Top Notch Typical P&l Statement

It is also known as the income statement or the statement of operations.

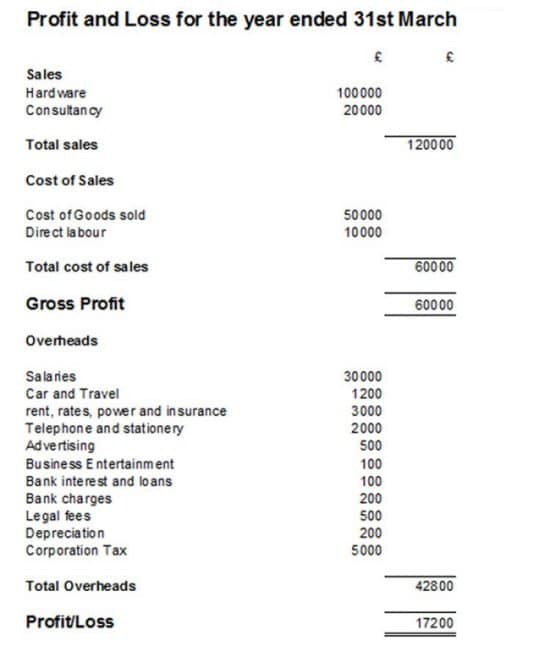

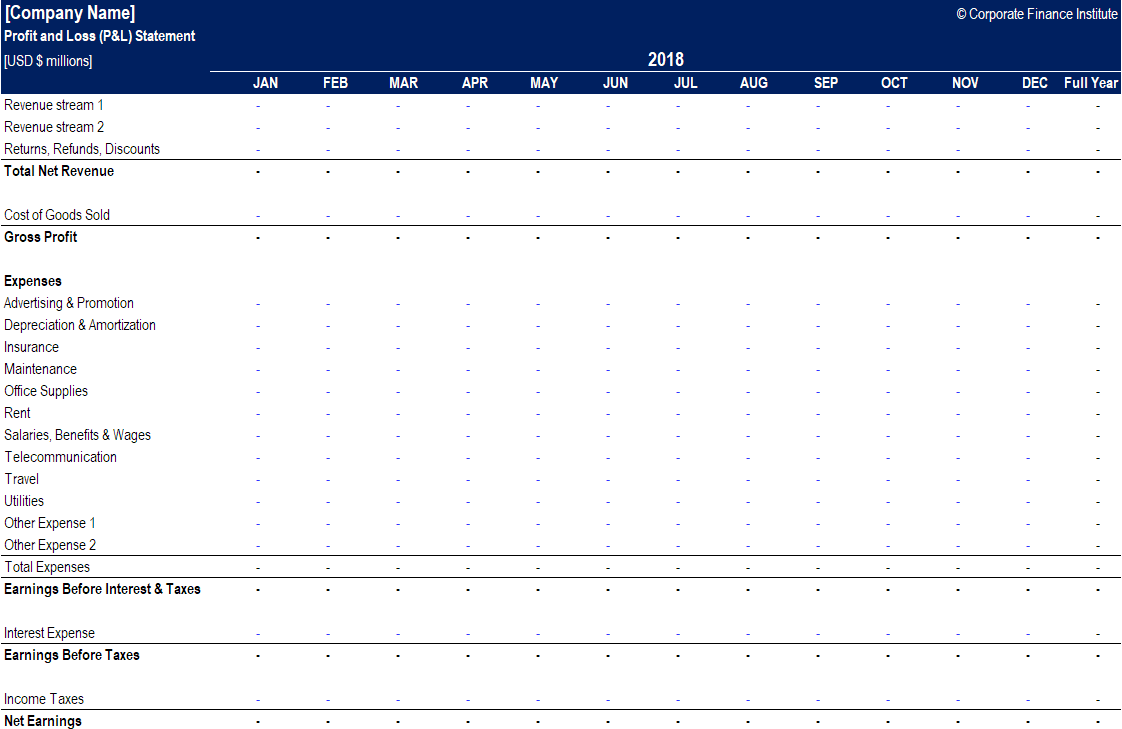

Typical p&l statement. The functional presentation arrangement breaks the salon business down into two or more areas of activity. Example profit and loss statement. They are typically carried out on a monthly quarterly and annual basis.

