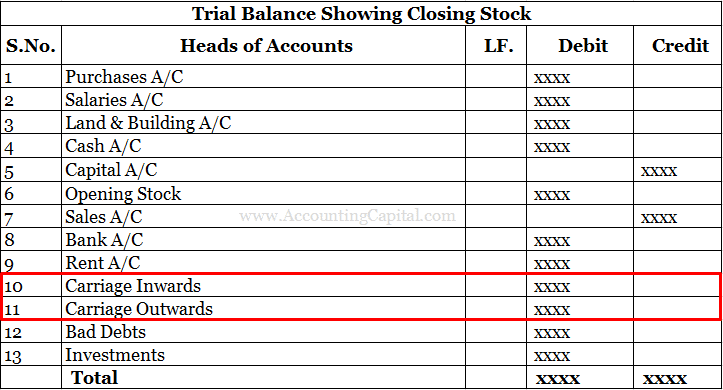

Wonderful Is Closing Stock Shown In Trial Balance

If closing stock is included in the Trial Balance the effect will be doubled.

Is closing stock shown in trial balance. Closing Stock Not Shown in Trial Balance The reason why closing stock is not shown in trial balance takes into consideration whether or not the closing stock has been adjusted with purchases or not. Closing stock generally does not appear in the trial balance because it is the leftover of the purchases which is already included in the trial balance. A Real account b Liability account c Revenue account d Not recorded in.

The value of total purchases is already included in the Trial Balance. It is important to understand and endure so that a correct trial balance is prepared and the ledger balances are accurately checked. Therefore purchases and opening stock cannot appear in the trial balance.

Closing stock is the balance of unsold goods that are remaining from the purchases made during an accounting period. Hence closing stock is not to be shown in the trial balance. Closing stock appearing in the Trial Balance is shown on a Asset side of from AS 1 at Dubai School of Government.

However the balance of Closing Stock is not taken in Trial Balance and only Opening Balance. Hence it will not reflect in the Trial Balance. An exception is when closing stock is adjusted with the purchase account balance.

Closing Stock is shown on the Asset Side of Balance Sheet. However if closing stock and cost of goods sold are present in the trial balance it means that the above entries have already been passed. To me the logical thing would be to enter the closing stock value into the trial balance when preparing year end final accounts because the closing stock figure would reflect the value of stock for the year end.

When closing stock is not shown in the trial balance. Closing Stock Not Shown In Trial Balance. Therefore closing stock cannot appear in the trial balance because there is no such account.