Awesome Goodwill Classification On Balance Sheet

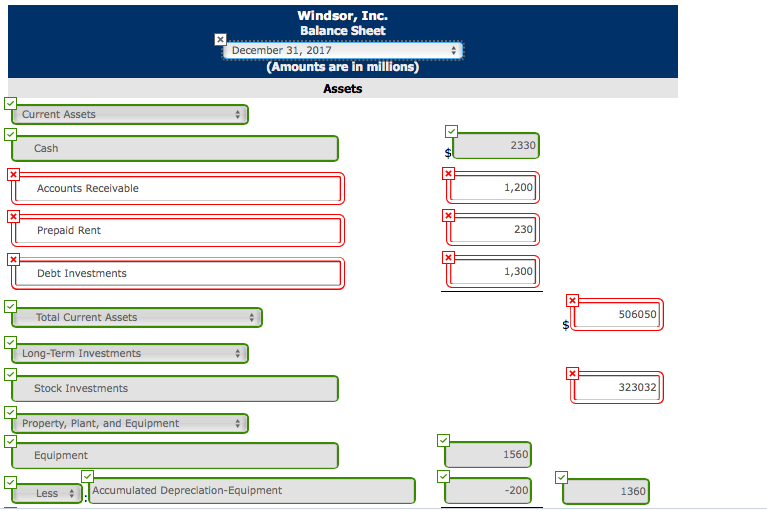

A classified balance sheet presents information about an entitys assets liabilities and shareholders equity that is aggregated or classified into subcategories of accounts.

