Brilliant Cash Flow Budget Definition

The difference in incoming payments and outgoing payments is referred to as cash flow.

Cash flow budget definition. 1how do you prepare budget for a department. The cash flow budget looks much like the operating budget. Variable costs which include expenses like fuel lodging and other operating costs range greatly from month to month.

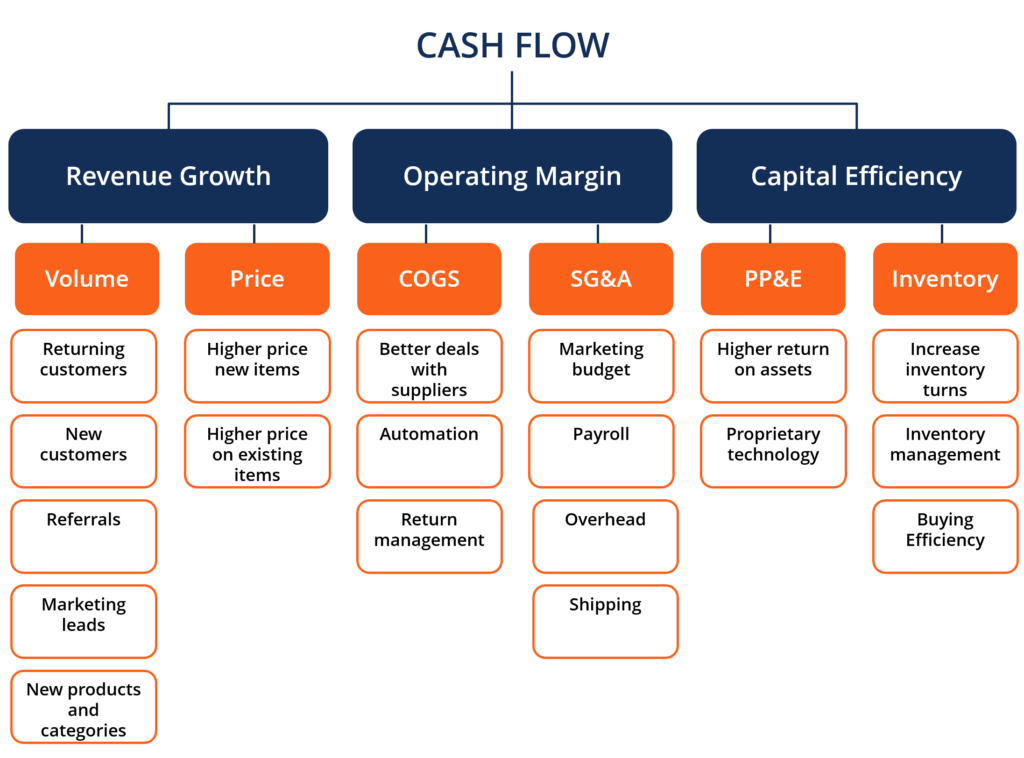

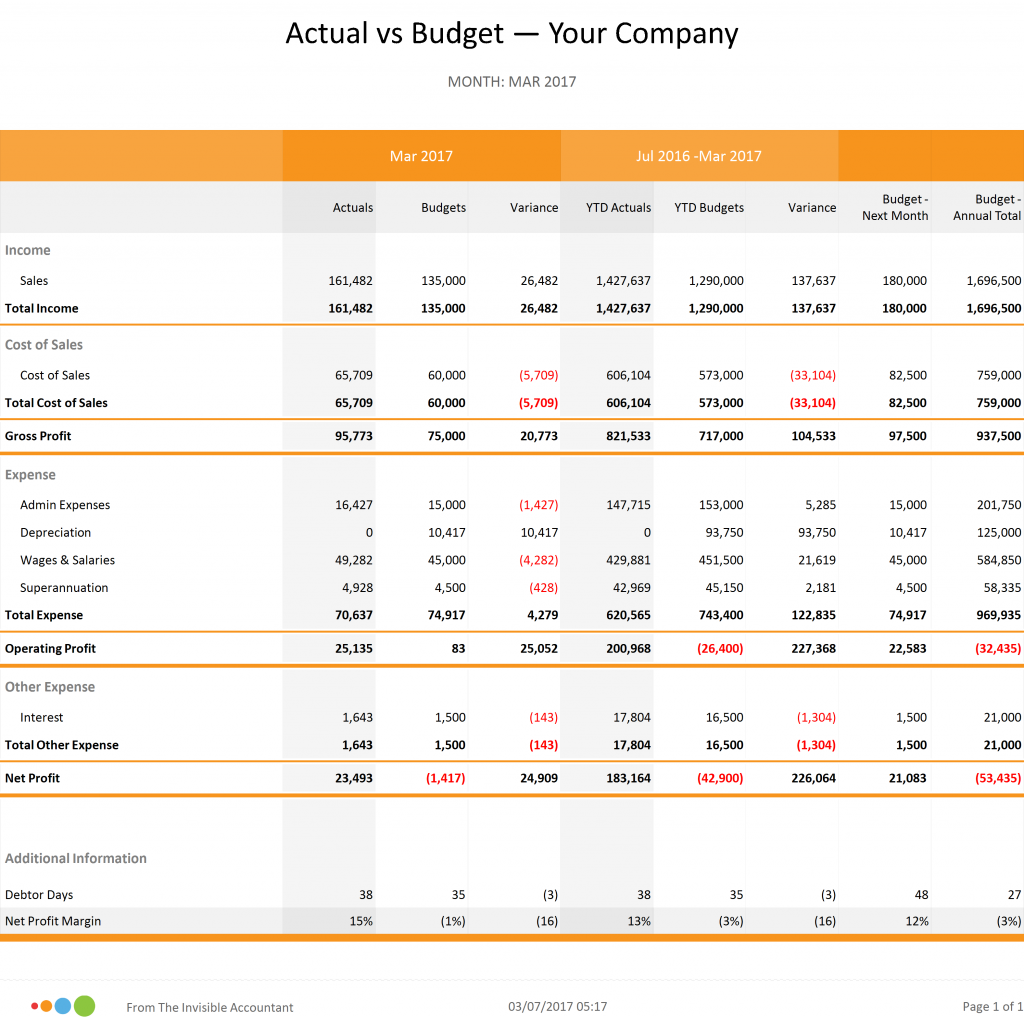

A budget differs from cash flow statement because a budget both projects how you