Awesome Accounting For Website Development Costs Ifrs

Servers and Internet connections of a web site are accounted for as property plant and equipment IAS 16 This section also doesnt apply to situations where you are in the business of creating websites for others.

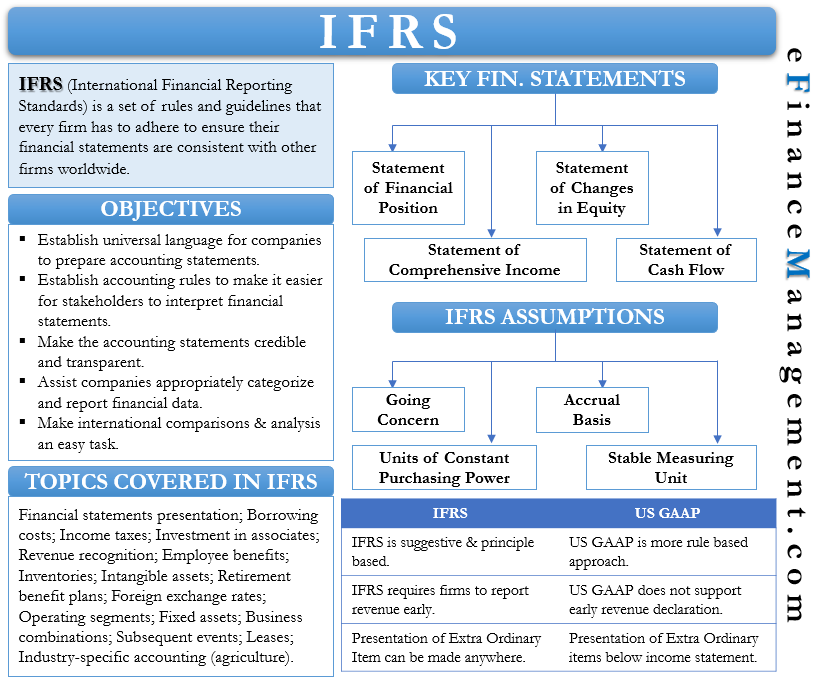

Accounting for website development costs ifrs. In March 2002 the International Accounting Standards Board issued SIC32 Intangible AssetsWeb Site Costs which had originally been developed by the Standing Interpretations Committee of the International Accounting Standards Committee. This means that the entity must intend and be able to complete the intangible asset and either use it or sell it and be able to demonstrate how. International Accounting Standard 38 is the only accounting standard covering accounting procedures for research and development costs under IFRS.

