Great A Classified Balance Sheet Balance Sheet Debit Credit Format

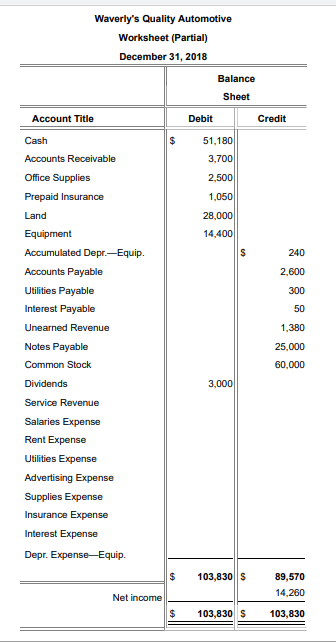

In this case we added a debit of 4665 to the income statement column.

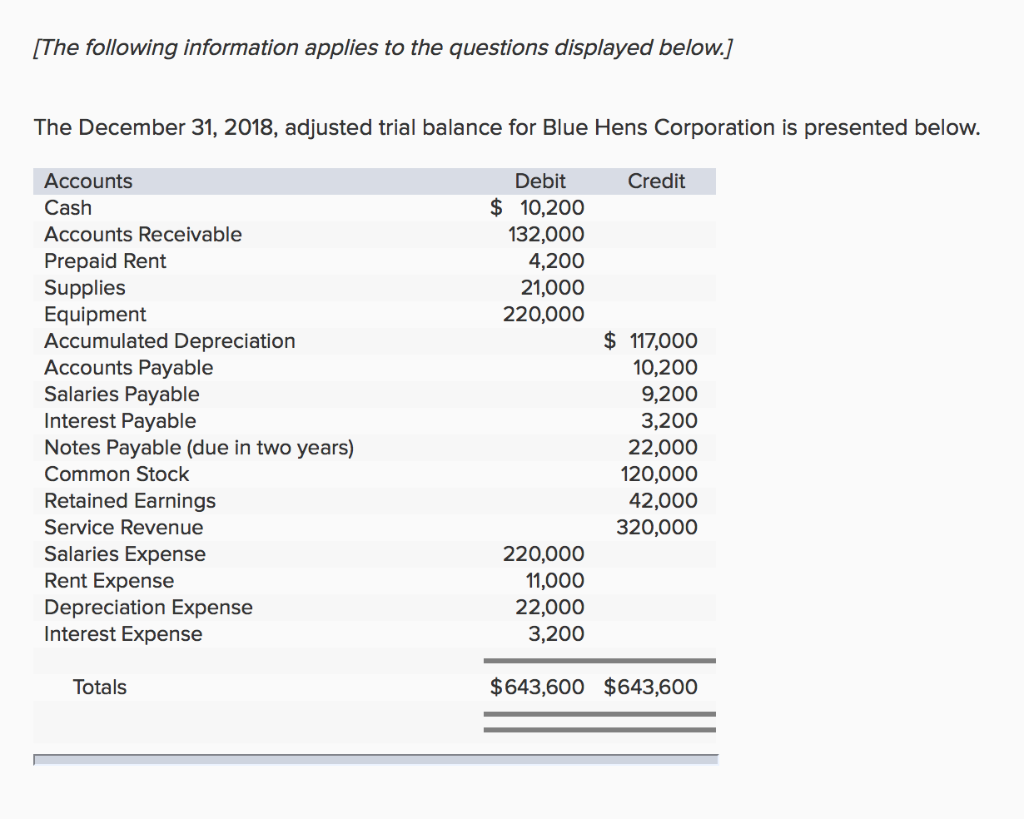

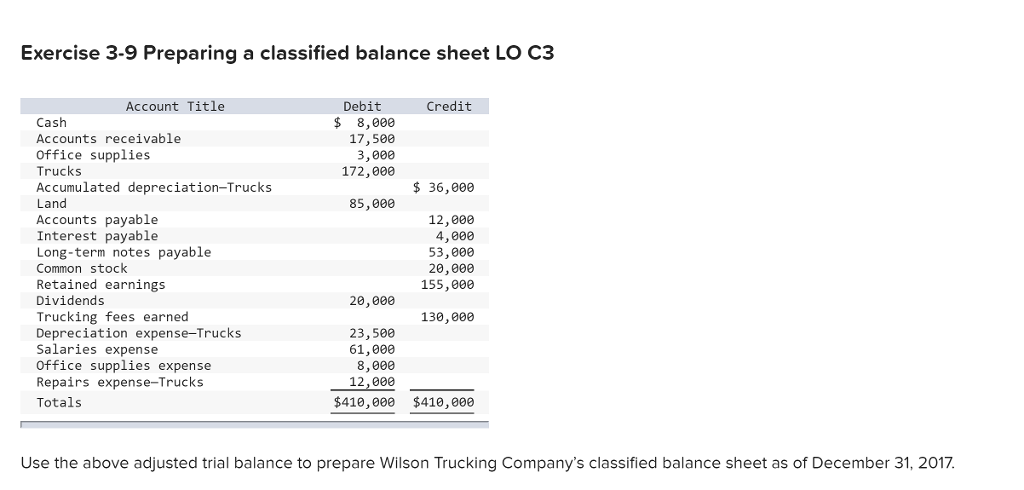

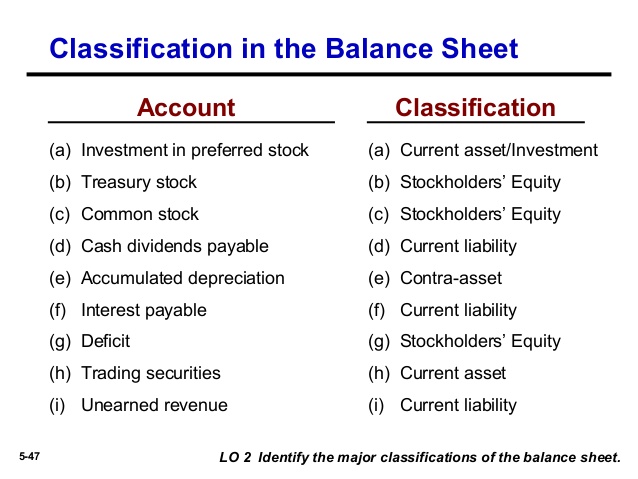

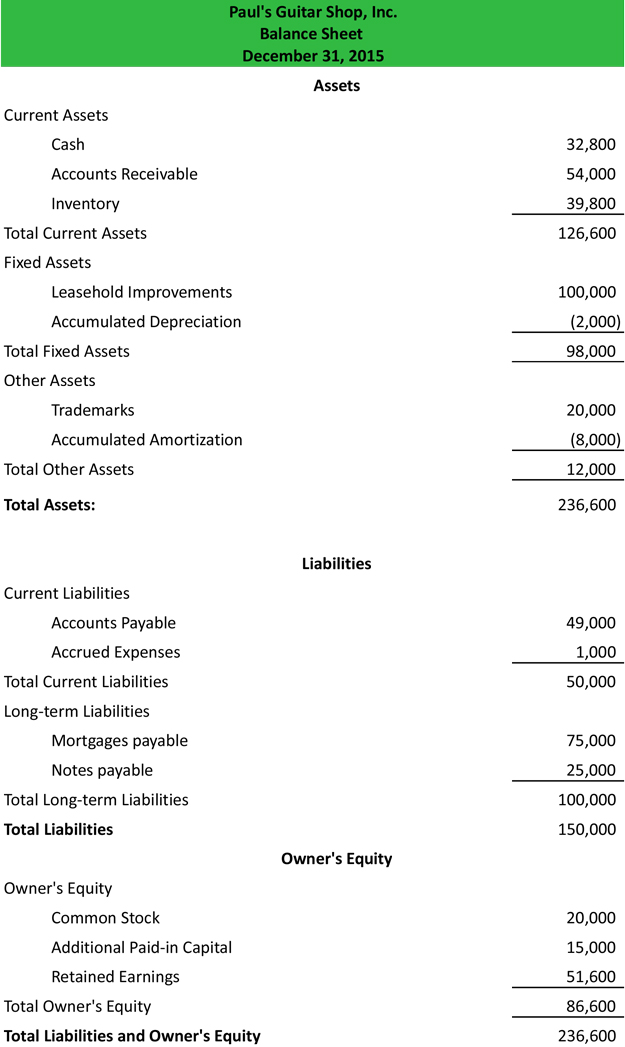

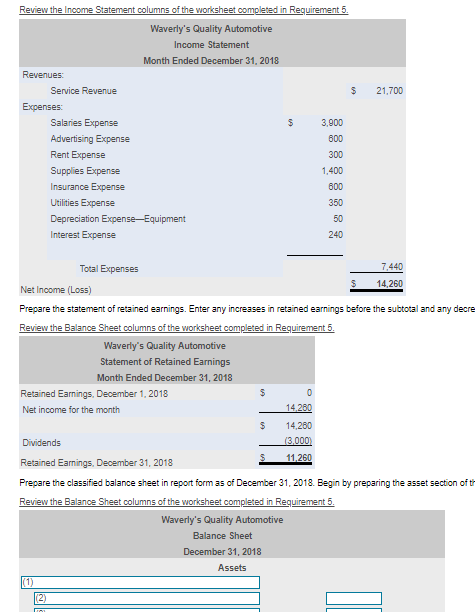

A classified balance sheet balance sheet debit credit format. Accounting for debits credits on the balance sheet income statement shown