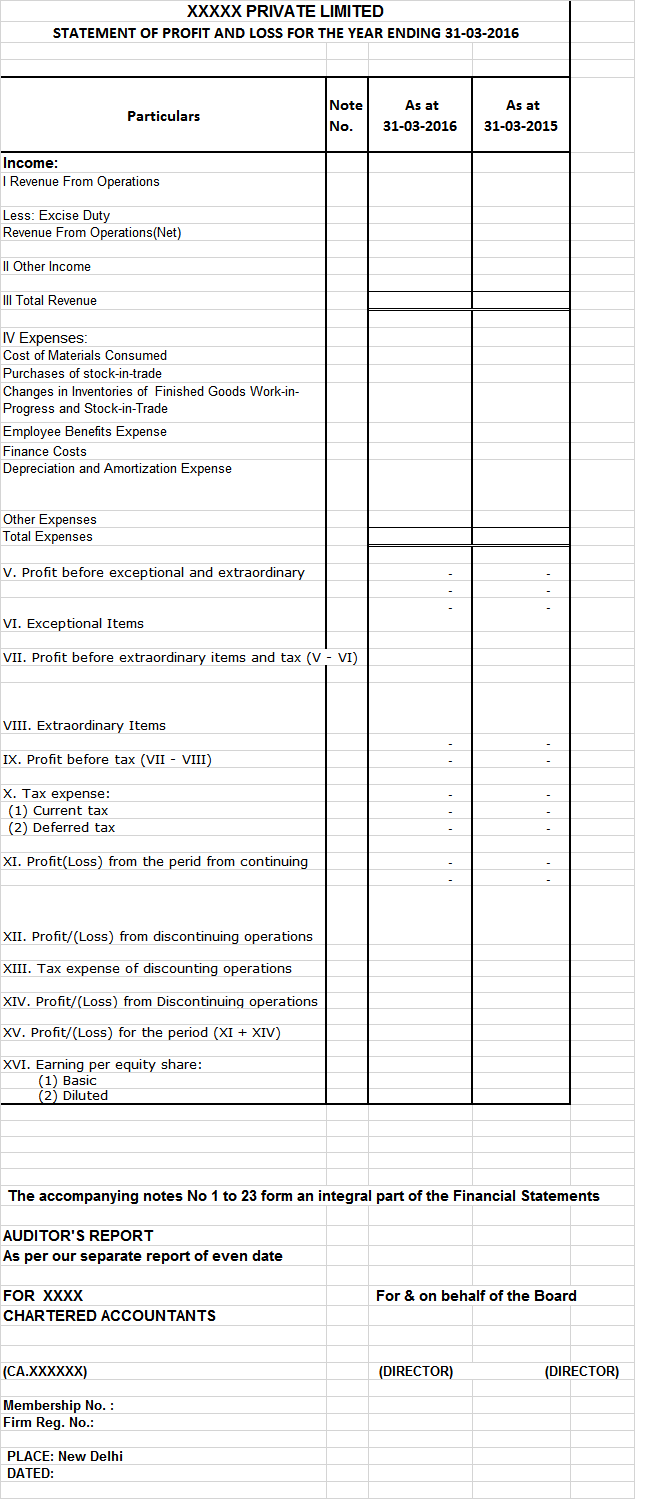

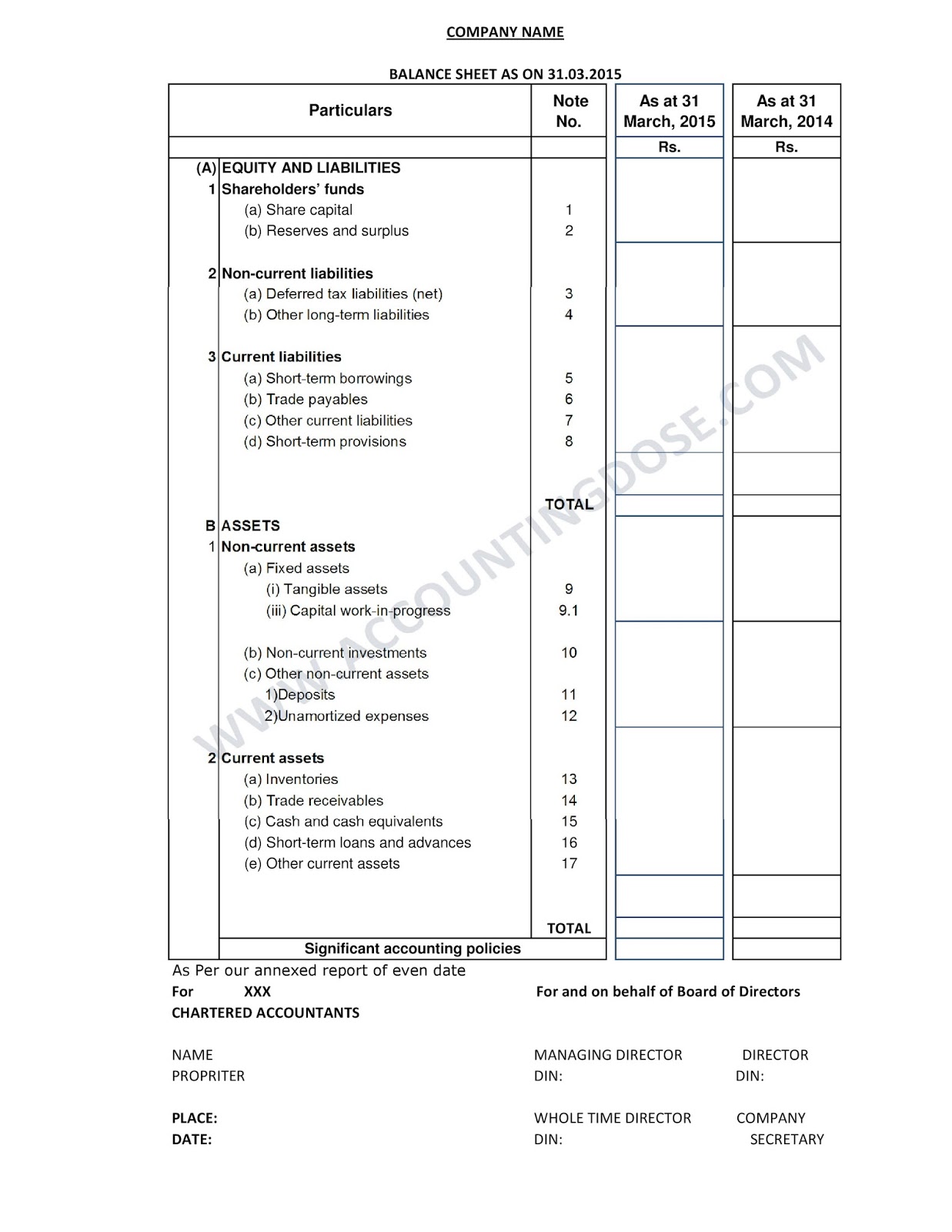

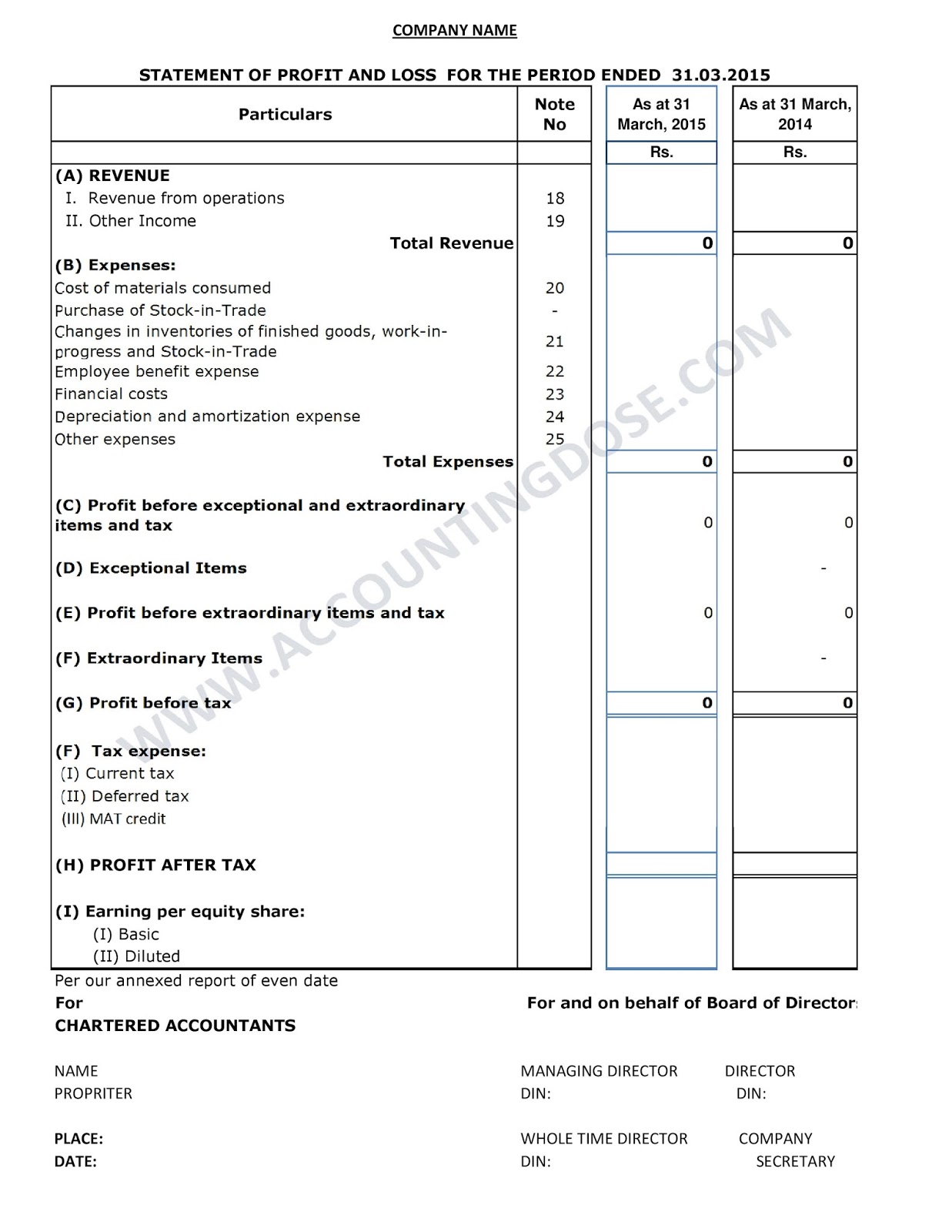

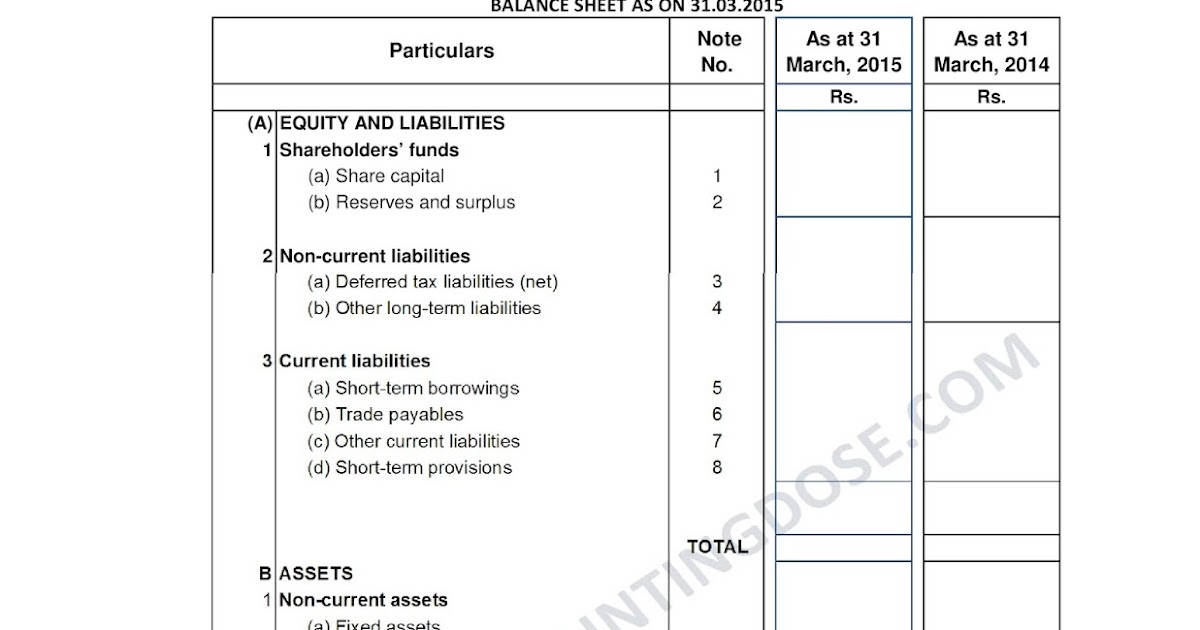

Balance Sheet PL Ac Notes to Accounts etc by the entities those who have to comply with Accounting Standards AS or Indian Accounting Standards Ind AS. February 28 2011 and this has formed the basis for the Schedule III of Companies Act 2013The relevant Schedule III to the Act is given in Annexure A Pg. As per Schedule III of Companies Act 2013 one of the criteria for classification of an asset as a current asset is that the asset is expected to be realised in the companys operating cycle or is intended for sale or consumption in the companys normal operating cycle.