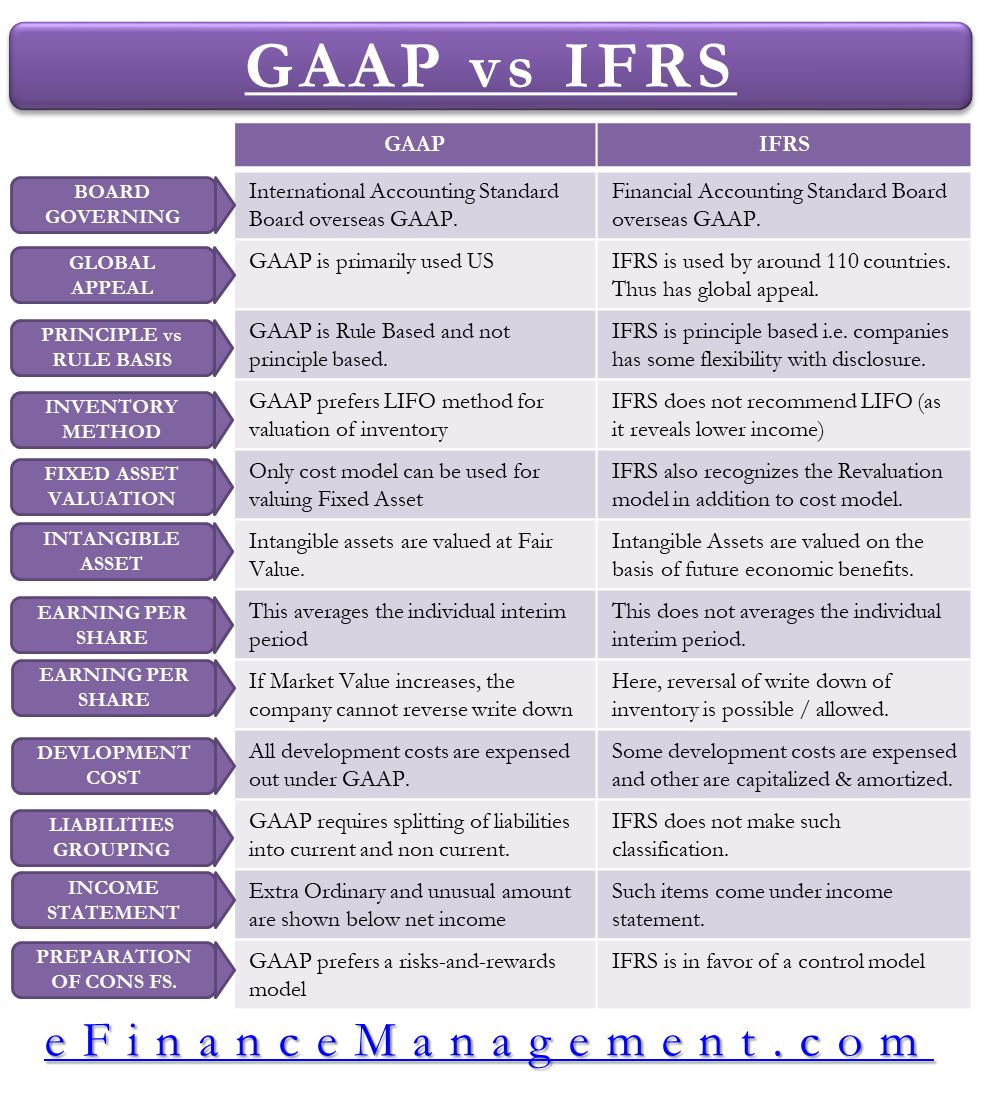

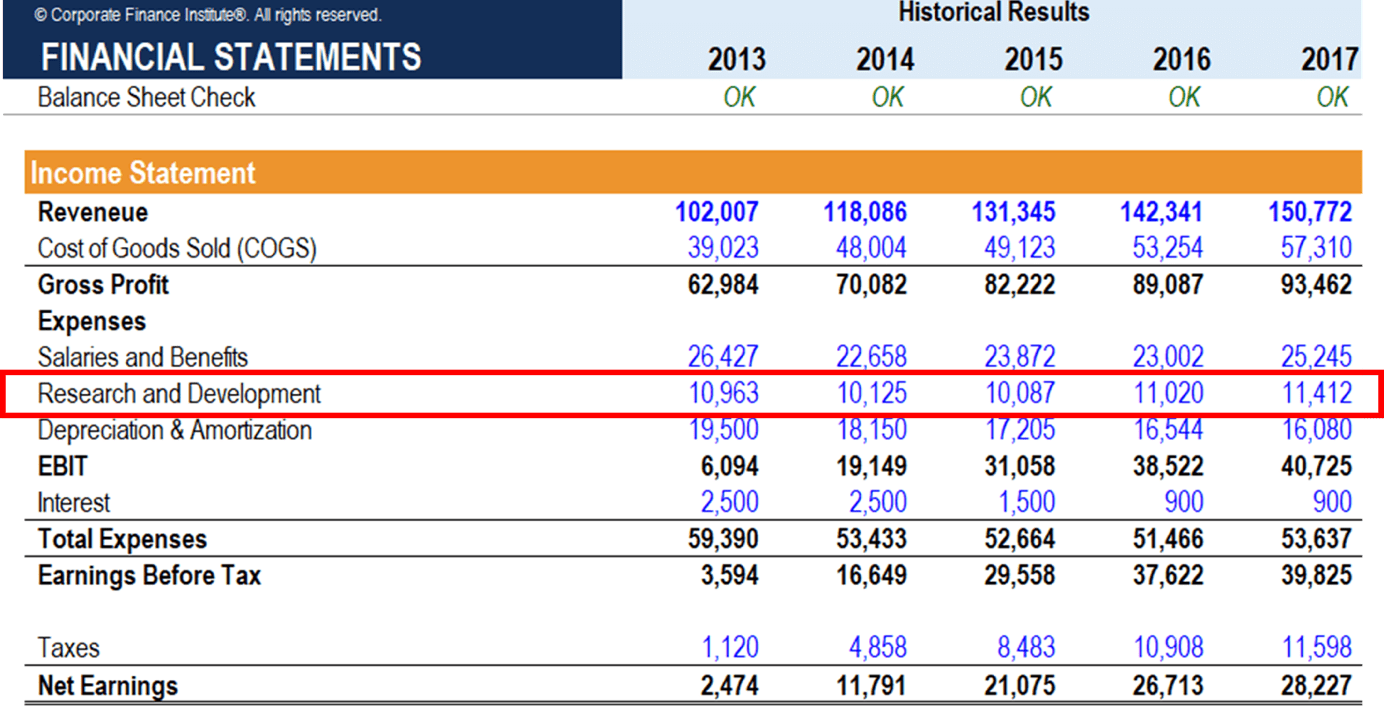

Ad Get a Website That Automatically Adjusts To Fit Your Brand and Style Guidelines. SIC- 32 - Intangible Assets was drafted to specifically deal with the proper accounting treatment related to the costs associated with the development of a website. The accounting for these research and development costs under IFRS can be significantly more complex than under US GAAP Under US GAAP RD costs within the scope of ASC 730 1 are expensed as incurred.

GAAP requires that some of the costs be expensed and others capitalized depending on the stage of the. Development costs are capitalised only after technical and commercial feasibility of the asset for sale or use have been established. This means that development costs can only be recognised as an intangible asset if all of the above criteria are met.