explained is a template for BS IS showing the relationship of debits c. The components of assets liabilities and equity are broken down into further sub-headings for provided in-depth information to the users. The balance sheet is also commonly referred to as the statement of financial position.

The Balance Sheet is an important document for schools using CASES21 Finance C21F. If future payment is possible the contingent nature of. For example most balance sheets use the following asset classifications.

If the future payment is considered probable the liability should be recorded by a debit to a loss account and a credit to a liability account. What is a classified balance sheet. Not exist on the balance sheet date.

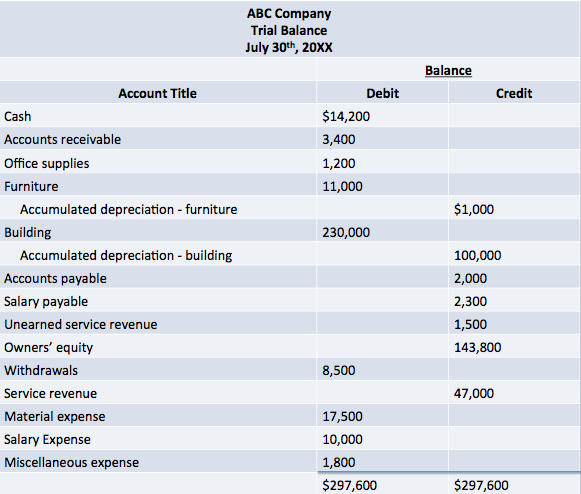

Gather the closing balance of ledger accounts and enter them into the trial sheet table. The balance sheet is derived using the accounting equation. Transactions are manually entered into the accounting record using adjusting journal entries AJEs which present debits before credits.

