Great Treatment Of Marketable Securities In Cash Flow Statement

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

State the purpose and preparation of statement of cash flow statement.

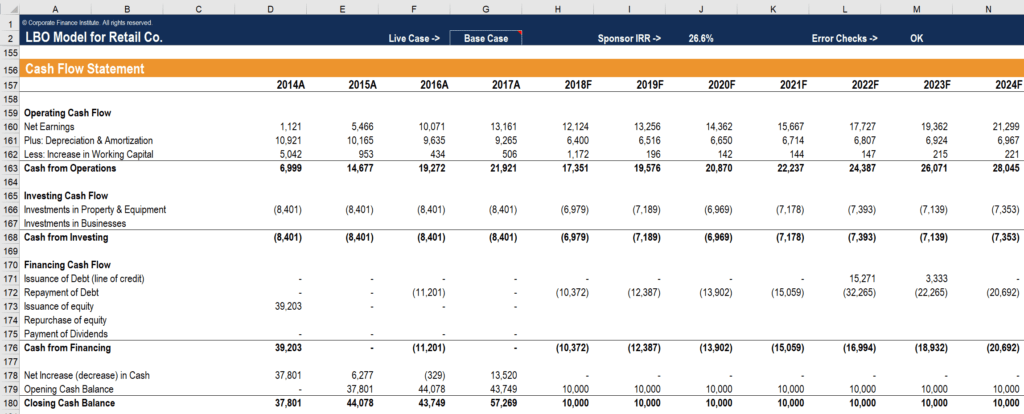

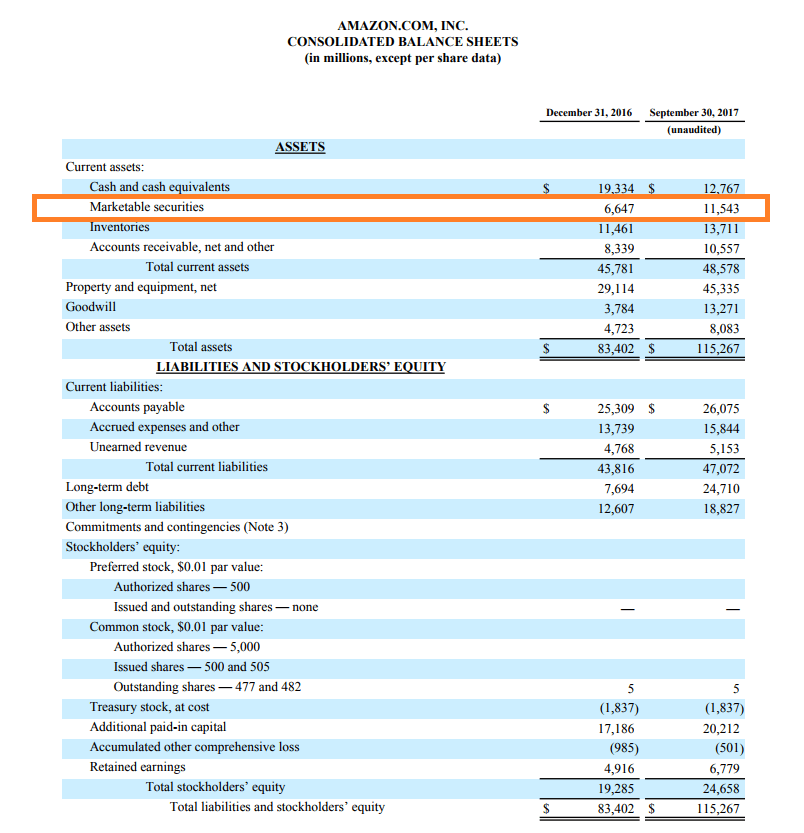

Treatment of marketable securities in cash flow statement. Marketable securities are second most liquid current asset after cash and cash equivalents. It include cash at bank and marketable securities. They are presented on a balance sheet in the current assets section just above cash and cash equivalents or below depending on whether the assets are presented in.

