Brilliant General Fund Balance Sheet

Instead General Fund or Accumulated Fund appears on the Balance Sheet.

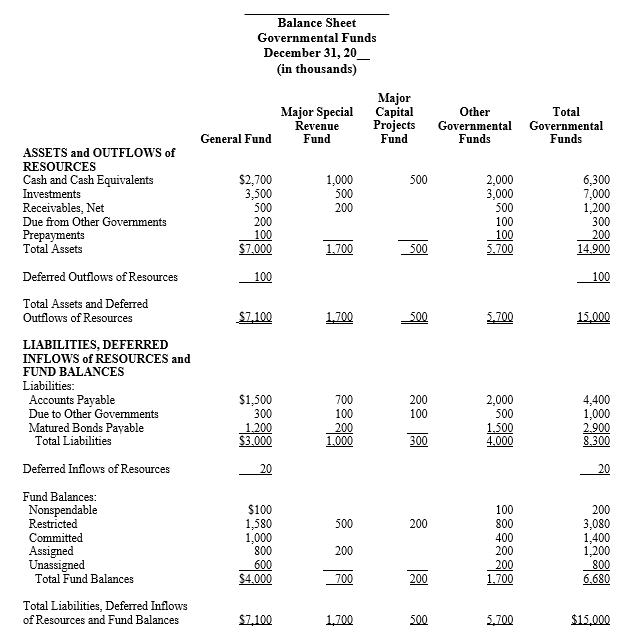

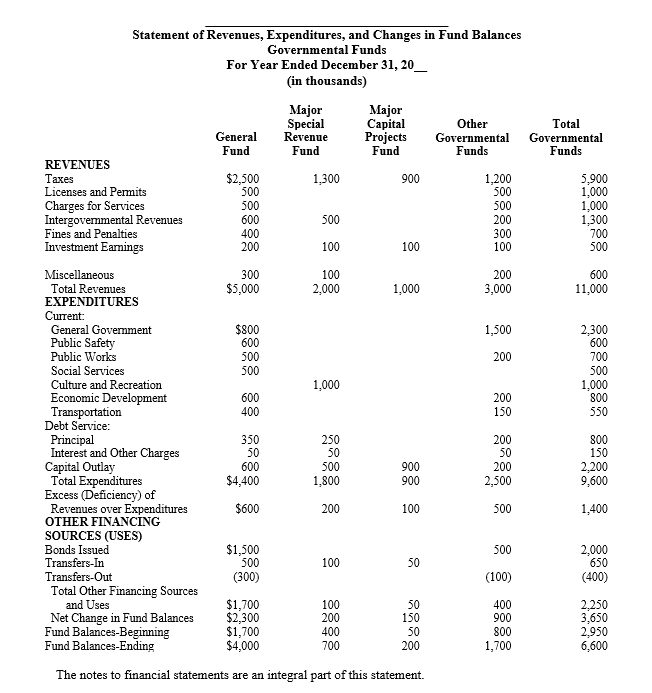

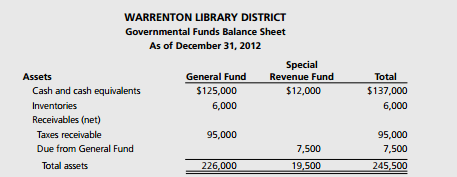

General fund balance sheet. Cities Towns Regional School Districts Special Purpose Districts Bureau of Accounts. The general fund is the only fund that can report a positive unassigned fund balance. ENTRY 80 AT099 Total Liabilities Deferred Revenues and Fund Balance is.

