Top Notch Negative Reserves In Balance Sheet

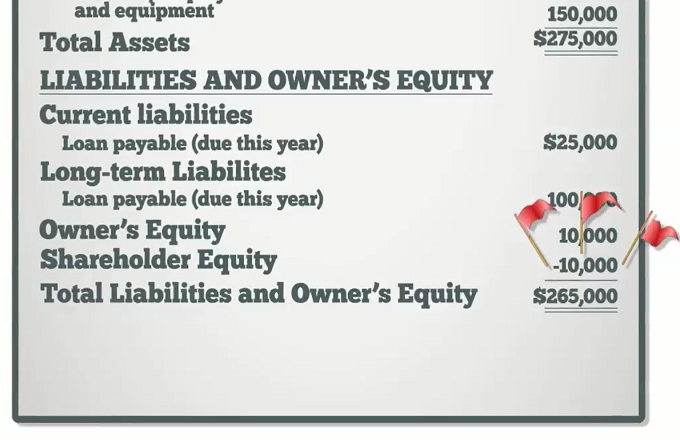

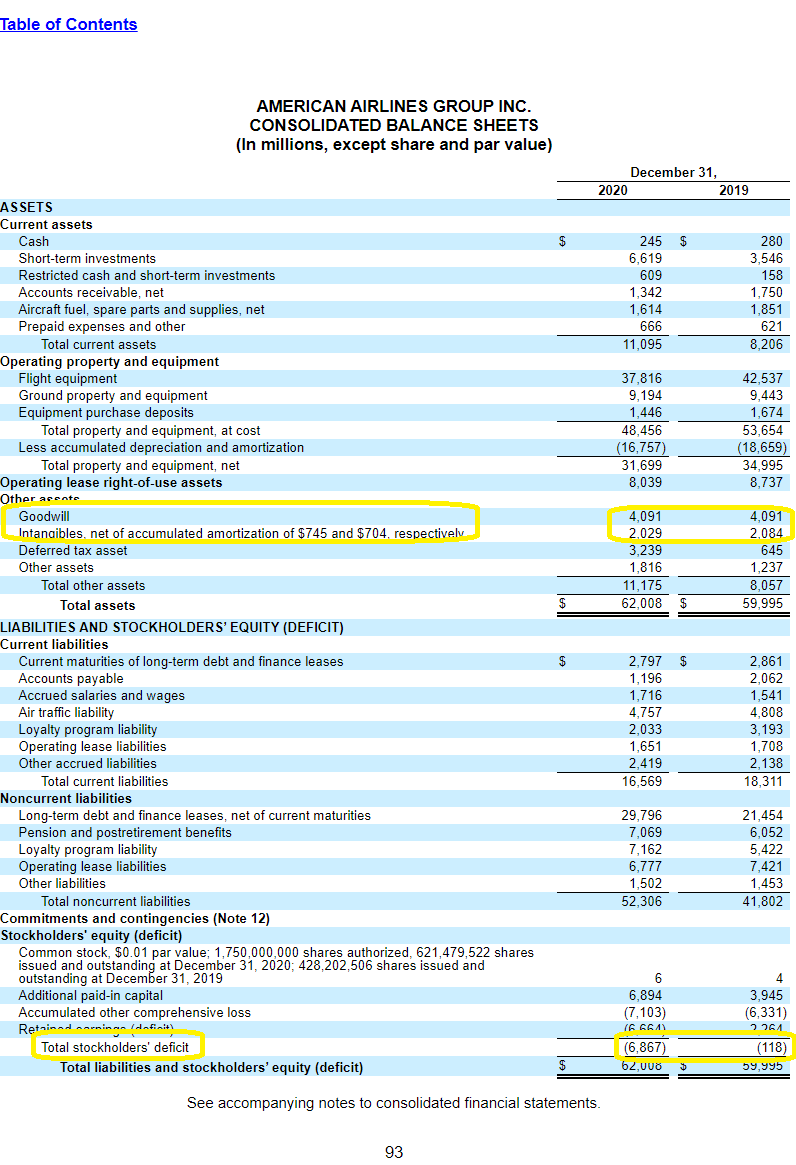

This creates a deficit.

