Ace Treatment Of Net Loss In Balance Sheet

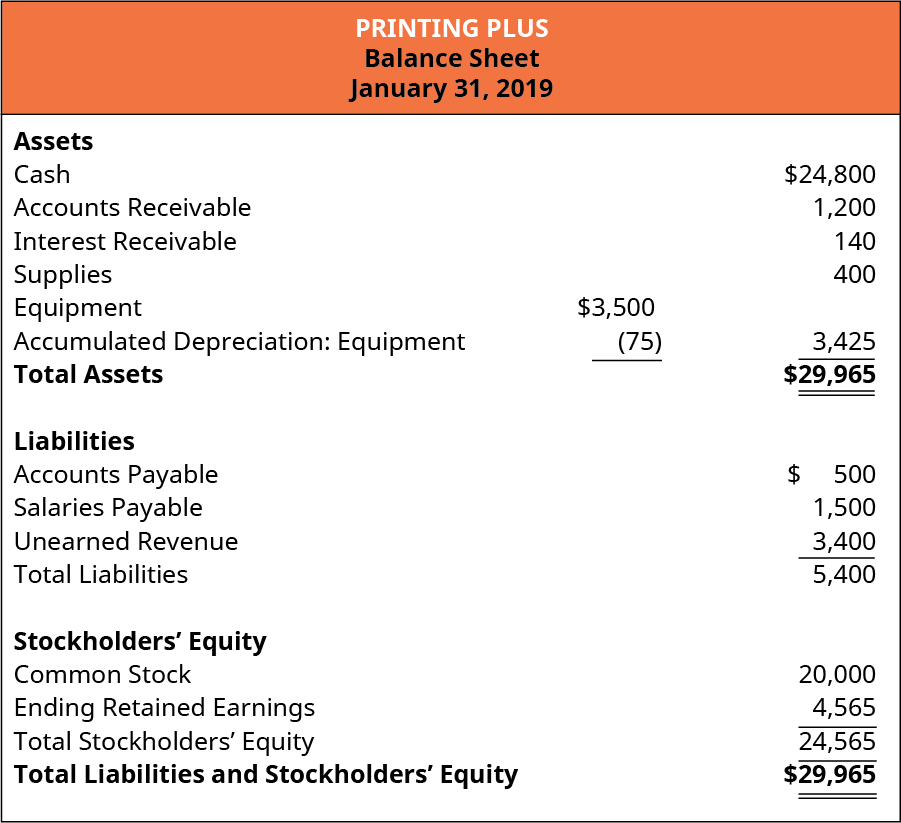

There are 3 different sections in a balance sheet represented by the following formula.

Treatment of net loss in balance sheet. If it is Net loss then we have to deduct from capital at. Acquired the shares on 1st April 2011 on which date General Reserve and Profit and Loss Account of S Ltd. If it is Loss on sale of an asset then we have to deduct from.

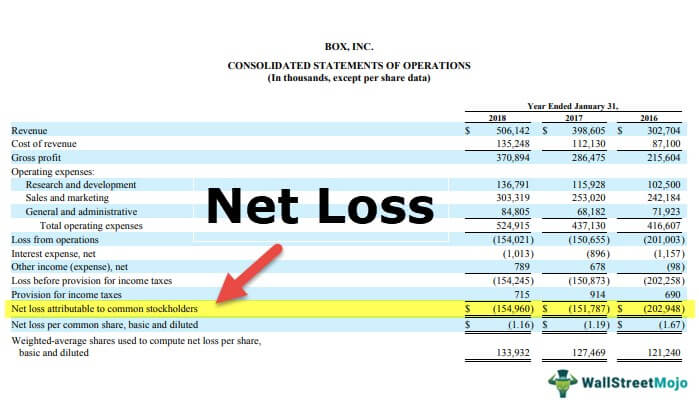

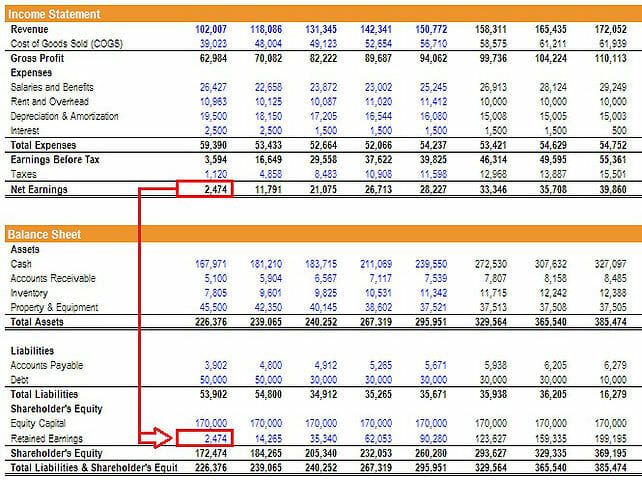

Net profit or loss. Further if losses are shown on assets side then it is meant that total assets will be reduced to that extent. Liability side balance sheet can be described as sources of fund.

The loss of 2000 because of decrease in value of Investment will be met out of Investment Fluctuation Reserve by crediting Investment and the balance 33000 will be transferred to Partners capital accounts in their old profit sharing ratio. Retained earnings represent all. Show the net gain on the credit side of the profit and loss.

It is shown on assets side of balance sheet. Show the net loss on the debit side of the profit and loss ac. It records the total amount of money owed the company for delivery of goods and services minus the amount it doesnt expect to collect.

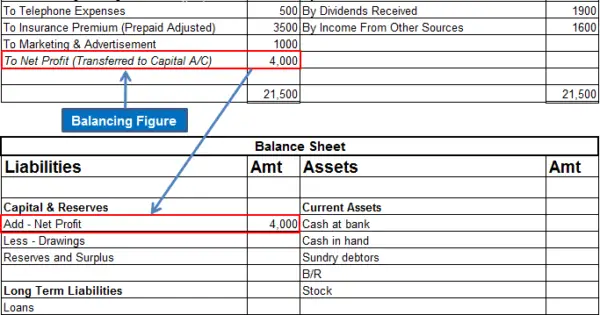

Is it an asset. Profit is part of capital or net worth. The net profit belongs to the ownership of the business which is represented by the Capital account.

The retained earnings account contains both the gains earned and losses incurred by a business so it nets together the two balances. This will be either a debit or credit depending on whether there is a loss or gain. Capital and Profit are sources of fund.