Awesome Accounting Treatment For Dividend

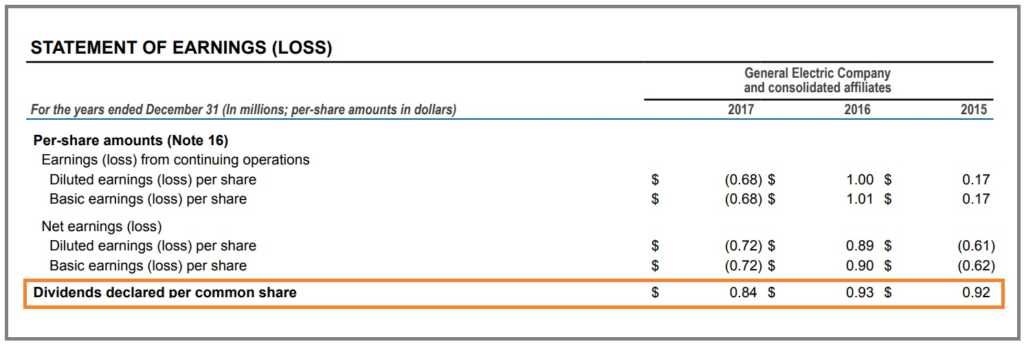

DDT paid on the dividends should be presented in the same way as the presentation of the transaction that creates those income tax consequences.

Accounting treatment for dividend. The IFRIC continued its discussion of the accounting for non-cash distributions discussing measurement of the distribution and dividend payable liability accounting for differences between the dividend payable and carrying amount of the distributed assets exceptions to the measurement principle and whether IFRS 5 should be applied to the assets to be distributed. Companies Articles often provide that. I have some shorts questions about accounting treatment for profit and dividend.

1- Suppose A acquires 10 of B at 112000 for 10000. For Corporation Tax Act CTA10S1168 1 says for the purposes of the Corporation Tax Acts dividends shall be treated as paid on the date when they become due and payable. My understanding that this is not subject to Corporation Tax by the holding company.