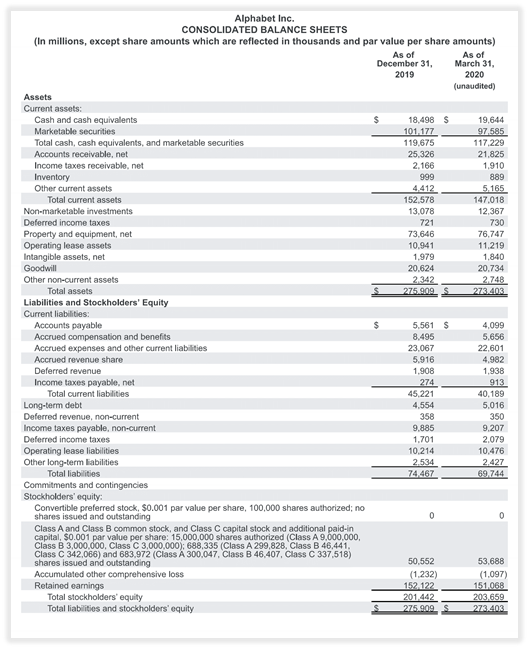

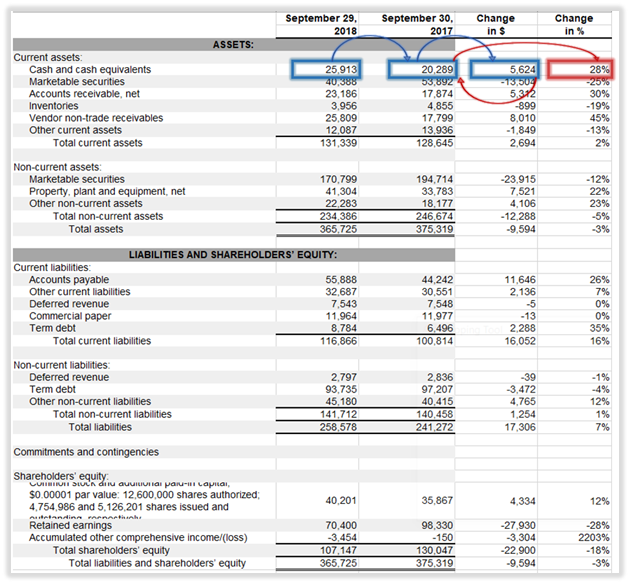

Negative reserves in balance sheet. The retained profits will be reduced by any dividends paid and there will be no way to determine what if any dividends have been made. These all are shown on the liability side of the balance sheet. Negative reserves in a balance sheet depicts that the company has accumulated losses.

Is it possible to have a negative amount in the balance sheet of a company correspondence to Reserves and surplus. If the net loss for the current period is higher than the retained earnings at the beginning of the period those retained earnings on the balance sheet may become negative. Negative reserves and surpluses.

The negative net income occurs when the current years revenues are less than the current years expenses. Bad debt reserves are shown on a companys balance sheet as a line item underneath account receivables the account it offsets or acts as a contra account to. Reserves on the balance sheet is a term used to refer to the shareholders equity section of the balance sheet.

Negative Balance Sheets Whilst Companies House will almost certainly accept your accounts as qualified with a negative balance sheet I would suggest you take advice on the implications for your personal guarantees. Typically an initial cash injection share capital plus retained profits to date. Negative equity on an annual sheet does not only mean that an HOA has lost money over the year but it also translates to flawed day-to-day operations which you must reconsider.

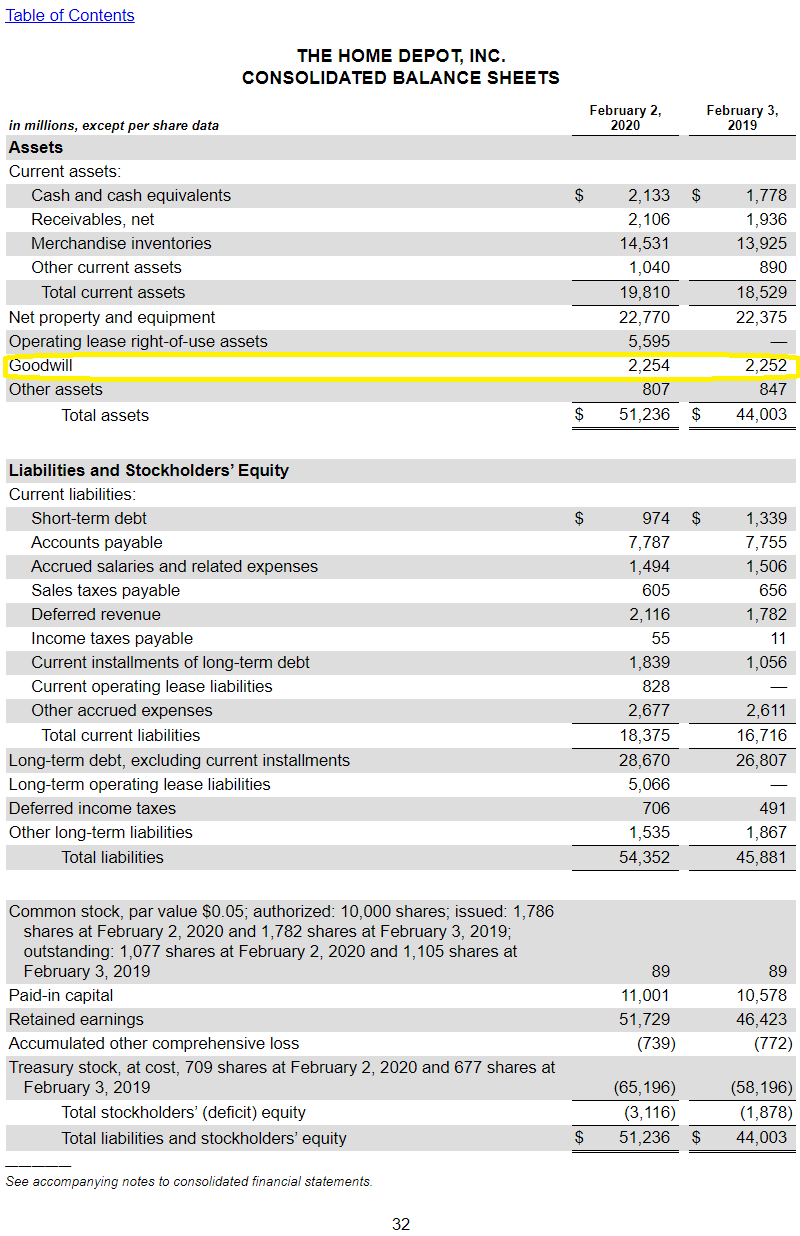

A reserve is always a credit balance. Big Store stops paying its bills and doesnt pay Company XYZ for 100000 worth of goods. I have prepared the accounts for a small company that has made a profit for the year and has retained earnings brought forward.

A negative figure indicates the business is insolvent cannot repay all its debts. The company has been facing losses in the current year or of earlier years. And from that we infer what the bank perceives as liquidity risk across all its assets.