Casual Mcdonalds Financial Performance

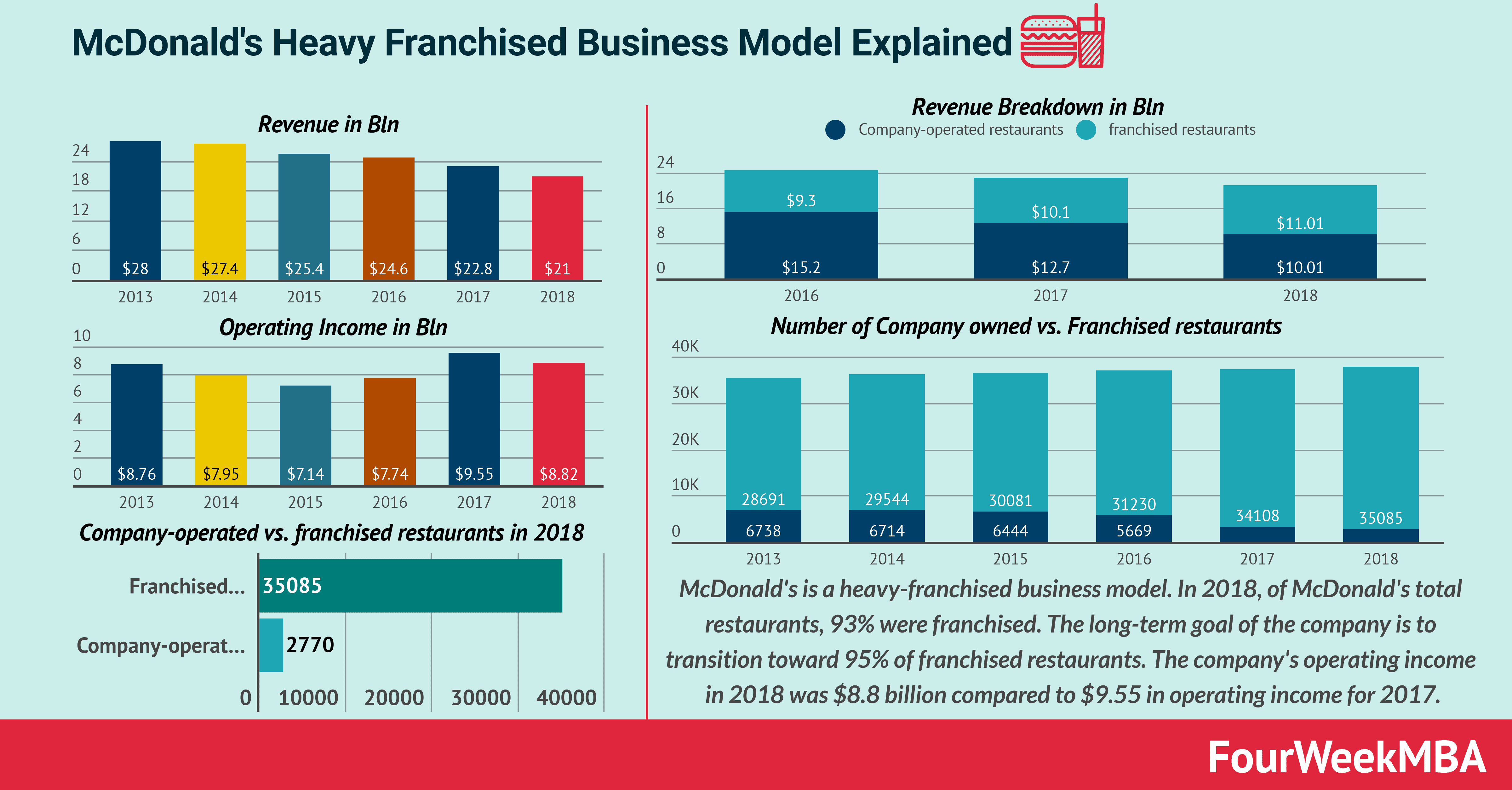

The success behind the McDonalds financial performance is basically due to their internal core competencies and other internal operations.

