Stunning Unearned Revenue Account Type

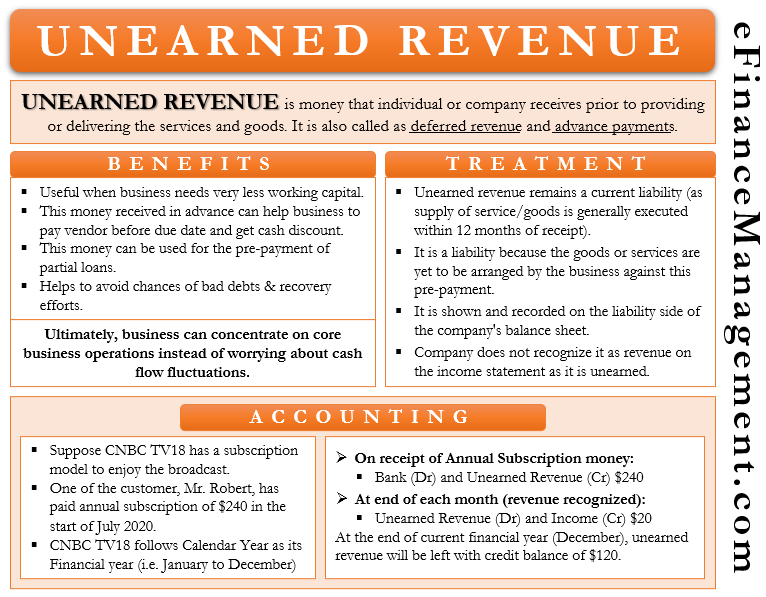

If a prepaid good or service becomes undeliverable or even if the client cancels their order the business must pay the client back as it is liable for the delivery or completion of that good or service.

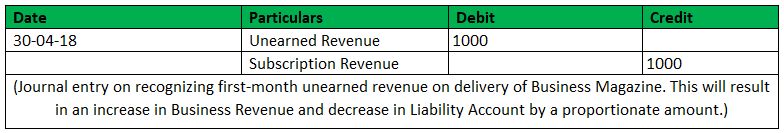

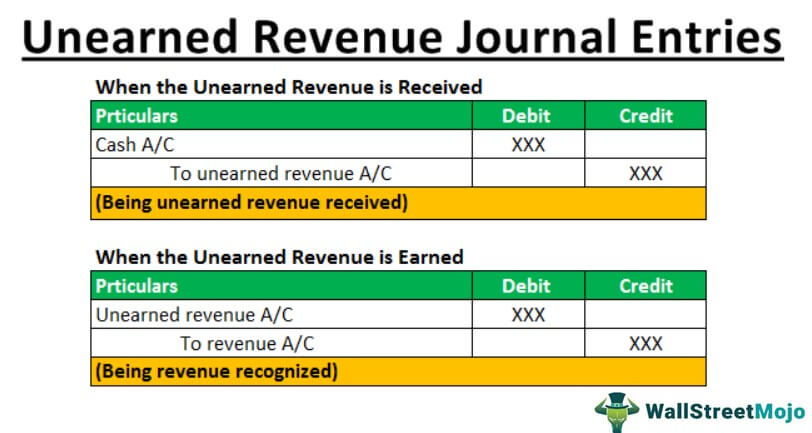

Unearned revenue account type. Unearned Revenue Journal Entry Examples Few examples of unearned revenue journal entry are stated below. What Type of Account Is Unearned Revenue. Two Types of Unearned Sales Revenue Reporting 1 Liability Method Under this method when the business receives deferred Revenue a liability account is created.

As we previously mentioned unearned revenue is an obligation that the business is yet to settle. A Retained Earnings account is used to record the earnings of a corporation and to record when earnings are given back to the owners in the form of dividends. The most common type of unearned revenue is revenue derived from interest and dividends.

