Glory Going Concern Disclosure Ifrs

IFRS Talks PwC IFRS Talks Episode 103.

Going concern disclosure ifrs. To support the consistent application of IAS 1 with respect to going concern disclosure the IFRS Foundation has published educational materials which are summarised in BDOs recent International Financial Reporting Bulletin IFRB 202103 Going concern IFRS Foundation publishes guidance on. In the current stressed economic environment arising from the covid-19 pandemic. Companies preparing financial statements using IFRS Standards are required to assess their ability to continue as a going concern.

In the current stressed economic environment arising from the covid-19 pandemic deciding whether the financial statements should be prepared on a going concern basis may involve a greater degree of judgement than usual. This paper provides the Interpretations Committee with a draft of a tentative agenda decision to bring this issue to a close. A going concern basis it shall disclose that fact together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern IAS 125.

Auditing disclosure requirements for going concern When applying IFRS an auditor is required to consider the adequacy of disclosures in relation to. In general this standard relates only to annual financial statements. Going concern disclosure The financial statements should not be prepared on a going concern basis where events after the reporting date indicate that the going concern assumption is no longer appropriate para 14 of MFRS 110 EventsAfter the Reporting Period.

Under the amendments to GAAP disclosures. This includes subsequent events which may cast significant. 291 X Example disclosures for entities that require going concern disclosures 299 XI Example disclosures for distributions of non-cash assets to owners 301 XII Example disclosures for government-related entities under IAS 24.

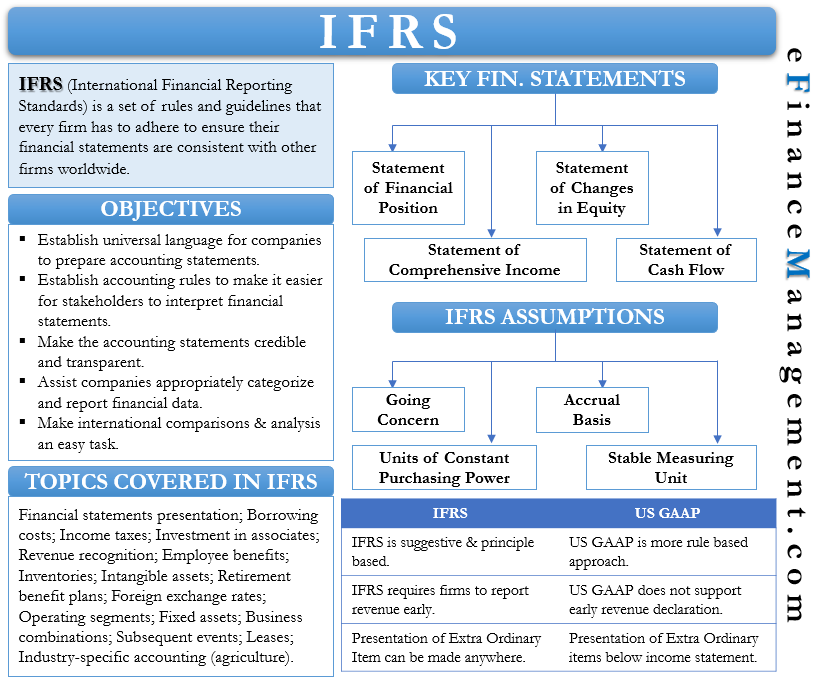

When the entity prepares the financial statements it is required to disclose these material uncertainties in the. The Director of Implementation Activities asked the Committee members if they agreed with the staff recommendation to bring closure to this. Going concern the underlying basis of financial statements Under IFRS Standards financial statements are prepared on a going concern basis unless management intends or has no realistic alternative other than to liquidate the company or stop trading.

Going concern disclosure relating to material uncertainty about an entitys ability to continue as a going concern 15 Feb 2021 GX Podcast. Disclosure Given the unpredictability of the potential impact of the pandemic there may be material uncertainties that cast significant doubt on the entitys ability to operate under the going-concern basis. They cover fair presentation and compliance with IFRS going concern accrual basis of accounting offsetting materiality and aggregation.