Wonderful Bad Debt Cash Flow Statement

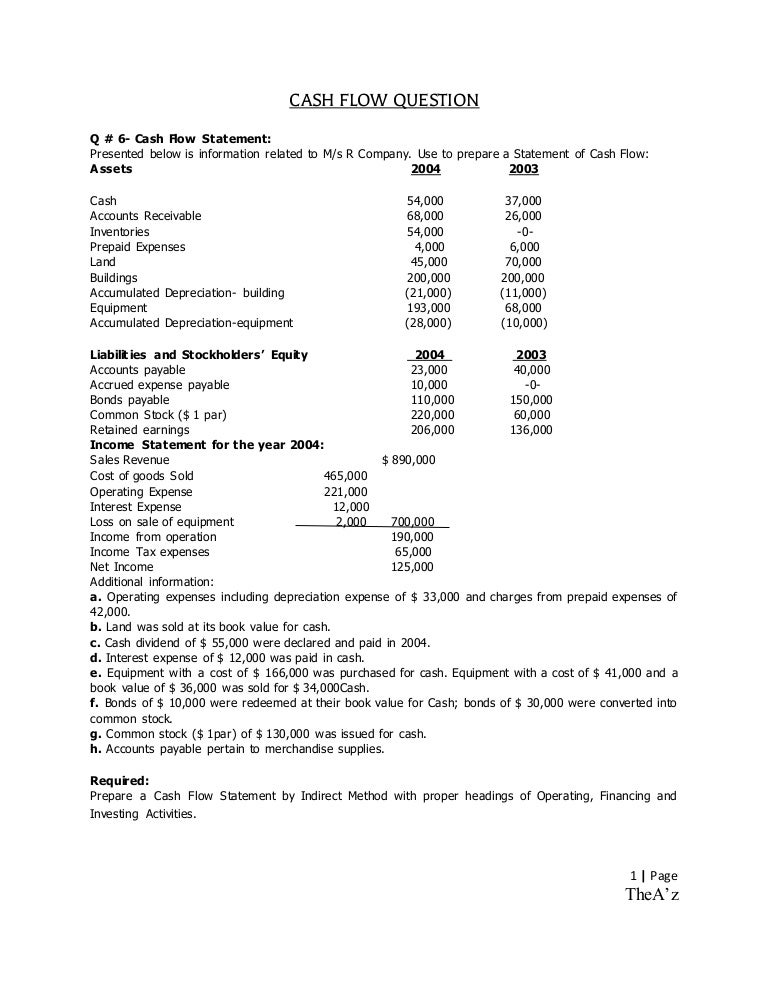

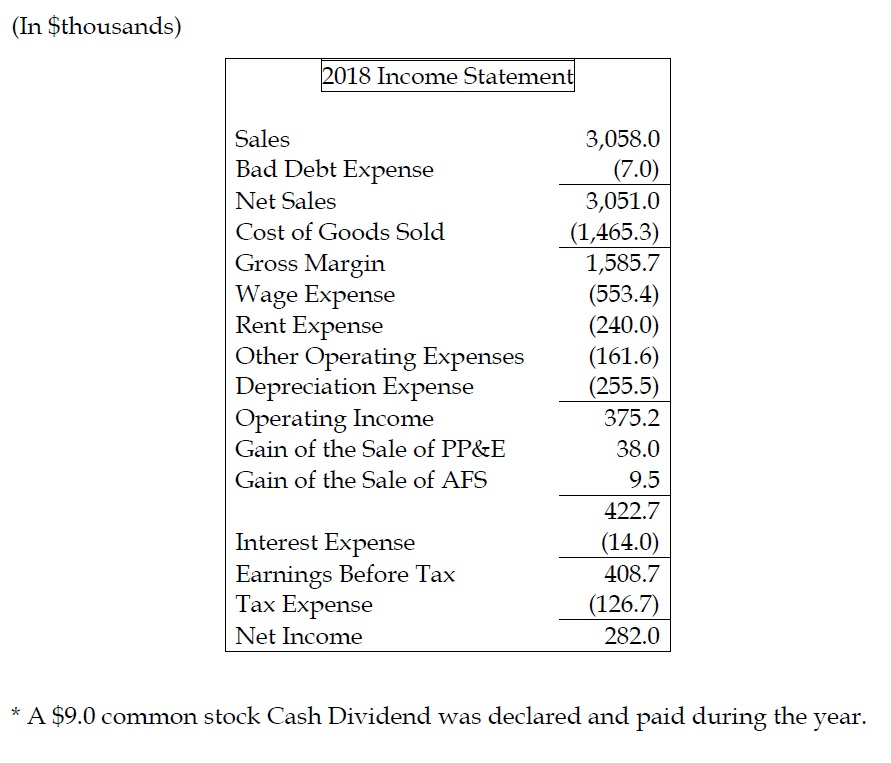

If you really want to argue yes it shows up in the income statement but somewhere along the cash flow statement would need to add it back to cancel it out as it is a non-cash activities to ensure the amount does not affect the cash flow statement.

