Awesome Meaning Of Provision For Doubtful Debts

Closing stock is valued at cost price or Net realizable value whichever is lower.

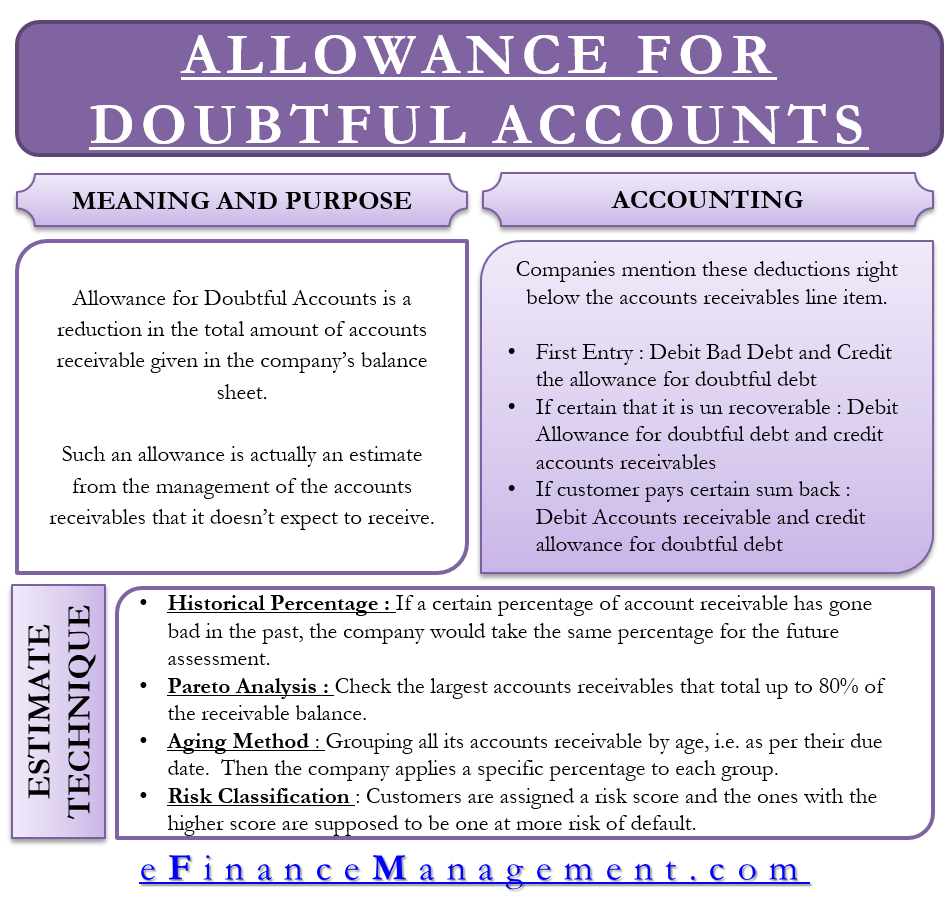

Meaning of provision for doubtful debts. Provision for Doubtful Debts. Put simply its a provision or allowance for debts that are considered to be doubtful. It is similar to the allowance for doubtful accounts.

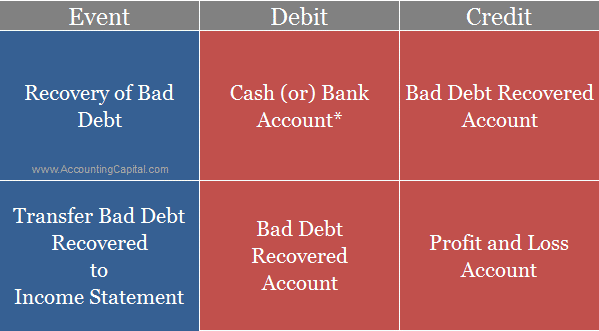

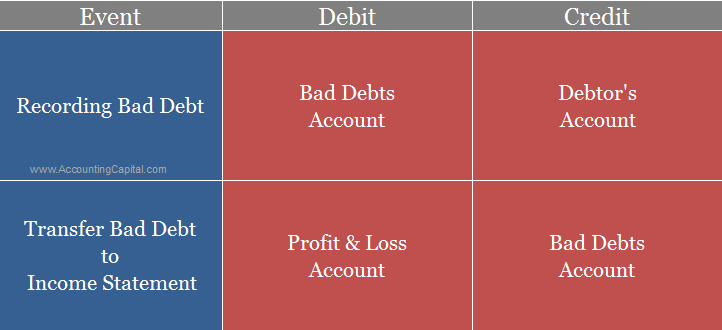

It help to show real value of debtor asset as on balance sheet date. It is nothing but a loss to the company which needs to be charged to the profit and loss account in the form of provision. Provision for pending law suit against the firm which may either be decided in its favor.

Provision for doubtful debts. Provision for Bad Debts Meaning. Before doing accounting treatment of provision for doubtful debts you must know the complete definition of provisionIn accounting it is a reserve that is against loss due to non payment of debtorsIn case debtor does not give us our amount.

The provision for doubtful debts which is also referred to as the provision for bad debts or the provision for losses on accounts receivable is an estimation of the amount of doubtful debt that will need to be written off during a given period. Meaning of Provision for Doubtful Debts-The term provision for doubtful debts refers to the estimated or predicted value of bad debts that arises from the sundry debtors that have been issued but have turned out to be uncollectible. Provision For Doubtful debts takes into consideration that when a company conducts it business there is bound to be some billings during the year whereby the customers might not be able to pay hence eventually turning bad.

Provision for doubtful debts or allowance for bad debts or un-collectible accounts state the proportion of trade receivables that the business expects but may not be recovered. Recoverability of some receivables may be doubtful although not definitely irrecoverable. Every year the amount of provision for doubtful debt gets changed due to the provision made in the current year.

Provision for doubtful debts acts as a liability for the business and is shown on the liability side of a balance sheet. Provision for doubtful debt is created in anticipation of bad debts etc. Provision for doubtful debts is a liability for the business and it appears on the liability side of a balance sheet.