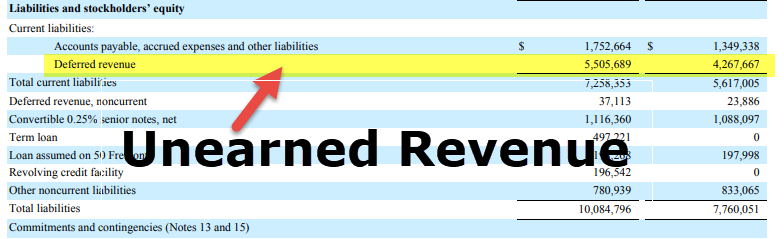

What is Equity Financial Accounting Tutorial 10 Revenues represent the value of the goods or services provided. Unearned revenue is simply cash customers have paid to Amazon in advance for services it has yet to render. Most people are involved in some form of investment be it debt or equity.

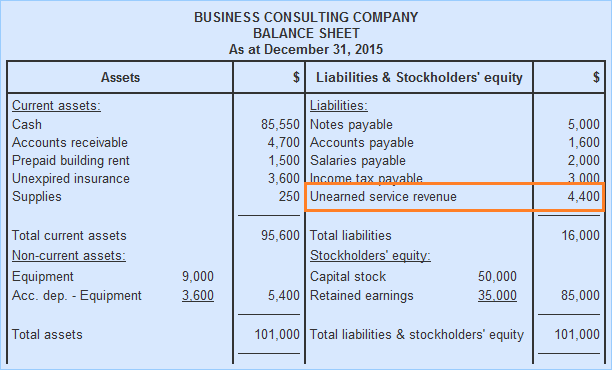

It is treated as a liability because the revenue has still not been earned and represents products or services owed to a. And since unearned revenue records services yet to be provided to clients who have paid for them in advance it counts as a current liability for the business. Unearned revenue is a libability account its mean that company received an amount in advance against goods and services.

Example 1 On 1 st April a customer pays 5000 for installation services. And when the business wil provide the good and services it will change into revenue. It is revenue received but not earned yet.

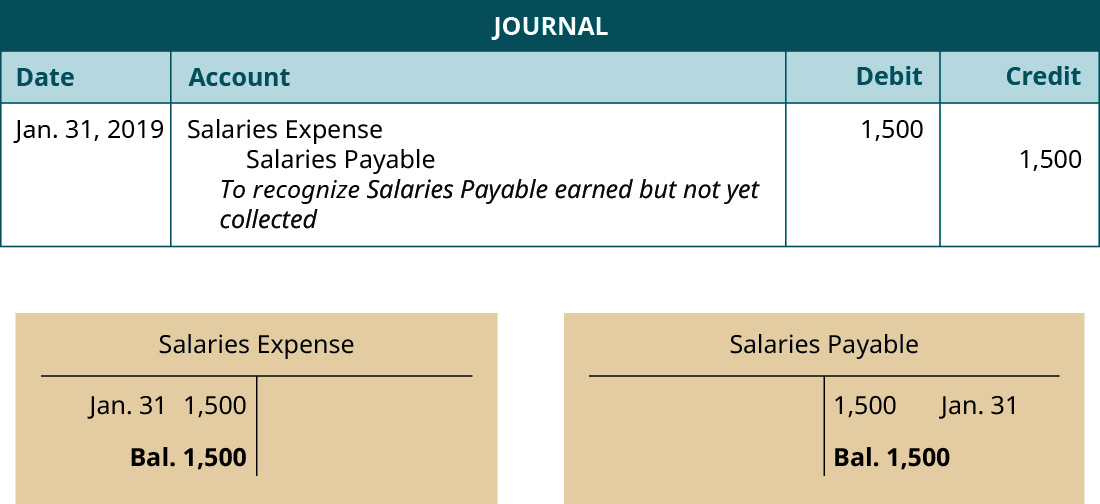

Unearned revenue is a liability. Unearned revenue also known as deferred income or prepaid earnings is not a contra revenue account with a debit balance presented on an income statement but rather a liability with a credit balance reported on a balance sheet. Unearned revenue is recorded as a debit to Cash account and credit to Unearned Revenue account.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)