Schedule III of Companies Act 2013 India 1. To Buy DVDs of CA CS CMA call us at 0551-6050551. 240 to include balance sheet profit and loss accountincome and expenditure account cash flow statement statement of changes in equity and any explanatory note annexed to the above.

Sub Section 3 of Section 129 of the Companies Act 2013. It may be defined as one which has one or more subsidiary companies and enjoys control over them. PREPERATION OF FINANCIAL STATEMENTS UNDER SCHEDULE III OF COMPANIES ACT 2013 1 While discussing the new provisions under Companies Act 2013 regarding preparation of Financial statements we will cover.

Schedule III of the 2013 Act deals with instructions for prepation of Balance Sheet and Profit and Loss of account of a company under section 129 of the 2013 act. Financial statement Consolidated Financial Statements 2 FINANCIAL STATEMENTS 3 MEANING OF FINANCIAL STATEMENT Sec. Omitted by Amendment to Schedule III to the Companies Act 2013.

MCA has amended Schedule III to the Companies Act 2013 vide Notification dt. In addition the. Where a company is required to prepare Consolidated Financial Statements ie consolidated balance sheet and consolidated statement of profit and loss the company shall mutatis mutandis follow the requirements of this Schedule as applicable to a company in the preparation of balance sheet and statement of profit and loss.