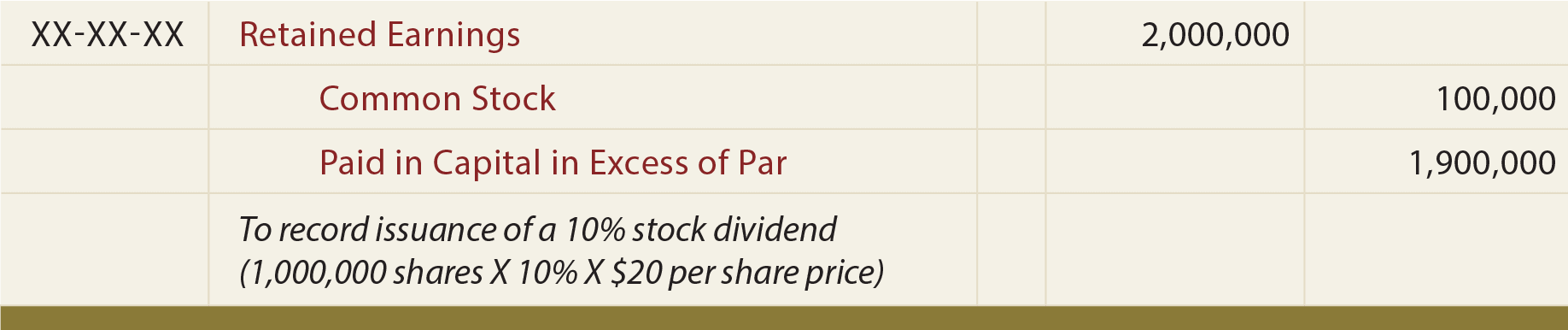

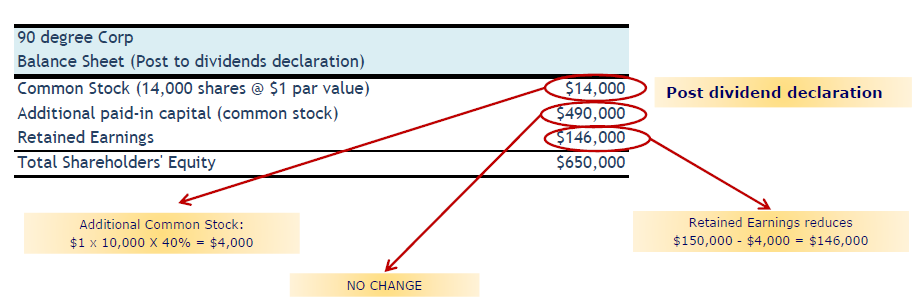

If the dividend is recognized in equity The DDT on the same should also be recognized in equity. The journal entries regarding it being as follows Because such a dividend does not change the cost of shares of the subsidiary company and the holding companys share of capital profits it will also not alter the cost of control or capital reserve on acquisition of shares. Dr Investment 300 Cr PL.

The background is the shareholders of a trading company create a holding company in order to protect the property assets. Accounting Treatment In order to perform the accounting for associates there is no need to consolidate its financial figures. A wholly owned subsidiary is paying a dividend to its holding company.

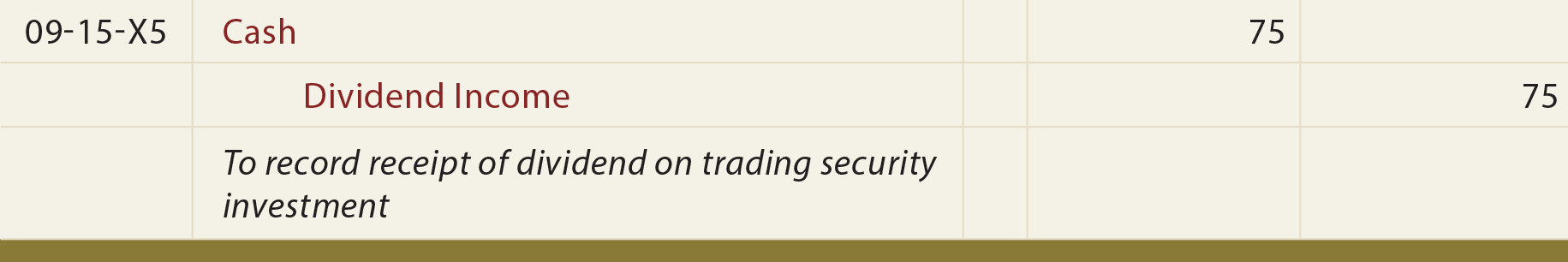

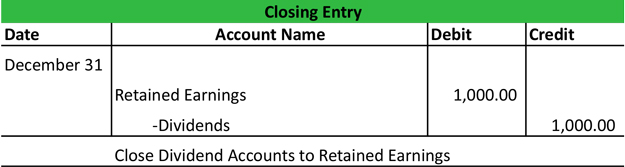

The journal entry looks like the following. Hence if the dividend itself is charged to profit or loss DDT also should be charged to profit or loss. Dividend received out of post acquisition profits is treated as a revenue receipt.