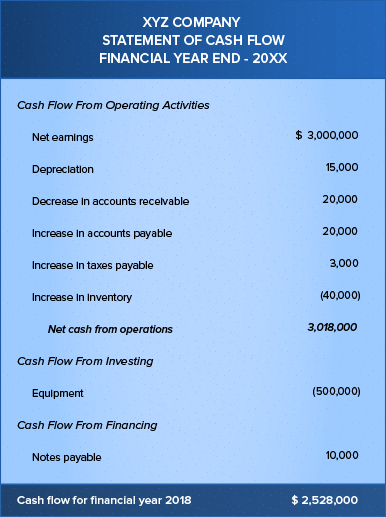

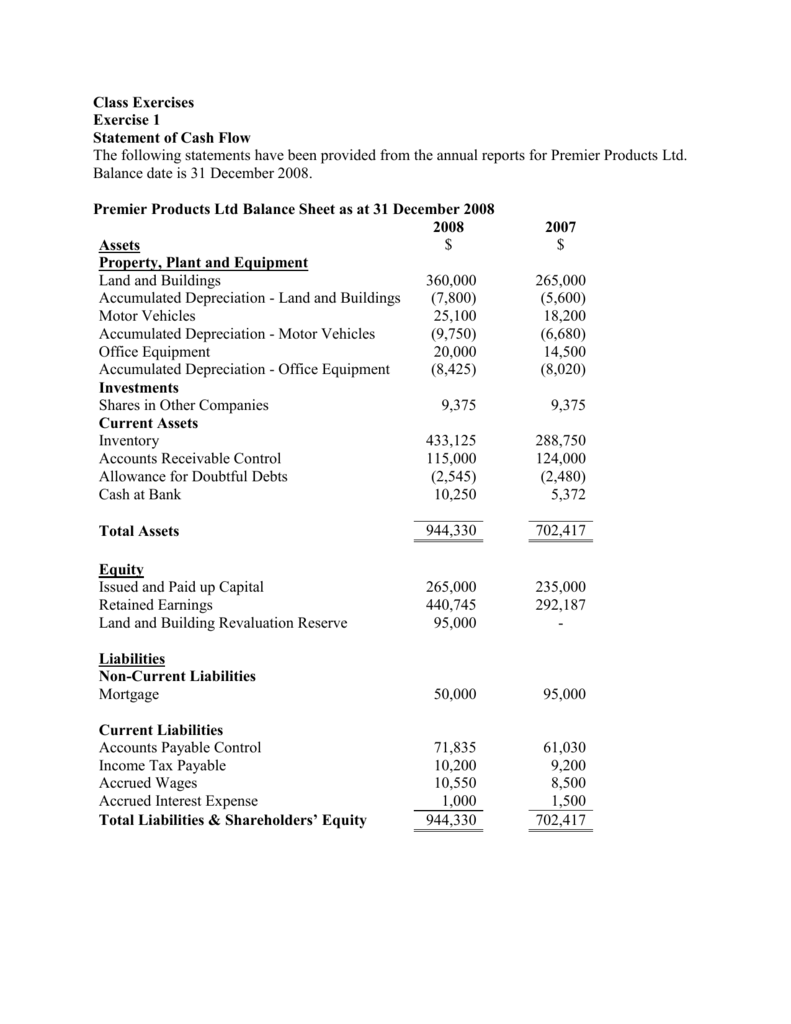

Bad debt cash flow statement. When using the indirect method for presenting your companys cash flows for operating activities one part of the statement also includes lines like Changes in receivables and prepayments and Changes in payables and prepayments. Gain on revaluation of investments. Cash up 40 ar down 100 so assets down -60 right side.

Because bad debts are generally not included in the cash flow statement. First the entry to write off the debt as shown in section 2 must be reversed as follows. Its important to remember that long-term negative cash flow isnt always a bad thing.

Some months you may spend cash in order to make money later onby investing in equipment for example. Like Alternative A the bad debts provision is viewed implicitly as a revenue deduction rather than a noncash expense and the reconciliation does not include a separate line item for the bad debts provision. These would include but are not limited to.

My assumption is that the prov. Can you explain me the treatment of Provision for Bad debts in Cash flow statement under indirect method. Indirect Impact of Bad Debt If your company prefers to use a bad debt reserve which is an amount set aside to cover bad receivables then the impact on the cash flow statement.

The cash flow statement looks at the inflow and outflow of cash within a company. Its just an accounting entry a loss or expense but there is no actual cash involved in the transaction. Uncollectible accounts being written off as bad debt expense have no impact on cash flow statements except in the most indirect manner.

One of the keys to using this tool to produce accurate statements of cash flows is to capture and list in the net asset column non-cash activities. Elimination of non cash expenses eg. DR Accounts.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)