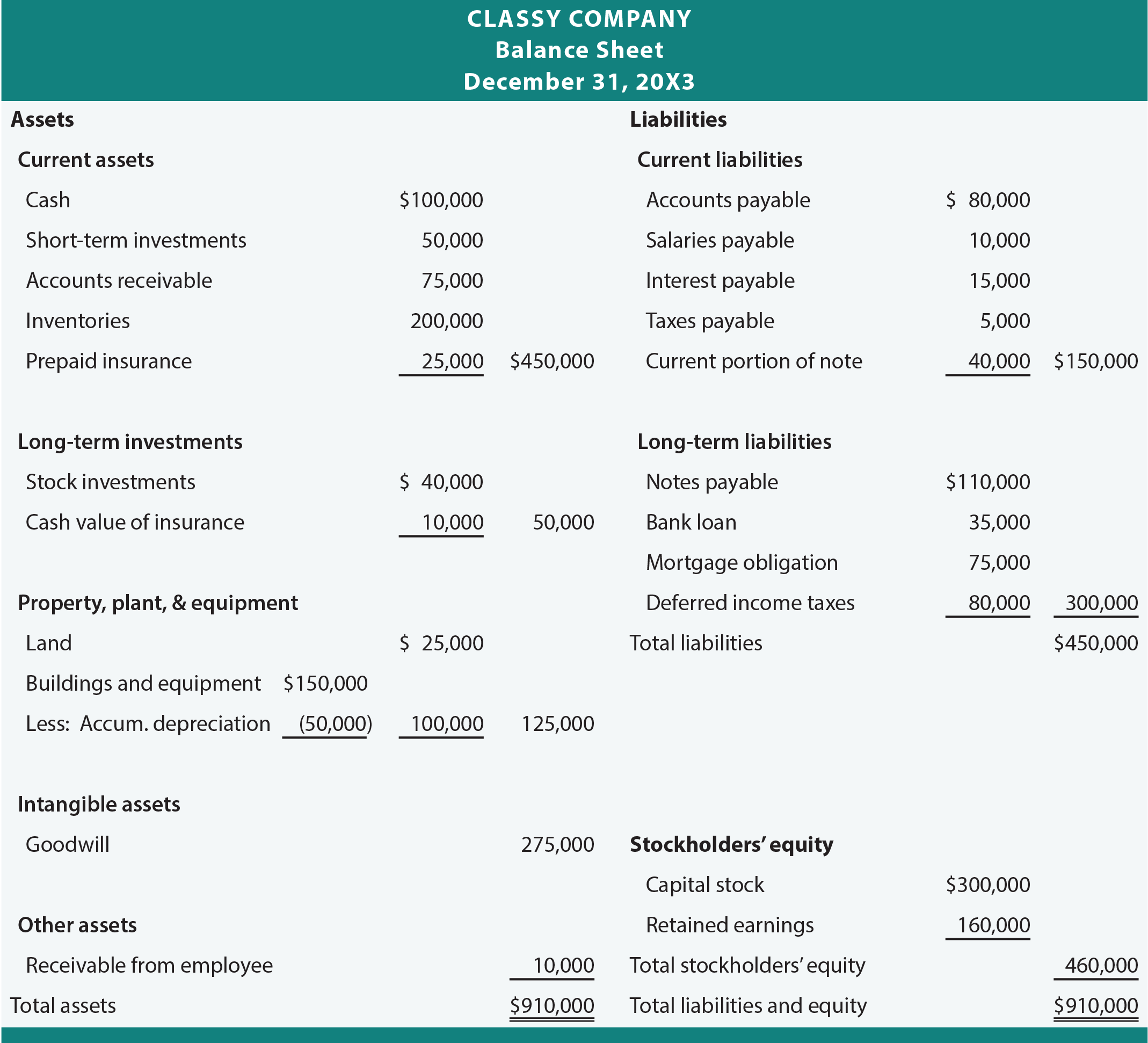

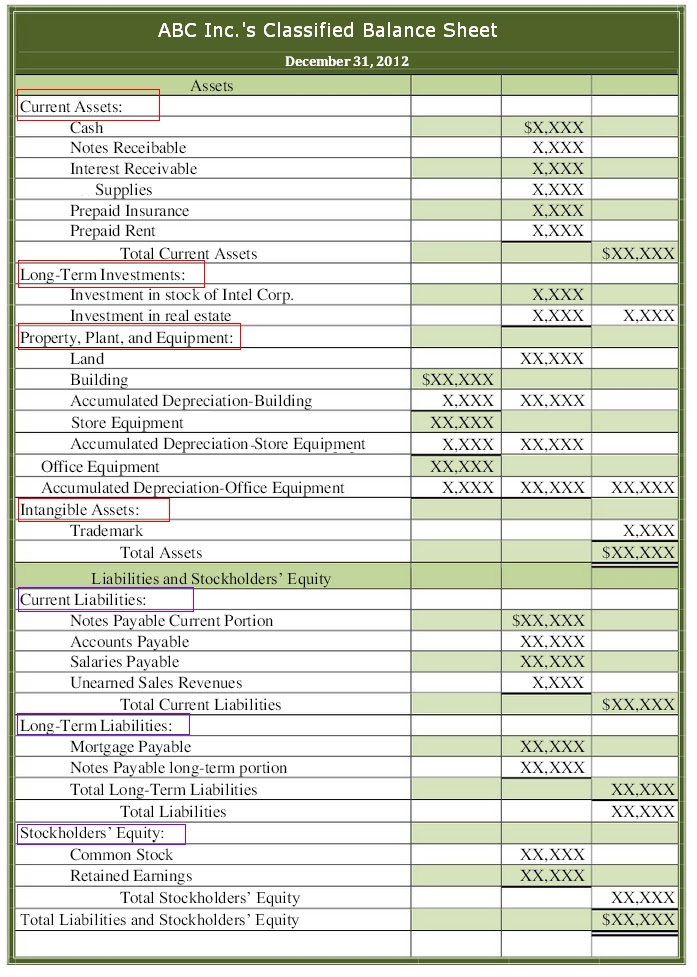

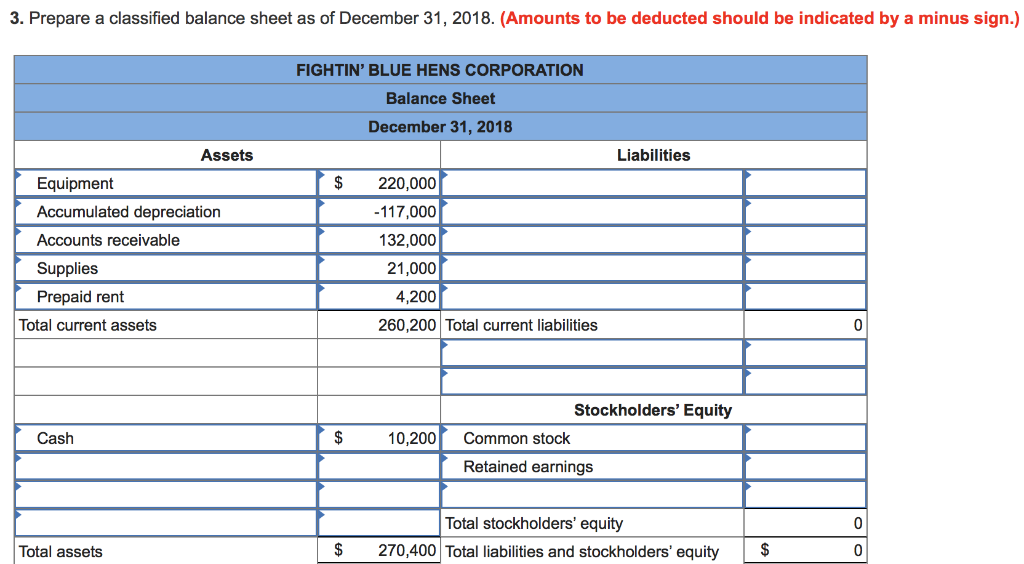

A company will use a Balance Sheet to summarize its financial position at a given point in time. This document outlines the major accounts listed in the Balance Sheet and the effect of transactions on each account. A balance sheet that groups together current and noncurrent assets and liabilities.

However the balance sheet date is not the date when a balance sheet is actually prepared and becomes available. If the student knows about debits and credits at the appropriate level this cheat sheet will be helpful to. Classified Balance Sheet Template.