Simple Ratio Analysis Of Coca Cola Company 2018

On the same note the current ratios for the Pepsi Company in the same years were 110 124 and 114 respectively.

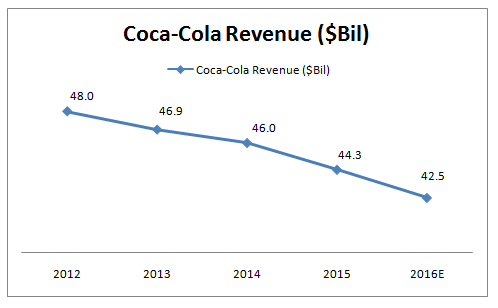

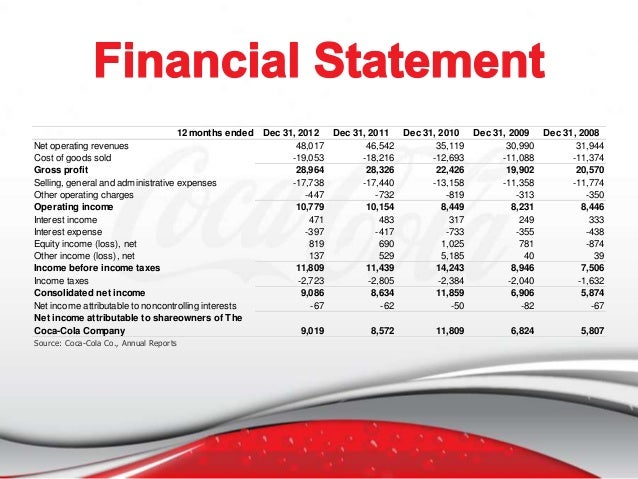

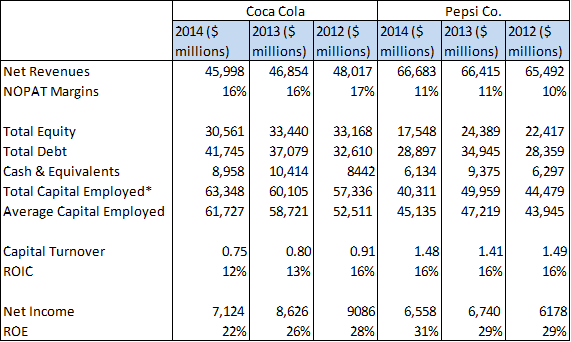

Ratio analysis of coca cola company 2018. -1 between the first and the second quartile. Calculated by dividing Earning Before Interest and Taxes EBIT by Revenues. Fourth quarter of 2017 Bartash 2018 PepsiCo Inc 2017 The Coca-Cola Company 2017.

Coca-Colas current ratio decreased in 2018 09x -355 and 2019 08x -126 and increased in 2016 13x 34 2017 13x 48 and 2020 13x 741. 2 above the third quartile. ROS is often a component of DuPont ROE analysis.

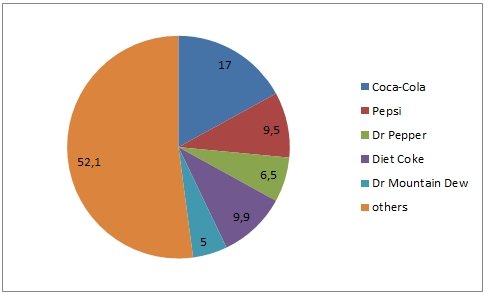

Request a free trial today. FINANCIAL ANALYSIS OF COCA-COLA 2 Introduction Coca-Cola was invented in 1886 by an Atlanta Pharmacist named John Pemberton The Coca-Cola Company 2016. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Coca-Cola Cos latest.

Coca-Cola Cos current ratio for the quarter that ended in Mar. Return on Equity ROE. The higher of this ratio is the better for the company.

Cash ratio A liquidity ratio calculated as cash plus short-term marketable investments divided by current liabilities. Cokes current ratio ended 2016 at 128. Coca Cola company recorded a current ratio of 128 in 2016 and having a current ratio above 1 is good for the company which it means Coca Cola is able to cover the short t erm debt.

Coca-Colas current ratio hit its five-year low in December 2019 of 08x. Coca-Cola Co has a current ratio of 133. 67 rows Current ratio can be defined as a liquidity ratio that measures a companys ability to pay.

:max_bytes(150000):strip_icc()/international-green-week-agricultural-trade-fair-461626100-f4460c91031e4823a247304431530c9a.jpg)