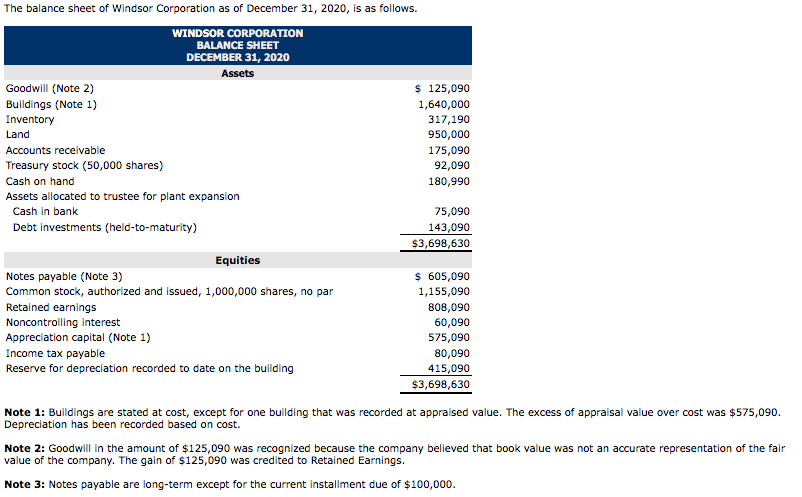

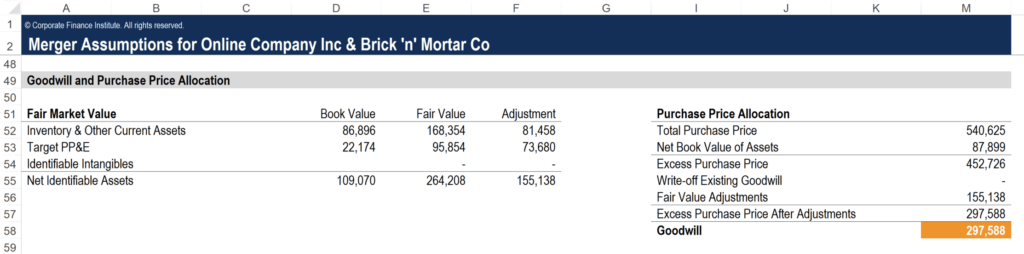

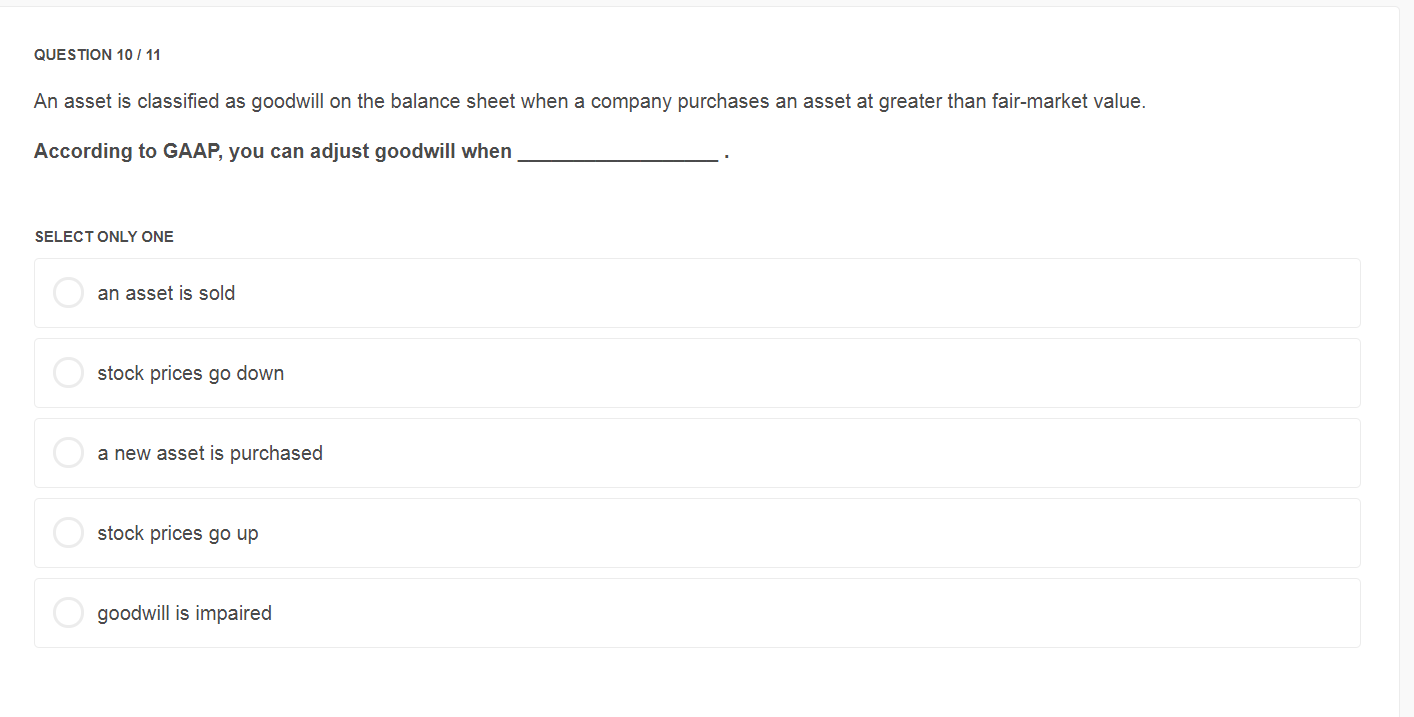

Goodwill classification on balance sheet. 6 Test the goodwill account. For more than one hundred years small business owners have often referred to goodwill as blue sky. The Generally Accepted Accounting Principles GAAP require that goodwill be recorded only when an.

