First Class 3 Sections Of Statement Of Cash Flow Off Balance Sheet Items Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

DCF Model Training Free Guide A DCF model is a specific type of financial.

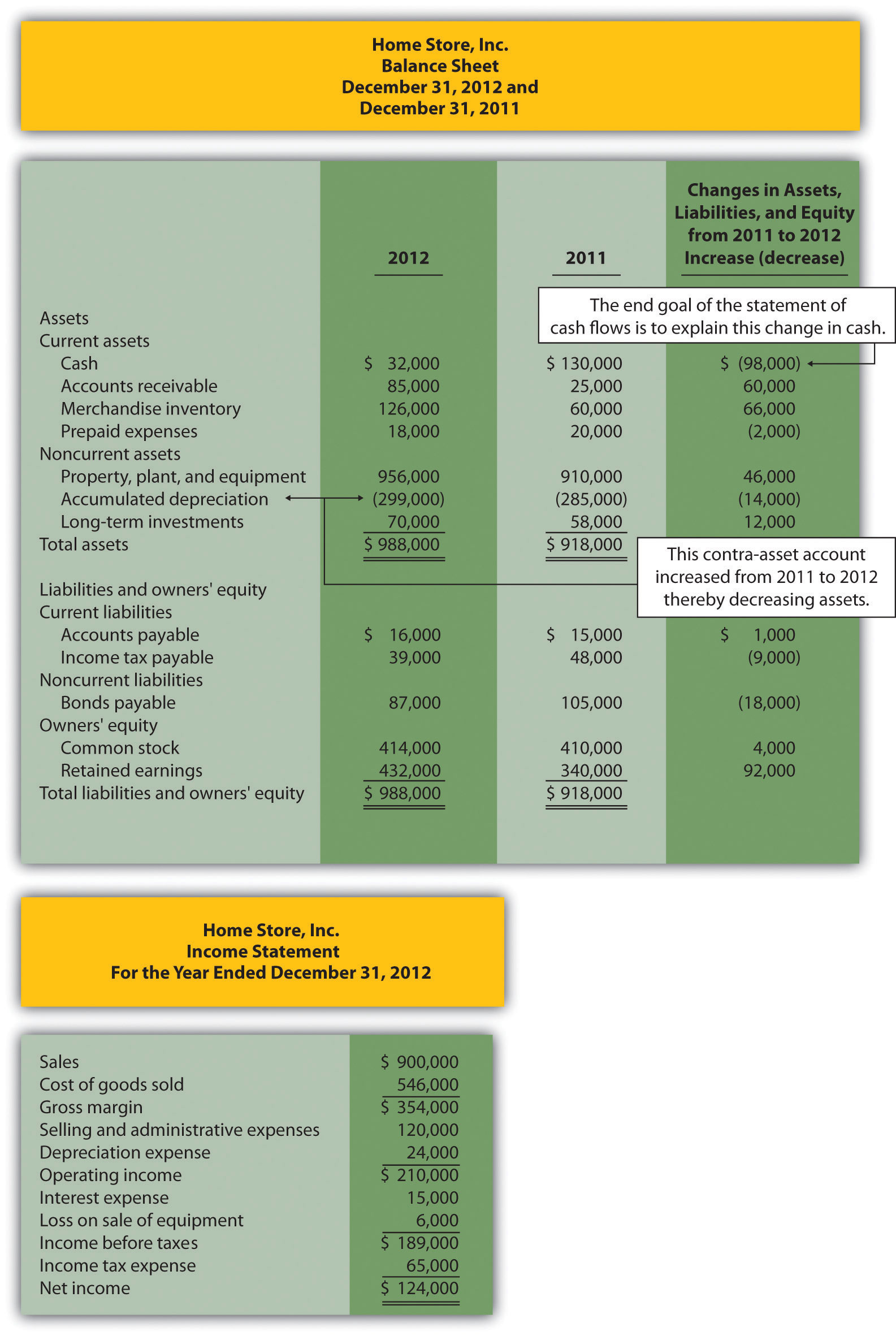

3 sections of statement of cash flow off balance sheet items examples. Key Takeaways A balance sheet reports a companys assets liabilities and shareholder equity at a specific point in time. As can be seen from the cash flow statement the cash drain is primarily from the investment of 400 in equipment. The interest expense appears on the income statement the principal amount of debt owed sits on the balance sheet and the change in the principal amount owed is reflected on the cash from financing section of the cash flow statement.

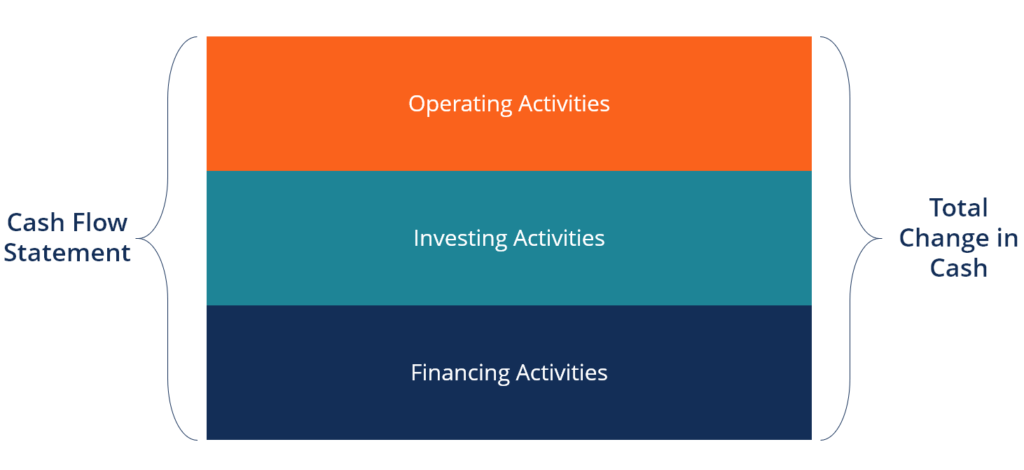

The CFS can help determine whether a company has enough liquidity or cash to. Financing events such as issuing debt affect all three statements in the following way. These three sections of the statement of cash flows designate the different ways cash can enter and leave your business.

A cash flow statement is a valuable measure of strength profitability and the long-term future outlook for a company. These financial statements are used as internal documents to direct the firms operations. Here is an example of what a cash flow statement might look like.

The other two financial statements are the income statement and balance sheet. A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in.

The statement of cash flows is one of three financial statements that a business has to prepare at the end of each accounting period. While accounting enables us to understand a companys historical financial statements forecasting those financial statements enables us to explore how a company will perform under a variety of. In financial accounting a cash flow statement also known as statement of cash flows or funds flow statement is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to.

The cash flow statement for the ABC Company shows there was a 205 cash shortfall in 200X. Effect of these activities. Examples of How the Balance Sheet and Cash Flow Statement Differ Below are copies of the balance sheet and cash flow statement for Apple Inc.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)