Mcdonalds financial performance. As per Waters 2006. Pro Forma financial statements of McDonalds for the following two monetary years were created keeping in mind the end goal of figuring out whether the associations expected performance is following their objectives and deciding future financing requirements of the organization. The data has been gathered from the income statement and.

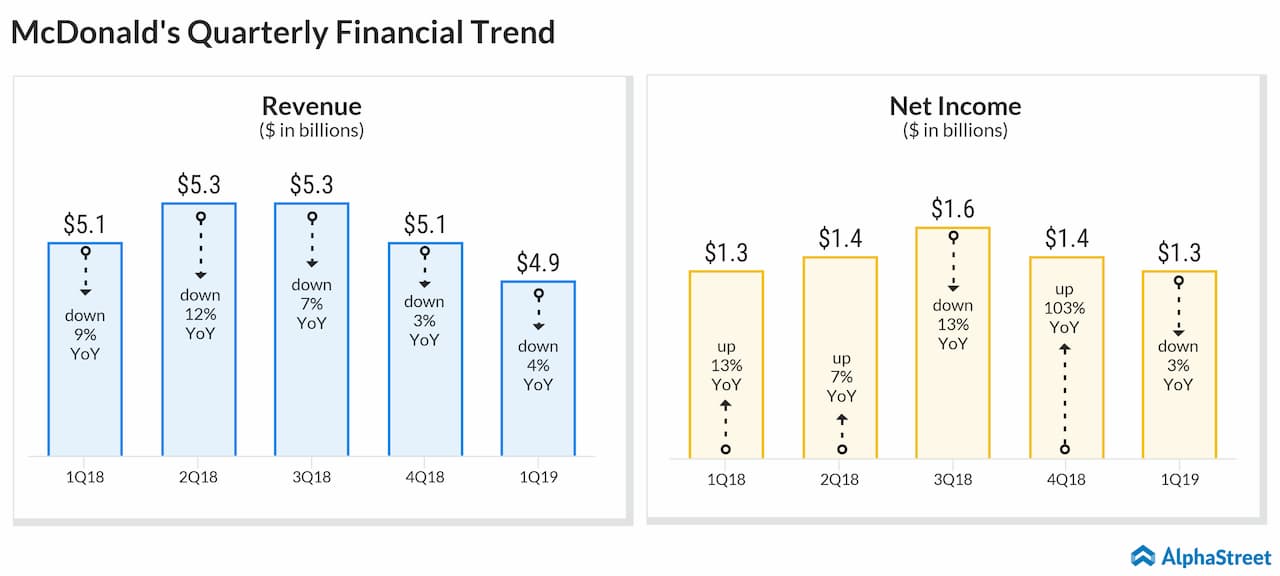

McDonalds Corp Earnings before Tax are projected to decrease significantly based on the last few years of reporting. MCD fared better than most restaurants during the Covid-19 crisis this year which hammered US. MCD Financial Summary For the three months ended 31 March 2021 McDonaldsCorp revenues increased 9 to 512B.

Of 04 and negative comparable sales in the International Operated segment and International Developmental Licensed segment of 150 and 105 respectively. The growth in revenue between 2011 and 2010 was 1636. McDonalds Corp Ordinary Shares.

Argentina Austria Brazil Chile Germany Mexico Peru Romania Russia Switzerland UK. McDonalds enjoyed a second successive year of growth in the number of guests. PERFORMANCE Assumed figures are as of FY 2012 Mcdonalds Burger King Yum.

Global comparable sales declined 77 reflecting positive comparable sales in the US. 2018 McTrip Financial Overview - PDF 154 KB November 27 2018. PERFORMANCE Cash Flow-to-Revenue Cash ROA Cash ROE 26.

Aggregate accruals deriving measures of the accrual component of McDonalds Corps earnings. McDonalds current ratio which is a measure of liquidity is 136 and confirms that the company is on sound financial footing. This essay on McDonalds and Yum.