Divine Calculation For Retained Earnings

Beginning of Period Retained Earnings At the end of each accounting period retained earnings are reported on the balance sheet as the accumulated income from the prior year including the current years income minus dividends paid to shareholders.

Calculation for retained earnings. If you need to do a retained earnings calculation theres a pretty simple formula that you can use. Its retained earnings calculation is. 1200000 Beginning retained earnings.

The amount for retained earnings is part of the net income. To calculate it one needs to subtract the cost of doing business from the revenue. If youre the sole owner that means any profits left.

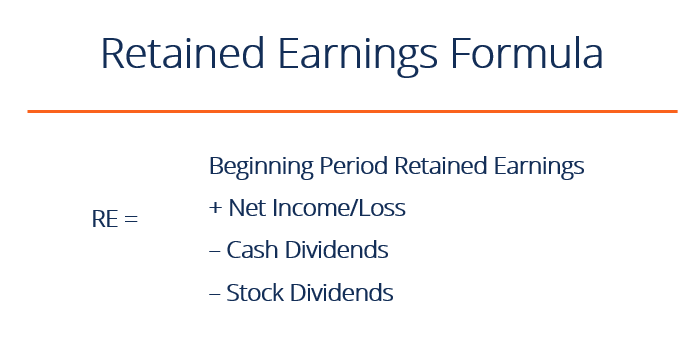

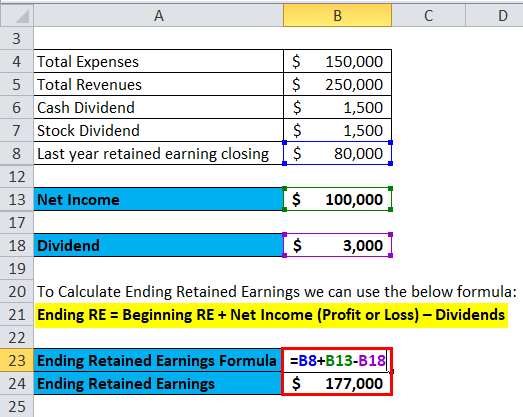

A business can then store its retained earnings in a special account and invest the surplus back into the company to pay off loans launch a new product or. To calculate retained earnings subtract a companys liabilities from its assets to get your stockholder equity then find the common stock line item in your balance sheet and take the total stockholder equity and subtract the common stock line item figure if the only two items in your stockholder equity are common stock and retained earnings. Retained earnings RE beginning retained earnings net income or net loss cash dividends stock dividends.

Example of the Retained Earnings Formula ABC International has 500000 of net profits in its current year pays out 150000 for dividends and has a beginning retained earnings balance of 1200000. Calculate your net income during the reporting period. Retained earnings are the accumulation of the entitys net profit from the beginning to the reporting date after deducting the dividend payments to shareholders.

Retained earnings are calculated by subtracting dividends from the sum total of retained earnings balance at the beginning of an accounting period and the net profit or - net loss of the accounting period. Retained earnings are calculated to-date meaning they accrue from one period to the next. The retained earnings formula is.

The formula for calculating Retained Earning The formula for calculating retained earnings in a situation where the company has a positive result is not the same as when there is a loss. Retained earnings are all the net income profits you have left after paying out dividends or distributions to ownersshareholders. Theres a bit of financial jargon in.