Spectacular Audit Of Trade Receivables

When trade receivables increase revenues increase.

Audit of trade receivables. Therefore evidence supporting accounts receivable tends to support sales. Match the total of the aged receivables listing to the sales ledgers control account. There might be a high risk for the overstatement of trade receivables to enhance current assets and the corresponding growth in sales.

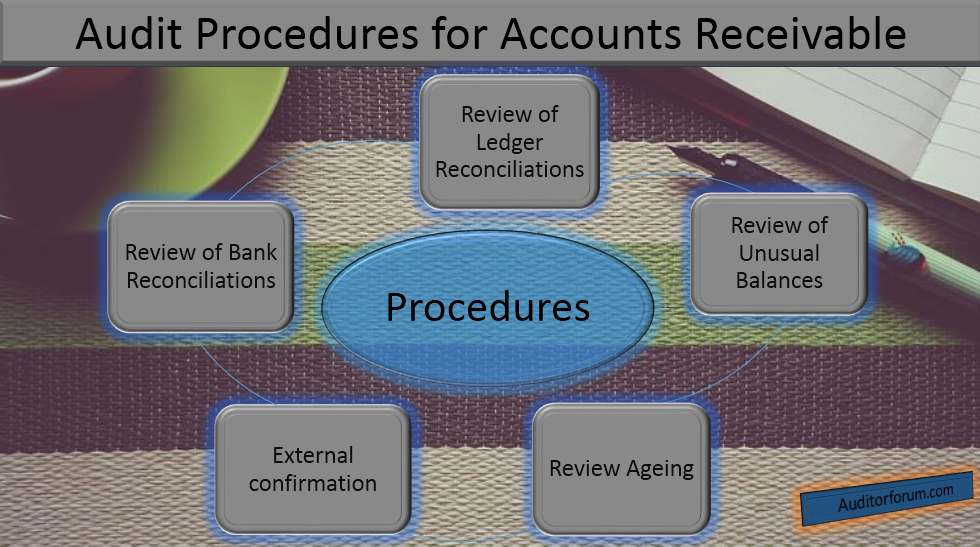

Audit procedures for receivables AUDIT PLAN. Auditors usually pull a sample of clients or customers from a companys account receivables ledger and review the original information that resulted in the current balance. As an auditor first you need to identify what are the audit risks in trade receivables.

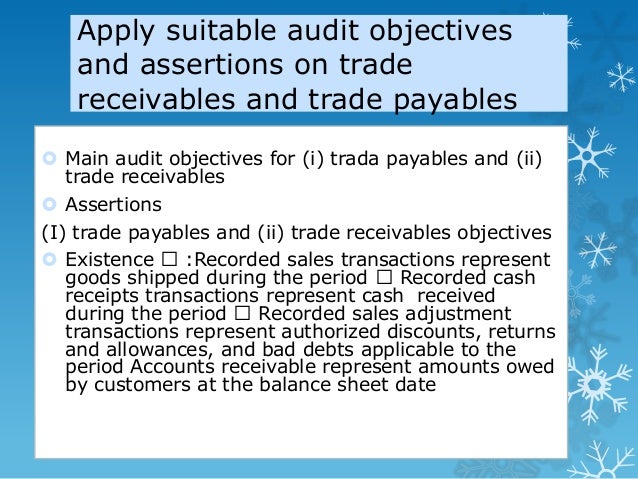

So a company can increase its net income by recording nonexistent receivables. The overall objective of the audit of accounts receivable and sales is to determine if they are fairly presented in the context of the financial statements as a whole. The auditors will ask for a period-end accounts receivable aging report from which they trace the grand total to the amount in the accounts receivable account in.

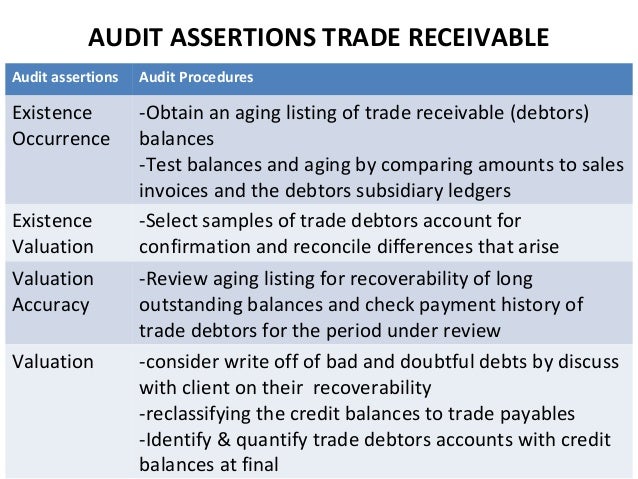

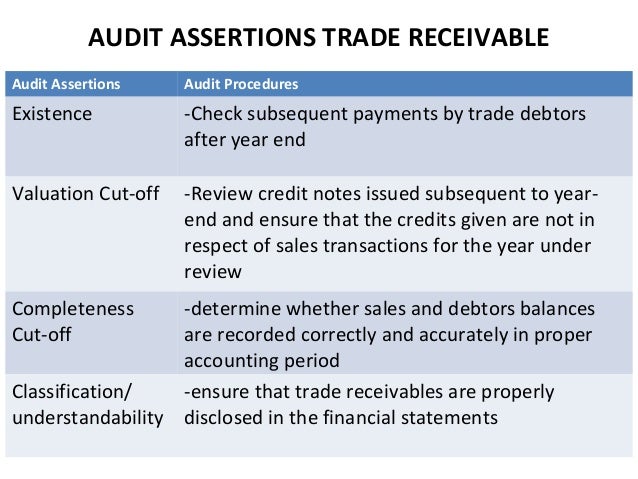

24 Inventories receivables audit The term Inventories Audit in the context of banks refers to verification and valuation of the entire gamut of current assets current liabilities loans and advances diversion of funds application of funds accuracy of Inventories statements. Testing these assertions include verifying its existence rights and obligations completeness accuracy classification and presentation. Trade Receivables - ACCA Audit and Assurance AA ACCA F8 The Audit of Receivables.

Along with revenues auditors need to prove receivables. Existence rights and obligations completeness valuation and allocation. If successful circularisations provide evidence directly from the receivables themselves.

Trace receivable report to general ledger. Other Audit Procedures that Auditor should also Performs during the Course of the Audit Below are the other audit procedures that auditor may carry out on the audit of accounts receivable. Trade receivables are one of the risky areas in an audit assignment and it should be tackled professionally and tactfully.