Perfect Extraordinary Items Ifrs

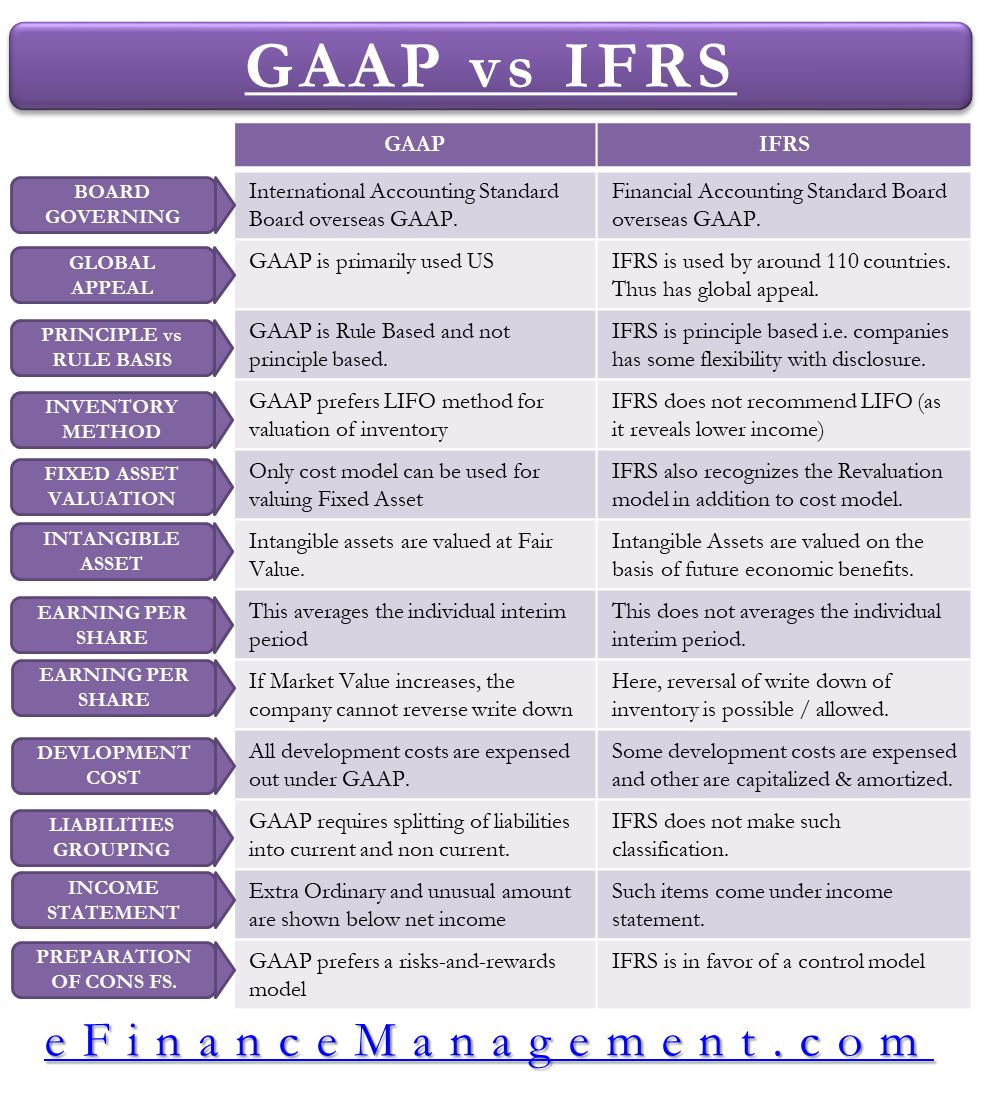

In GAAP the extraordinary items are segregated and are shown below net income in the income statement.