Equivalents where cash and cash equivalents include Cash Bank Balance Marketable Securities etcunless specified otherwise Current Investments are considered as Marketable Securities. They are typically securities that can be bought or sold on an exchange. Before understanding Cash Flow Statement first we should understand What is Cash and Cash Flow.

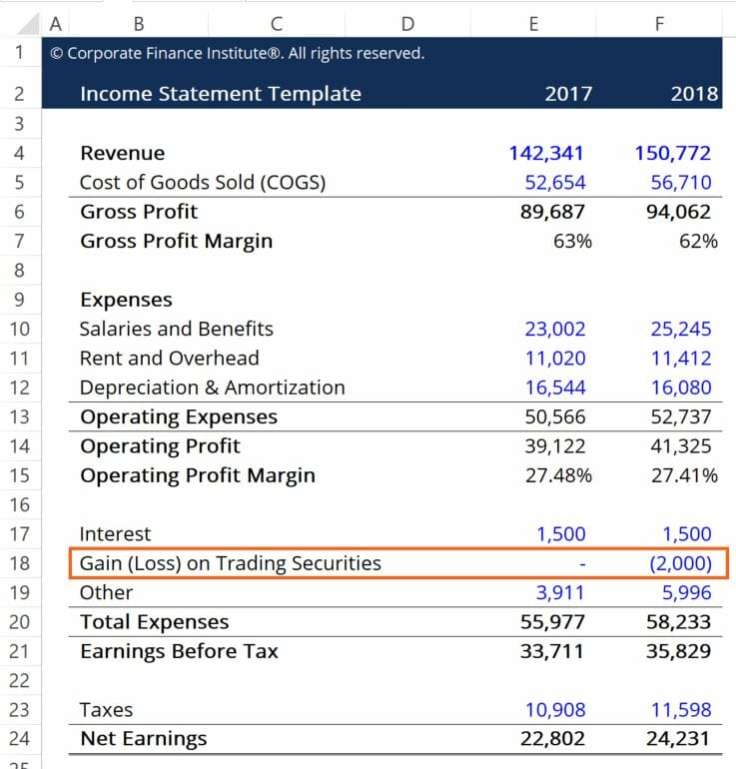

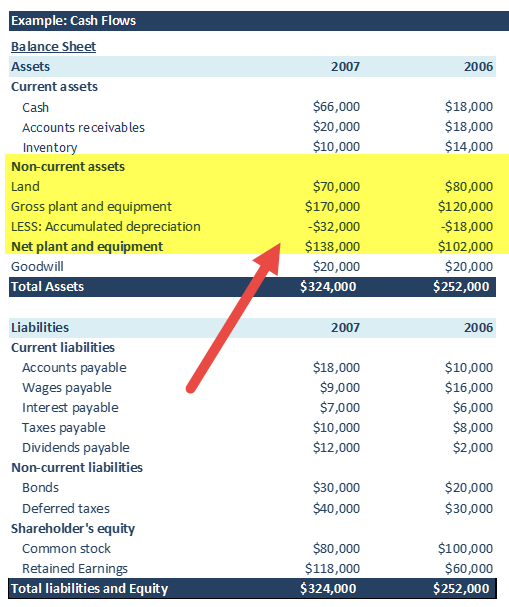

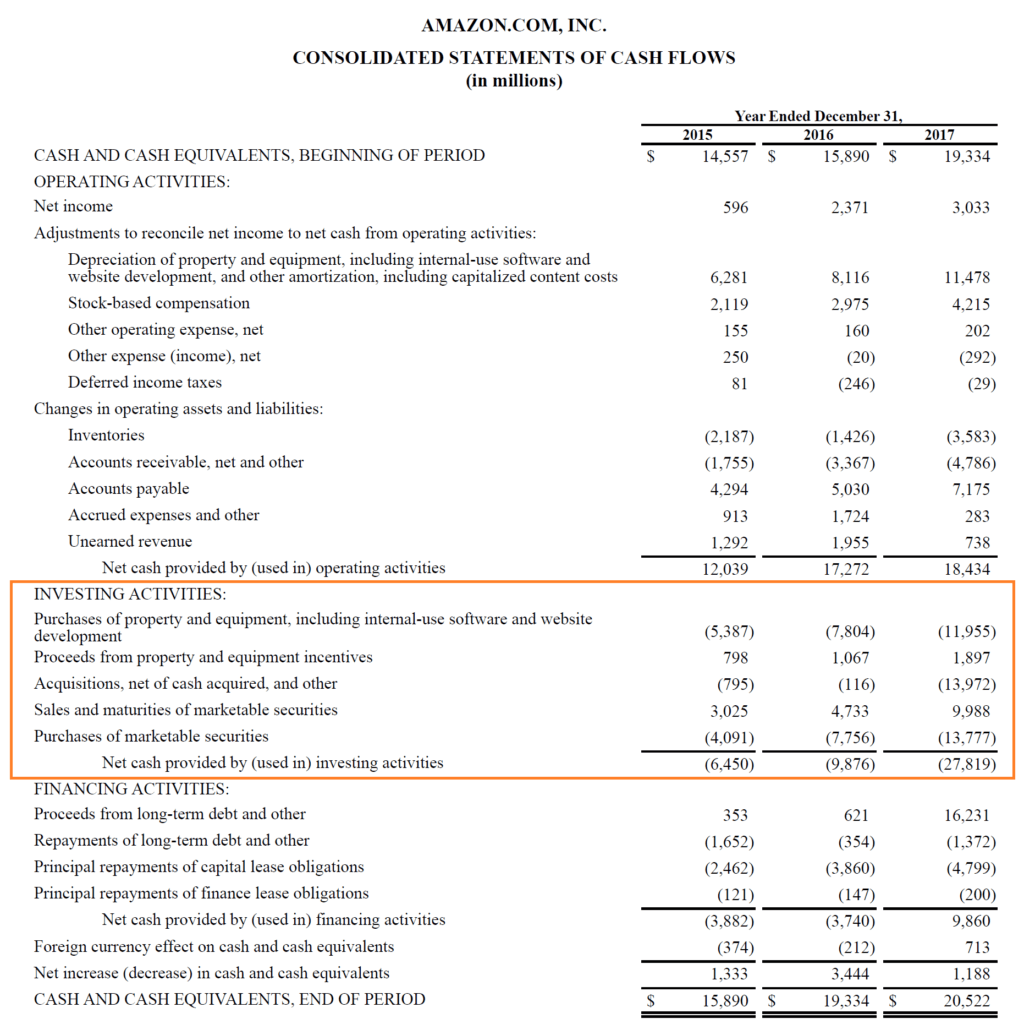

The total cash inflow in example 1 and example 2 is 134940 45975 88965 which will be reported as investing cash inflow in statement of cash flows of Fine Company. A debt instrument that meets the cash flow characteristics test and is not designated at FVTPL under the fair value option must be measured at FVTOCI if it is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows and sell financial assets. All other debt instrument assets are measured at fair value through profit or loss FVTPL.

Indirect method has 3 sections. Cash flows from capital and related financing activities include acquiring and disposing of capital assets borrowing money to acquire construct or improve capital assets repaying the principal and interest amounts and paying for capital assets obtained from vendors on credit. However increase or decrease in the marketable securities will not be considered as it implies balance of previous year and current year.

The reason is that this type of securities is shor. Cash Equivalent means those assets which can be converted in cash very easily and quickly without bearing any loss. The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating investing and financing activities for a.

Cash Flows from Capital and Related Financing Activities. The Cash flow stat. Therefore these are the part of Cash and cash equivalent.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)