Wonderful If A Company Fails To Adjust For Accrued Revenues

Assets will be overstated and net income and stockholders equity will be overstated.

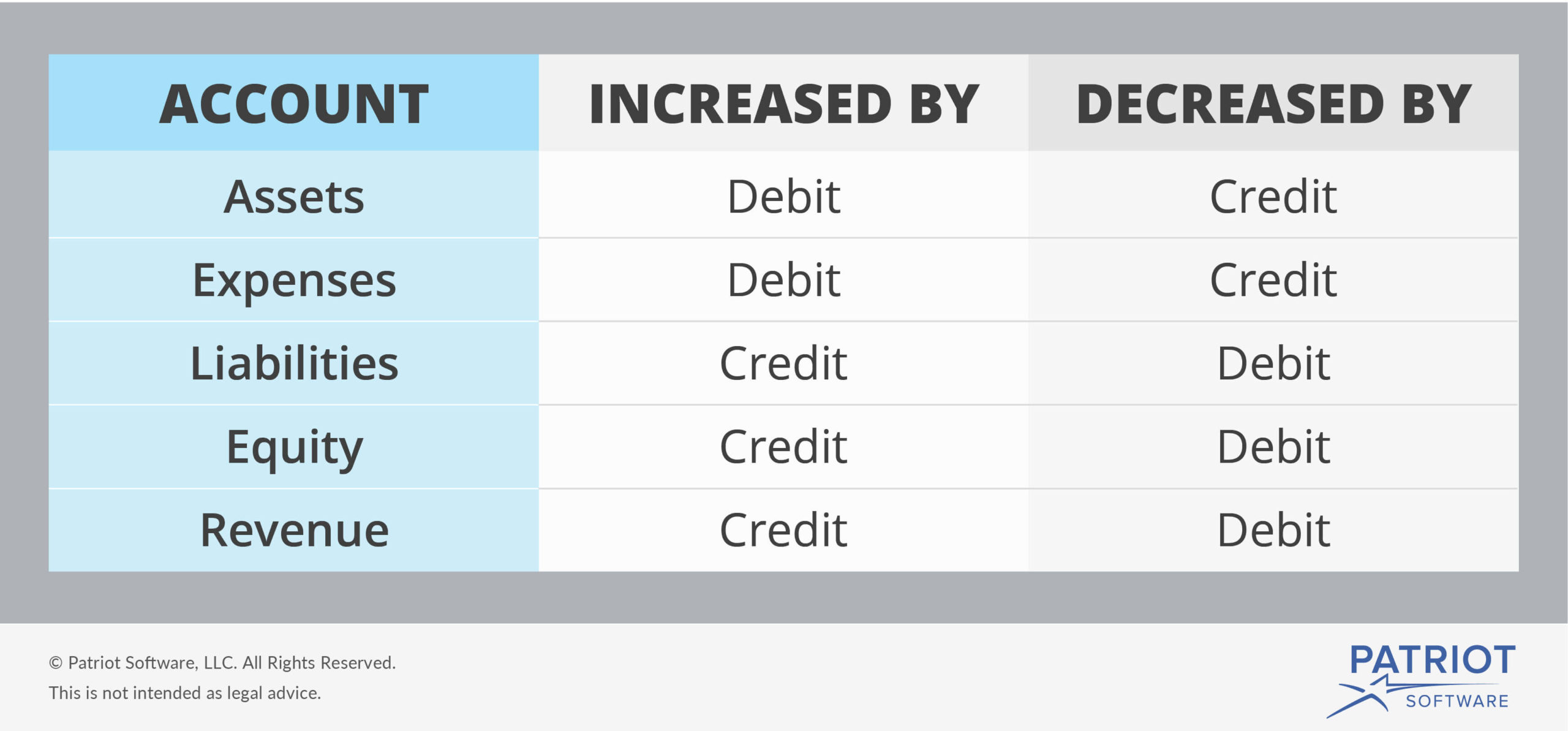

If a company fails to adjust for accrued revenues. Liabilities will be understated and revenues will be understated. 1 Interest Expense will be understated too little expense being reported by 1000 2 Net Income will be overstated too much net income being reported by 1000 3. Assets will be overstated and net income and stockholders equity will be overstated If a company fails to adjust a Prepaid Rent account for rent that has expired what effect will this have on that months financial statements Liabilities will be overstated and revenues will be understated.

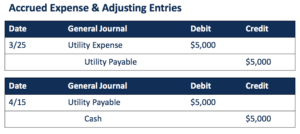

If a company fails to adjust for accrued revenues. Liabilities will be understated and revenues will be understated. The accountant records this transaction as an asset in the form of a receivable and as revenue because the company has earned a revenue.

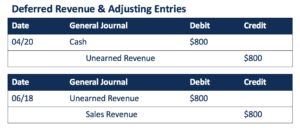

Assets will be understated and revenues will be understated. Liabilities will be understated and revenues will be understated. Example 1 Revenue Goes From Accrued Asset to Accrued Revenue An asset revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer.

Assets will be overstated and revenues. QUESTION 36 If a company fails to adjust for accrued revenues. Assets will be overstated and net income and stockholders equity will be overstated.

Assets will be overstated and revenues will be understated. In the second year the company bears the remaining one-third of the costs 400000 and is allowed to book the remaining one-third of. Assets will be understated and revenues will be understated.

A liabilities will be understated and revenues will be understated. If a company fails to adjust a Prepaid Rent account for rent that has expired what effect will this have on that months financial statements. The accountant of Reliable Consulting Company failed to make an adjusting entry to record 6000 for unearned service revenues that were earned before the end of the fiscal year.

/GettyImages-175599141-2ce72850981343a9ade6410691182453.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)