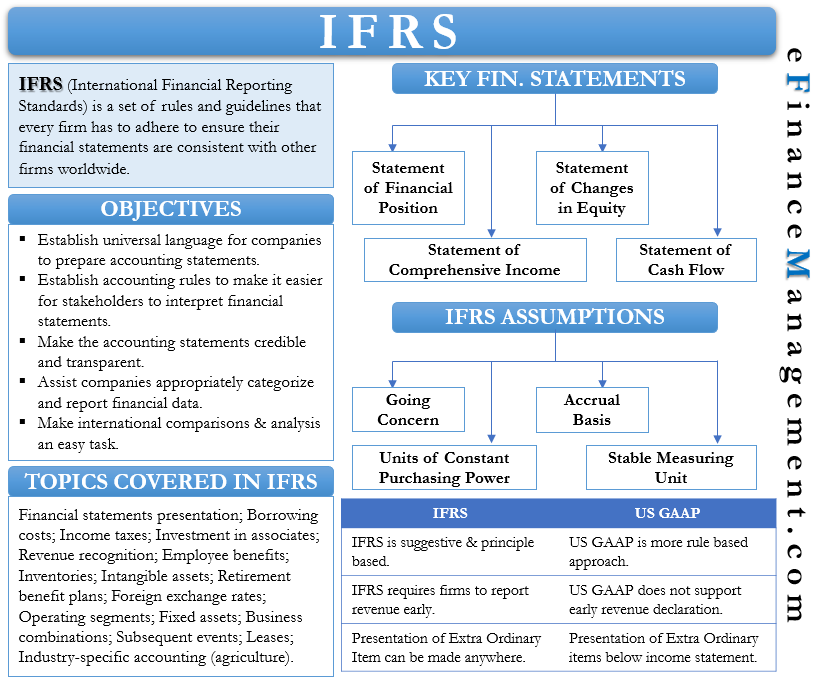

Extraordinary items ifrs. Extraordinary items are defined as being both infrequent and unusual and are rare in practice. A two statement approach a statement of income and a statement of comprehensive income. That standard defined extraordinary items as income or expenses that arise from events or transactions that are clearly distinct from the ordinary activities of the enterprise and therefore are not expected to recur frequently or regularly.