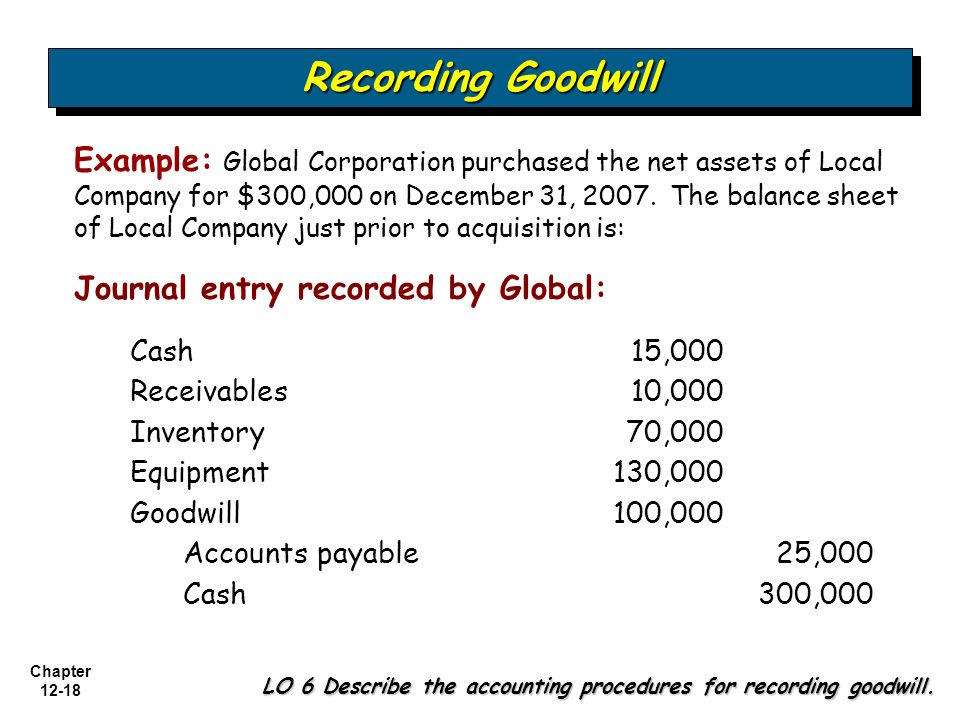

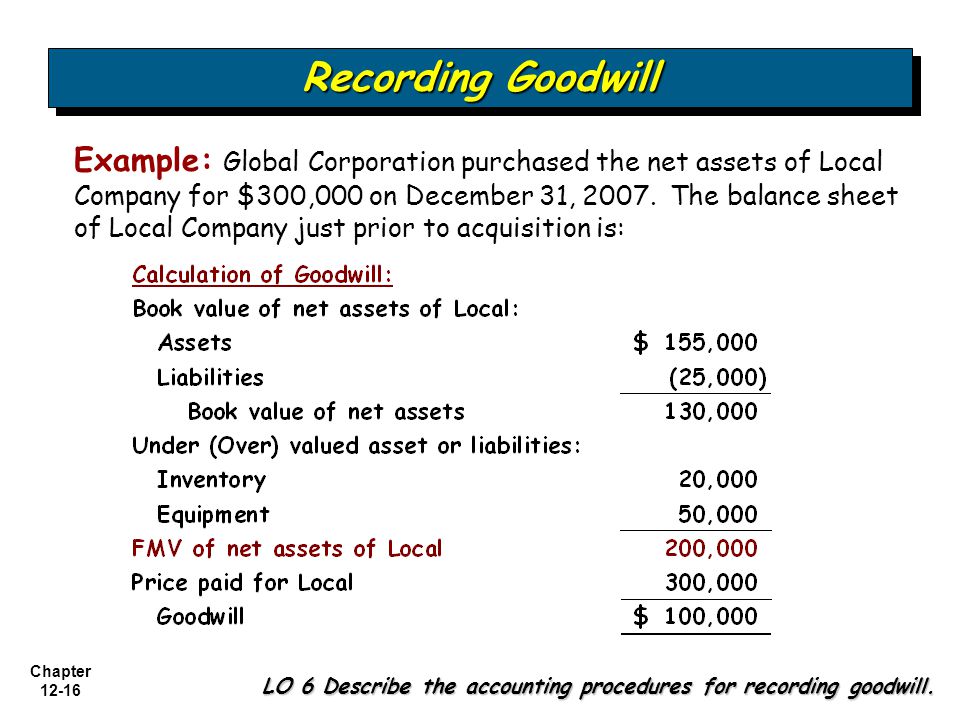

The remaining unallocated 50000 gets put on your balance sheet as goodwill. During a merger or acquisition. This is called a.

Goodwill can lose value over time like with many financial assets. Unlike other assets that have a. Specifically goodwill is recorded in a situation in which the purchase price is higher than the sum of the fair value of all visible solid assets and intangible assets purchased in the.

Goodwill is recorded when a company acquires purchases another company and the purchase price is greater than 1 the fair value of the identifiable tangible and intangible assets acquired minus 2 the liabilities that were assumed. Because it cannot be seen or touched it is classified on the balance sheet as an intangible asset. This is then continually passed on into the next quarter.

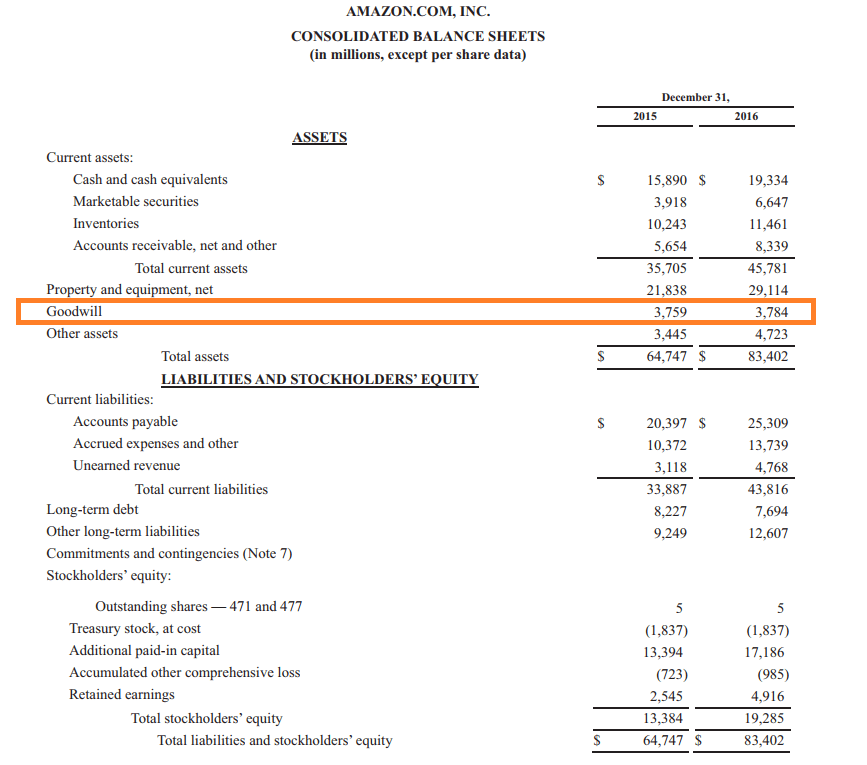

Goodwill is an intangible asset account on the balance sheet. The price you pay for the current value of the tangible assets such as real estate food equipment appliances tables chairs or other goods adds up to 450000. 1 Under the current system when goodwill is valued it is placed on a balance sheet and continuously carried over into the next periodany additional acquisitions will be added to the balance carried over.

This series of entries adds the 800000 in assets to the books adds the 200000 in Goodwill and subtracts 1 million in cash from the books to reflect cash leaving to fund the purchase. Shown on the balance sheet goodwill is an intangible asset that is created when one company acquires another company for a price greater than its net asset value. Intangible assets and goodwill are often classified as separate and distinct line items on a companys balance sheet.