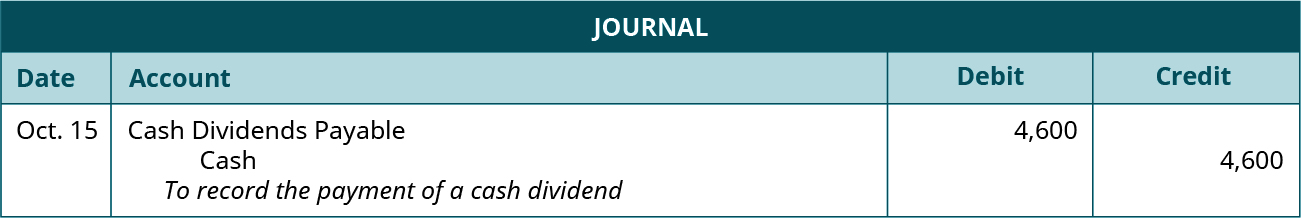

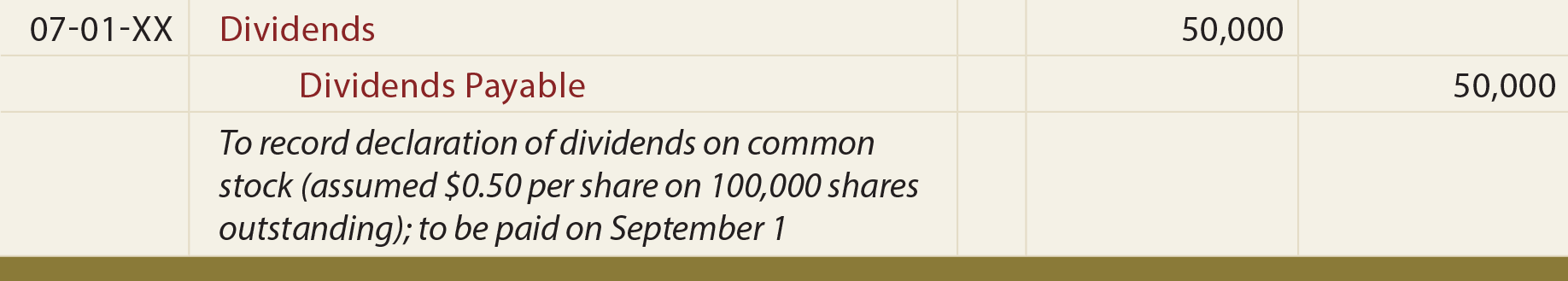

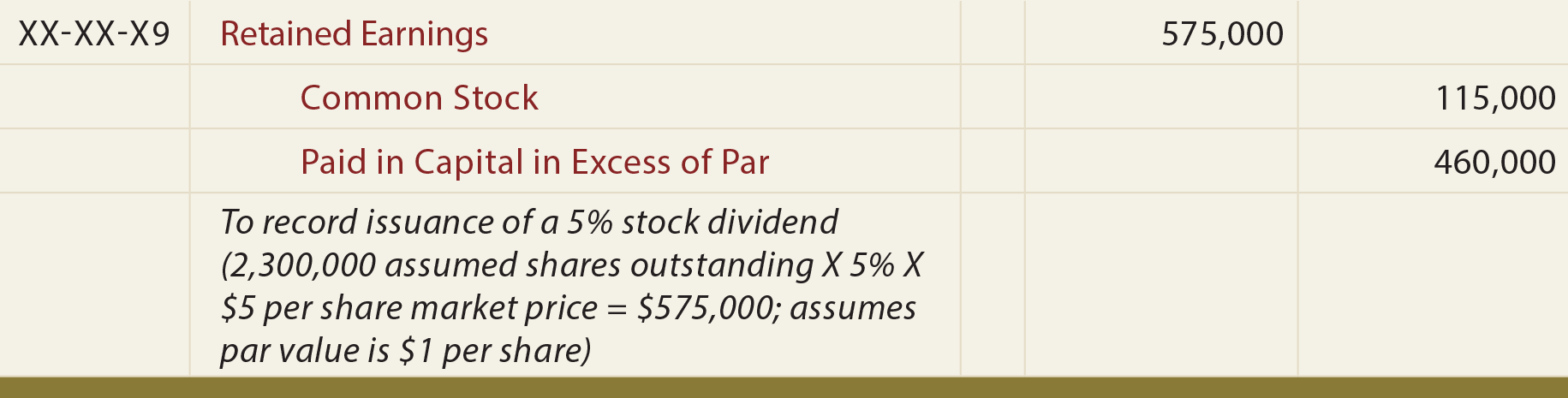

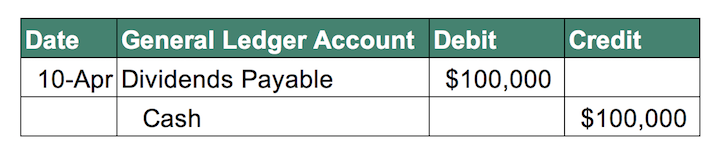

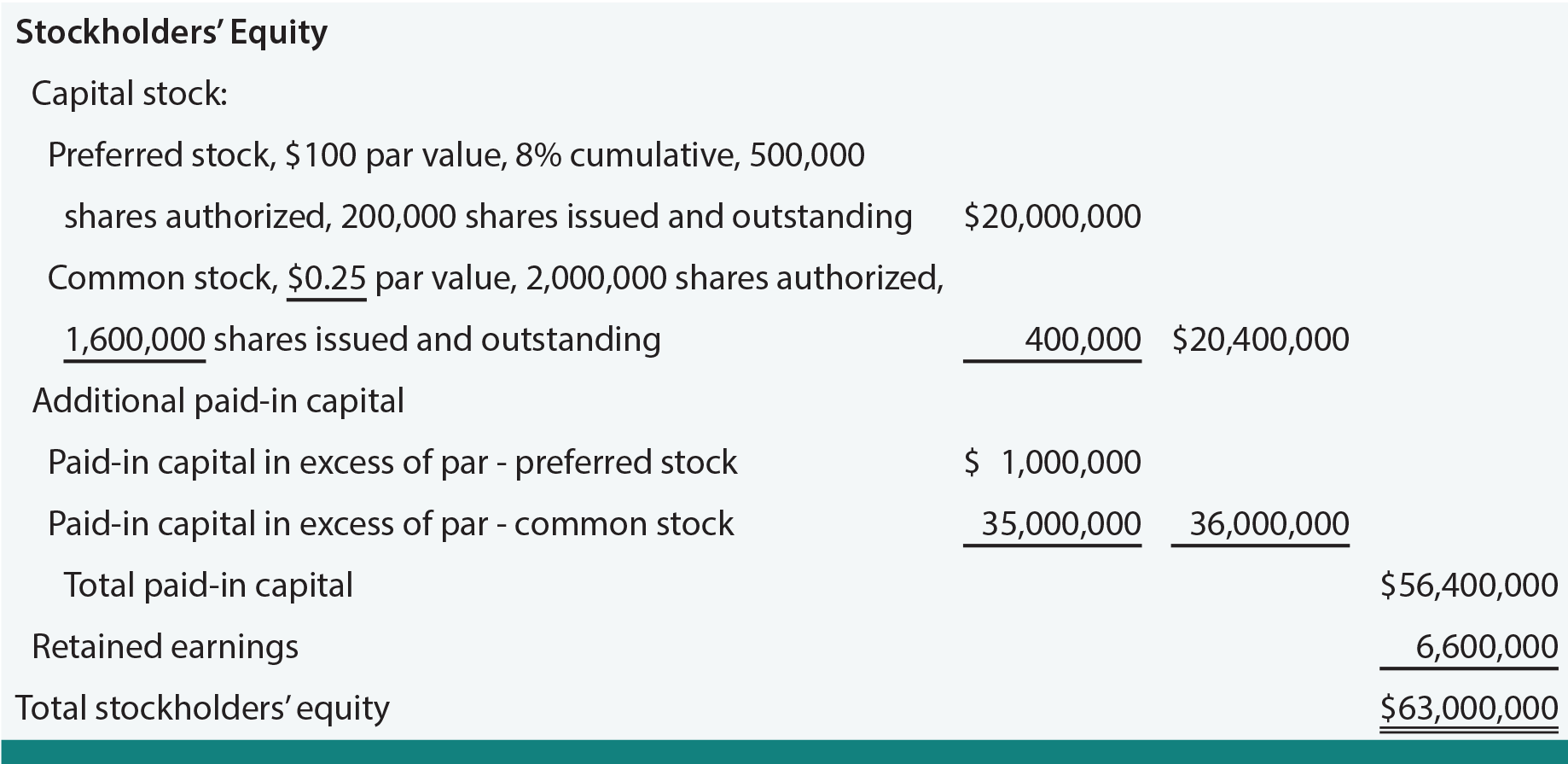

How to account for dividend from subsidiary. Accounting Treatment Dividends on ordinary share capital constitute an apportionment of the profits attributable to owners of the business and hence should not be charged as an expense in the income statement. Dividends are often declared by the company prior to actual cash payment to the stockholders.