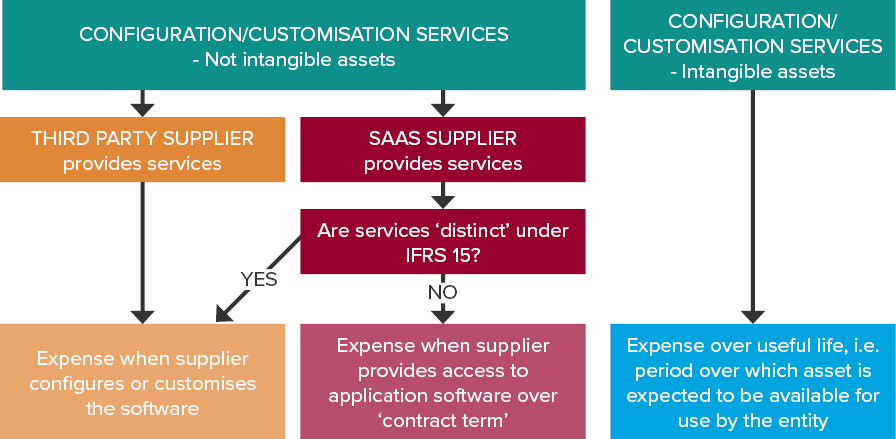

IFRS Spotlight September 2018 Accounting for cloud-based. Employee training costs Development of training materials content. IFRS development cost.

When accounting for internal expenditure on the development and operation of an entitys own web site for internal or external access the issues are. Examples are technology companies and startups. 3 Applying IFRS - Accounting for cloud computing costs July 2020 1.

The cost of purchasing developing and operating hardware eg. Ad Get a Website That Automatically Adjusts To Fit Your Brand and Style Guidelines. Research costs under IAS 38 are expensed during the accounting period in which they occur and development costs require capitalization if certain criteria are met.