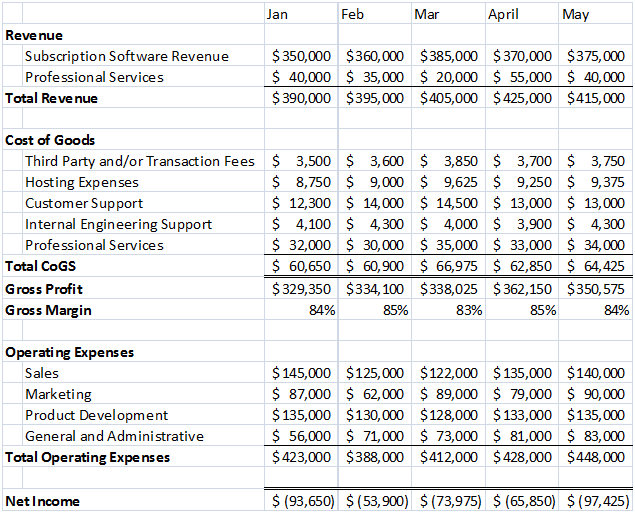

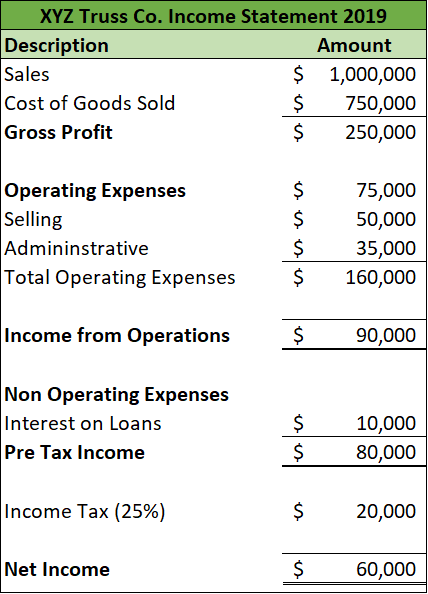

PL statement also enables you to calculate food cost percentage gross profit and net profit or loss. What is the Profit and Loss Statement PL. It is also known as the statement of operations earnings statement statement of financial results or income or expense statement.

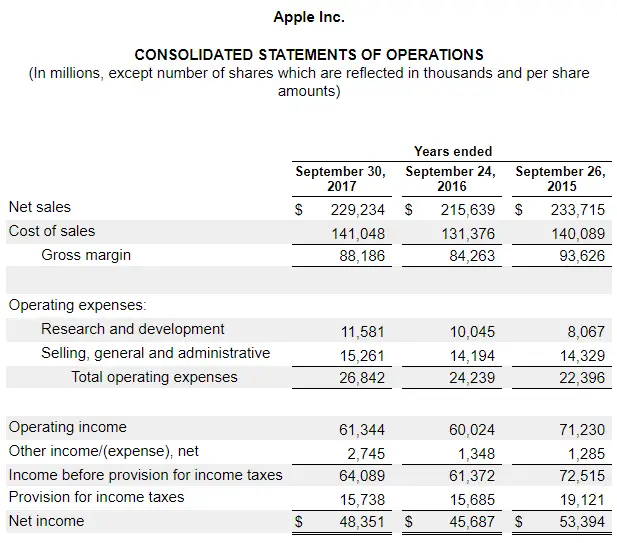

Ad Over 2000 Essential Templates to Start Organize Manage Grow Your Business in 1 Place. This form of a profit and loss statement allows the owner to quickly and decisively determine performance throughout the entire operation. To clarify the above statements the following financial statements of the V.

Each entry on a PL statement provides insight into the cash. These metrics can be calculated from your sales COGS and costs and they allow you to fully understand your restaurants financial state. A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time.

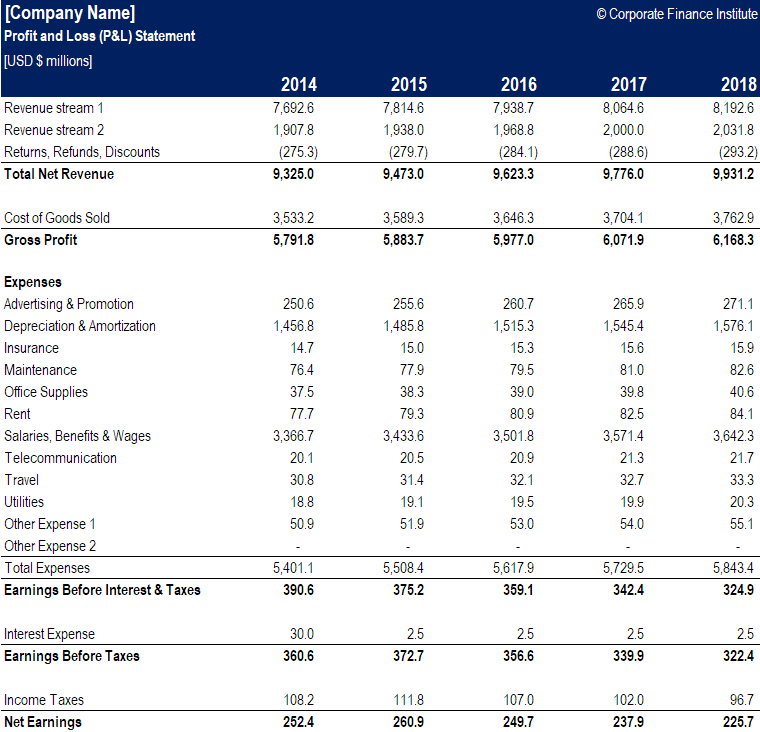

According to Investopedia a profit and loss statement is a financial statement that summarizes the revenues costs and expenses incurred during a specific period of time usually a fiscal quarter or year. Free Profit and Loss Template PL Template Download CFIs free Profit and Loss template PL template to easily create your own income statement. The profit and loss PL statement is a financial statement that summarizes the revenues costs and expenses incurred during a specified period usually a fiscal quarter or year.

Operating revenues and expenses are segregated from nonoperating income and costs for example. The PL statement shows a companys ability to generate sales manage expenses and create profits. Restaurant Profit and Loss Statement Breakdown.