Matchless Accounting Solvency Ratios Retail Balance Sheet Example

Moreover the total assets to total.

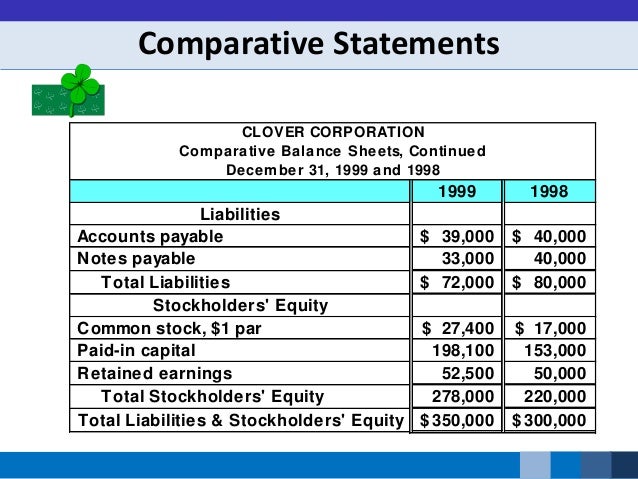

Accounting solvency ratios retail balance sheet example. You can learn more about accounting from the following articles. The debt-to-asset ratio shows the percentage of total assets that were paid for with borrowed money represented by debt on the business firms balance sheet. What are Accounting Ratios.

One of the most commonly used solvency ratios total assets to total liabilities is calculated at a single point in time in the balance sheet statement while the cash flow from operations to average total liabilities ratio covers a period of time. Solvency ratios also called leverage ratios measure a companys ability to sustain operations indefinitely by comparing debt levels with equity assets and earnings. Accounting ratios cover a wide array of ratios that are used by accountants and act as different indicators that measure profitability liquidity Liquidity In financial markets liquidity refers to how quickly an investment can be sold without negatively impacting its price.

A balance sheet is financial statement that outlines the assets anything of value owned by the company and liabilities debts that you owe of a retail business. In other words solvency ratios identify going concern issues. We can say all of the assets and equity stated in the balance sheet are involved in the equity ratio calculation.

A balance sheet can also be referred to. You have 13000 in current assets and of that total 3000 is inventory. What are Solvency RatiosThey help in determining whether company will be able to repay its long term debtsHence it helps in finding out whether company will be able to survive over a long period of timeImportant Solvency RatiosSnoRatio NameFormulaIdeal RatioWhat is betterRemarks1Debt equity Rat.

Ratio Analysis Template is a ready-to-use template in Excel Google Sheets and OpenOffice Calc that helps you to know the financial performance in key areas. Here we discuss the top 4 types of Balance Sheet Ratios like Efficiency ratios Liquidity Ratio Solvency Ratio Profitability Ratios along with formulas and classifications. Quick ratio 25000 20000.

Ratios For our curriculum in Grade 12 we are going to use ratios to analyse the information available in the Income Statement and the Balance Sheet. Lets redo our example above using the quick ratio. Many people confuse solvency ratios with liquidity ratios.