expect to allocate the cash flow and records how the cash flow was actually spent at the end of the month. To future-proof commercial success you need to know where cash is coming in and where the money is going out. Negative cash flow indicates that a company does not have the revenue to meet its expenses and positive cash flow means that there is a surplus of funds every month.

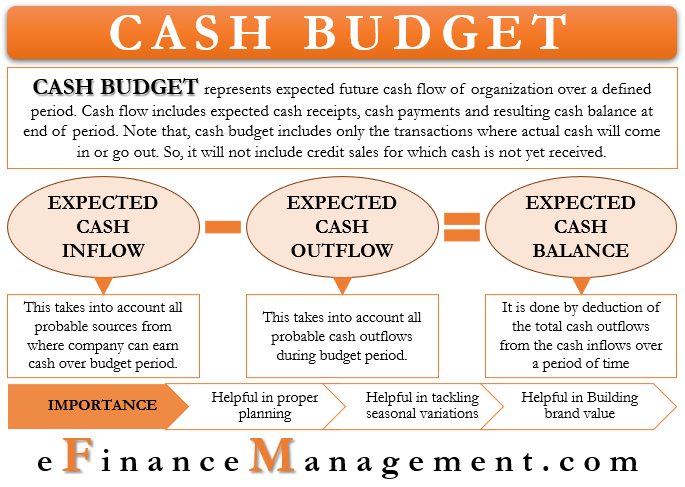

It has many of the same budget lines. Definition of cash flow budget. A cash flow statements purpose is to manage your.