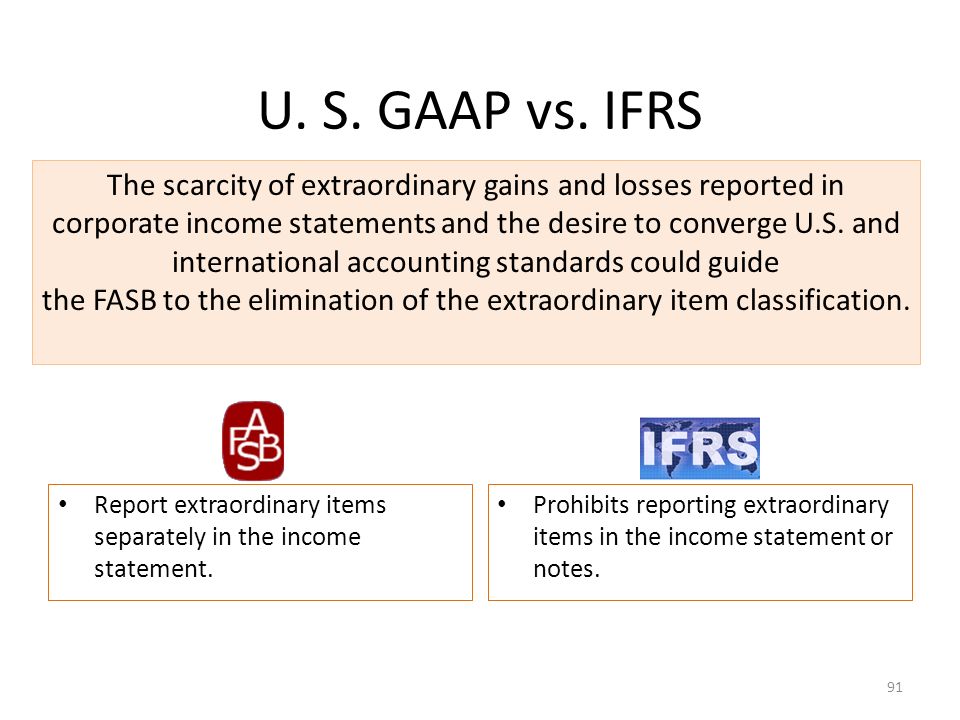

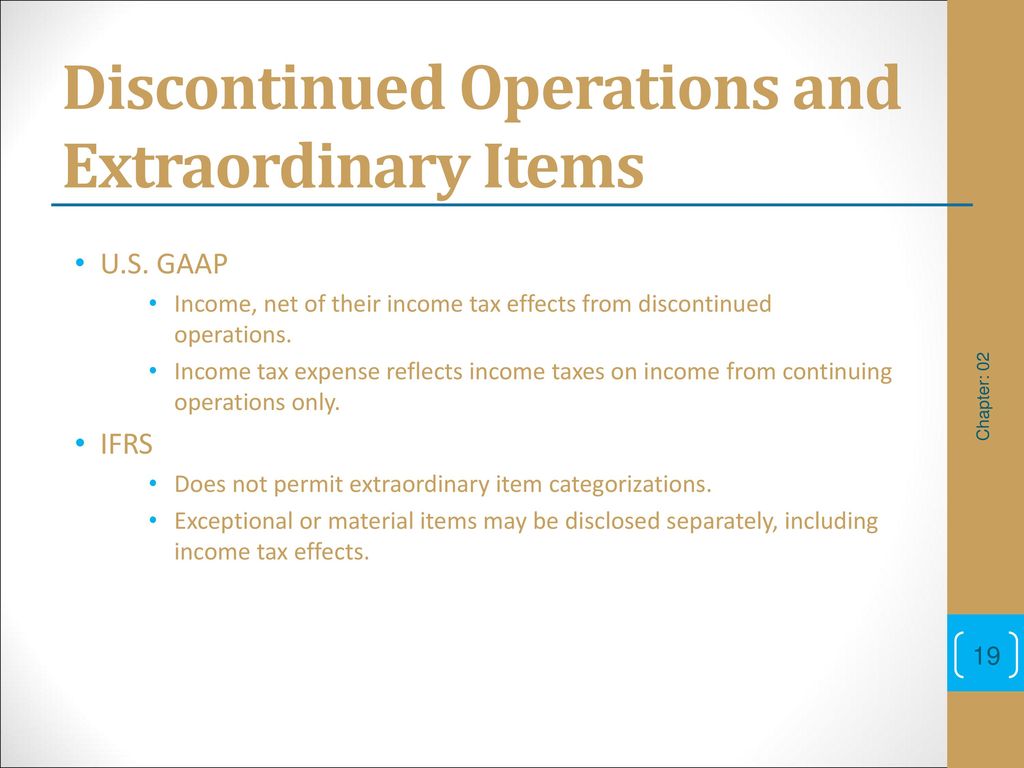

An item is unusual if both of the following criteria are met. Neither IFRS nor US GAAP allow classification of any item as an extraordinary item in the income statement. A single primary statement of income and comprehensive income.

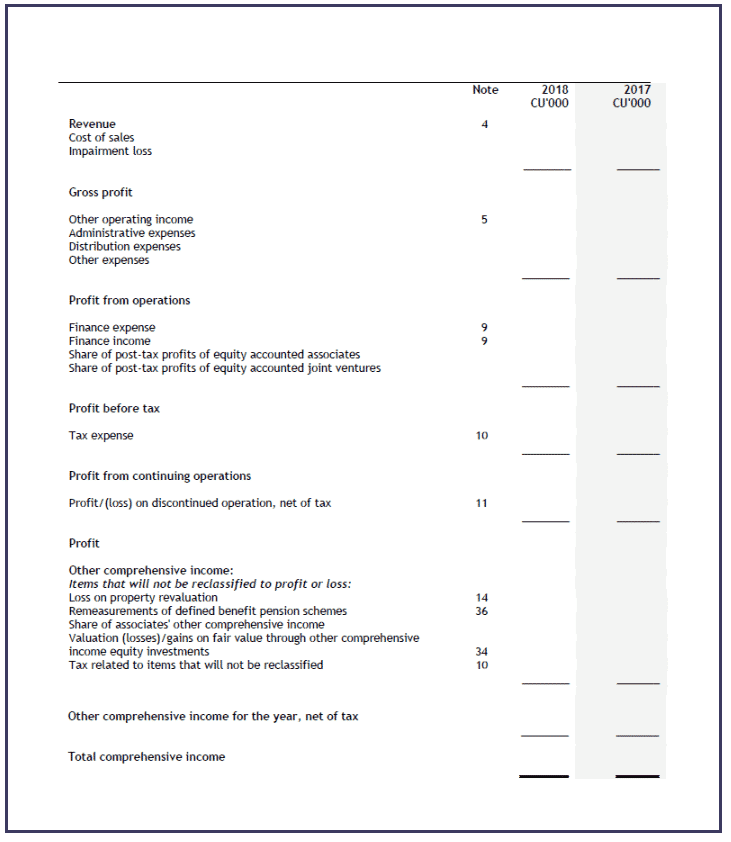

Additional line items may be needed to fairly present the entitys results of operations. IFRS uses a revaluation model for valuation of fixed assets. IAS 187 Certain items must be disclosed separately either in the statement of comprehensive income or in the notes if material including.

IAS 185 Items cannot be presented as extraordinary items in the financial statements or in the notes. However apparently these terms seem to have different treatments according to accounting standards especially IAS 1 in which extraordinary items and material items also referred as exceptional items have been discussed separately under different. Extraordinary Items refers to those events which are considered to be unusual by the company as they are infrequent in nature and the gains or losses arising out of these items are disclosed separately in the financial statement of the company during the period in which such item came into the existence.

In IFRS extraordinary items are not segregated and are included in the income statement. The formal use of extraordinary items has been eliminated under Generally Accepted Accounting Principles so the following discussion should be considered historical in nature. Entities may utilize one of three formats in their presentation of comprehensive income.

The International Financial Reporting Standards IFRS does not recognize extraordinary items only nonrecurring items. While the use of templates would offer a high degree of uniformity across companies such use can result in companies reporting a large volume of. Items currently classified as extraordinary are only a subset of the items of income and expense that may warrant disclosure to assist users in predicting an entitys future performance.

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1153850516-c94af82d74404d5a8d458a9fcb34bc50.jpg)

:max_bytes(150000):strip_icc()/GENOte23saleonetimeitem-ef0a5df240b94d3c98042e62dca9b917.jpg)

/GettyImages-642294479-de3eb9b0d3084dd59d0d84a701f97d2c.jpg)