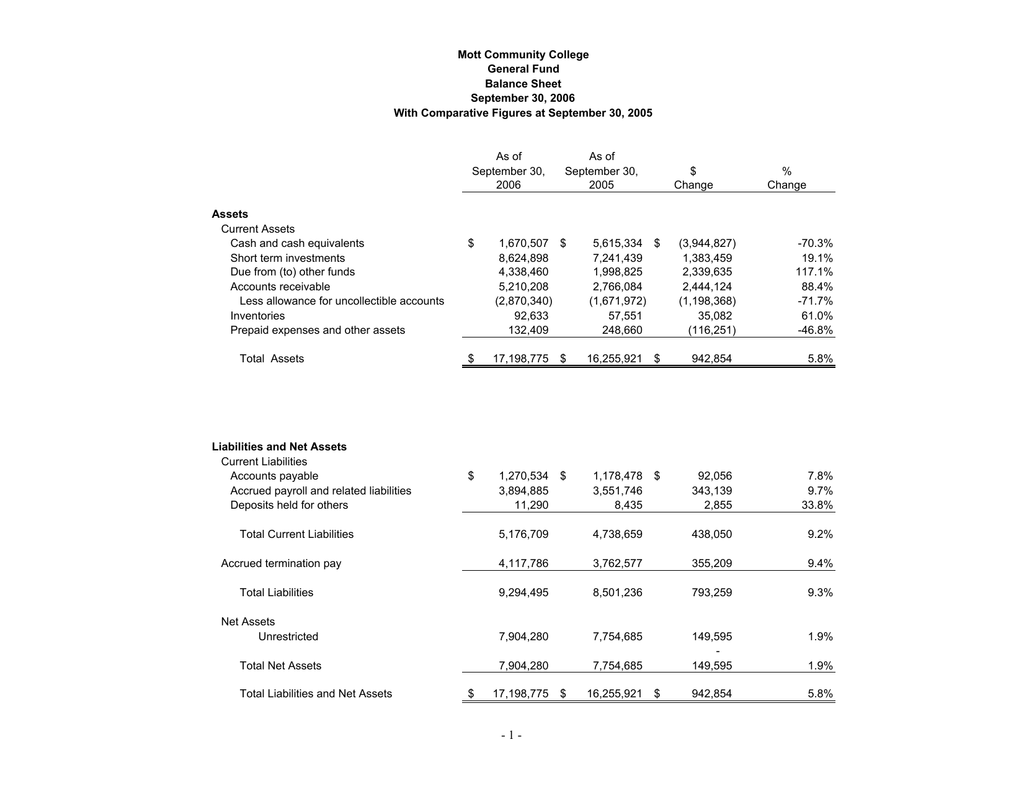

A balance sheet is a financial statement that shows a snapshot of a company or funds assets and liabilities. A capital project fund with a fund deficit. City of Smithville General Fund Balance Sheet December 31 2020 Assets Cash 331960600 Taxes Receivable-Delinquent 41839900 Less.

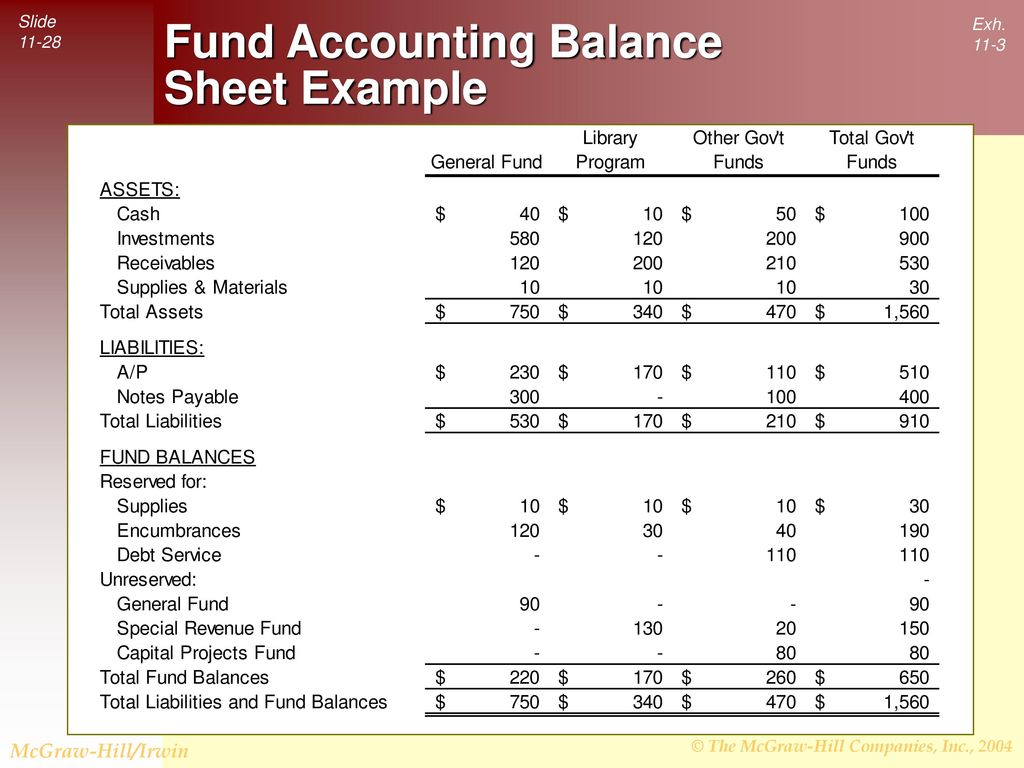

Fund balance is reported from the perspective of the underlying resources within fund balance. The Non-profit organizations do not use the term Capital. Fund balance and net position are the difference between fund assets plus deferred outflows of resources and liabilities plus deferred inflows of resources reflected on the balance sheet or statement of net position.

Negative or Residual Fund Balance Amounts Restricted committed or assigned should never be negative. General Fund Balance Sheet Includes HJR 2 Revenue Estimate Millions General Fund Balance SheetIncludes HJR 2 Revenue Estimate Millions. Estimated uncollectible interest and penalties 950 Net 4250 Due.

Proprietary and fiduciary fund equity is reported as net position. Assets liabilities. The assets of the organization are recorded on the Right side and liabilities on the Left side.

In the context of financial reporting the term fund balance is used to describe the net position of governmental funds calculated in accordance with generally accepted accounting principles GAAP. The Federal Reserves balance sheet The Federal Reserve operates with a sizable balance sheet that includes a large number of distinct assets and liabilities. CITY OF MONROE General Fund Balance Sheet As of December 31 2019 Assets Cash 503000 Taxes receivable 210000 Less.