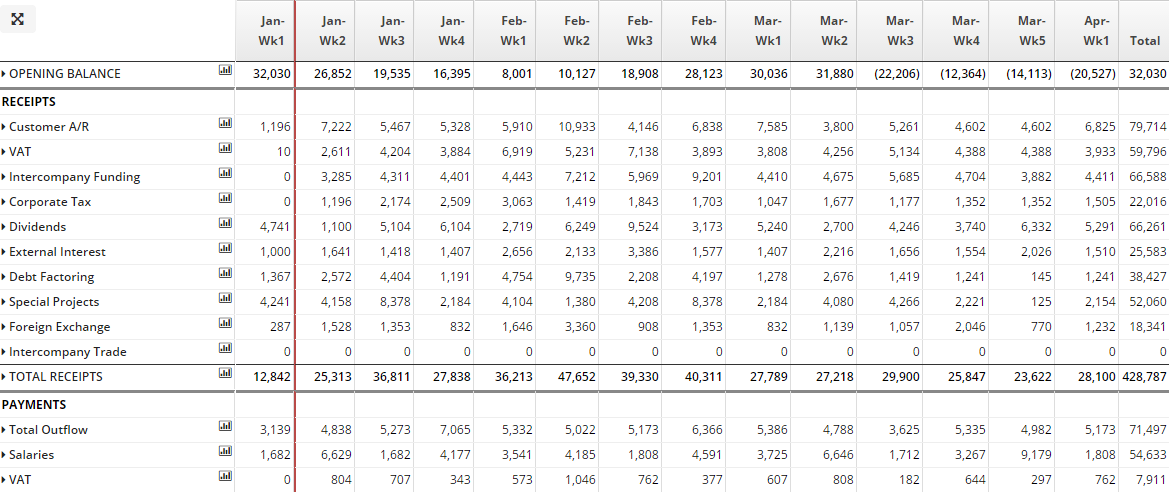

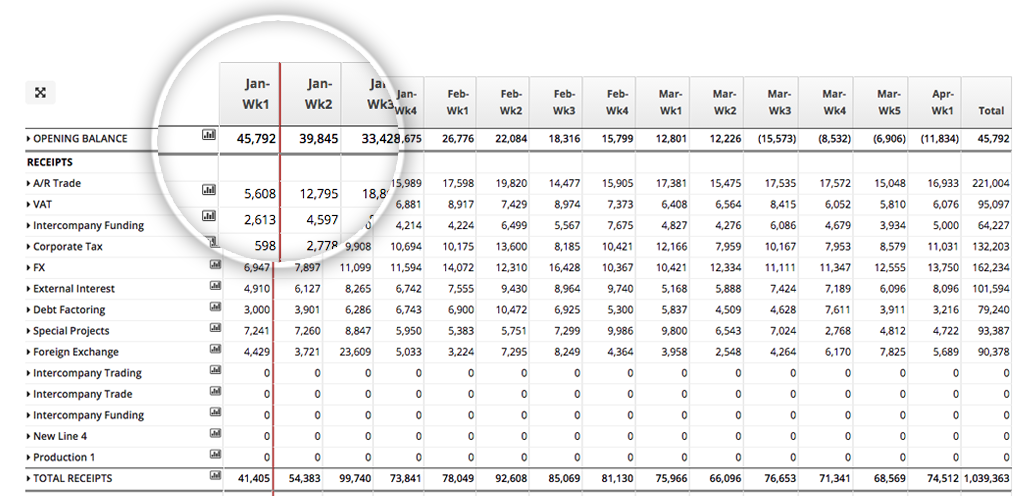

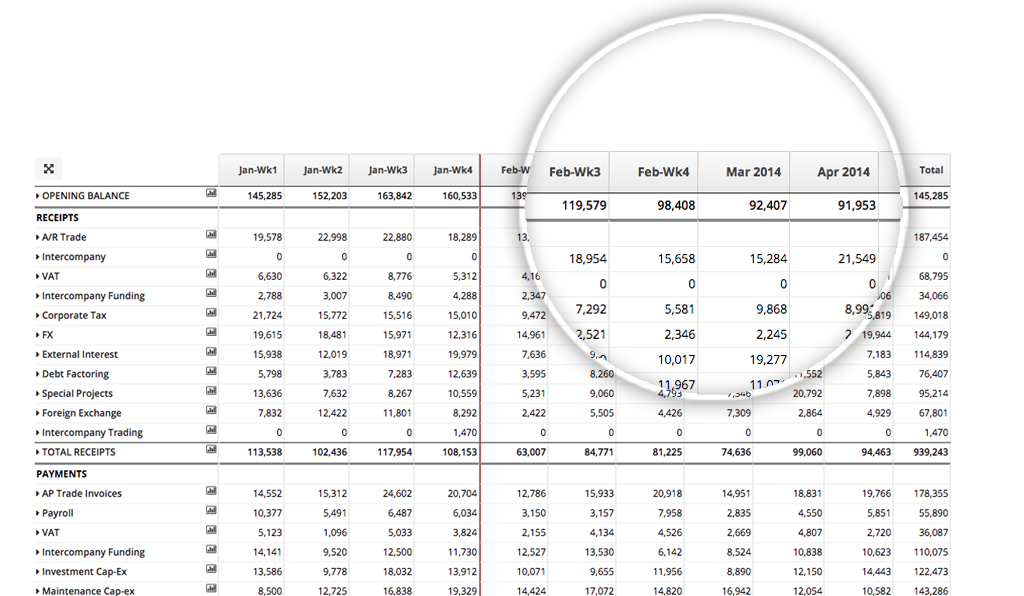

The cash flow budget is used to forecast financing surplus or deficit. A cash budget is an estimate of cash flows for a period that is used to manage cash and avoid liquidity problems. The cash budget allows you to estimate all your revenues and expenses beforehand and works as a guideline to keep the cash in the check.

Anon39087 July 30 2009. Often referred to as a cash budget or a cash flow the cash flow budget allows a company to keep on top of cash income and outgoings over time. Using the cash flow budget the investor can determine the feasibility of the financial plan establish spending priorities.

It is an estimate of the cash receipts expected in the future over the budget period the expenditure to be incurred in cash and finally the cash balance with the. The cash flow budget tells if you have sufficient money to pay your bills at the end of the month. What Does Cash Budget Mean.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)