Exemplary Profit And Loss Account Is Prepared Examples Of Contingent Assets Include All Of The Following Except

Promise of land to be donated by city as an enticement to move manufacturing facilities.

Profit and loss account is prepared examples of contingent assets include all of the following except. B Assets and equities. Every insurance company has to prepare Profit Loss account. The amount of a contingent loss should be provided for by a charge in the statement of profit and loss if.

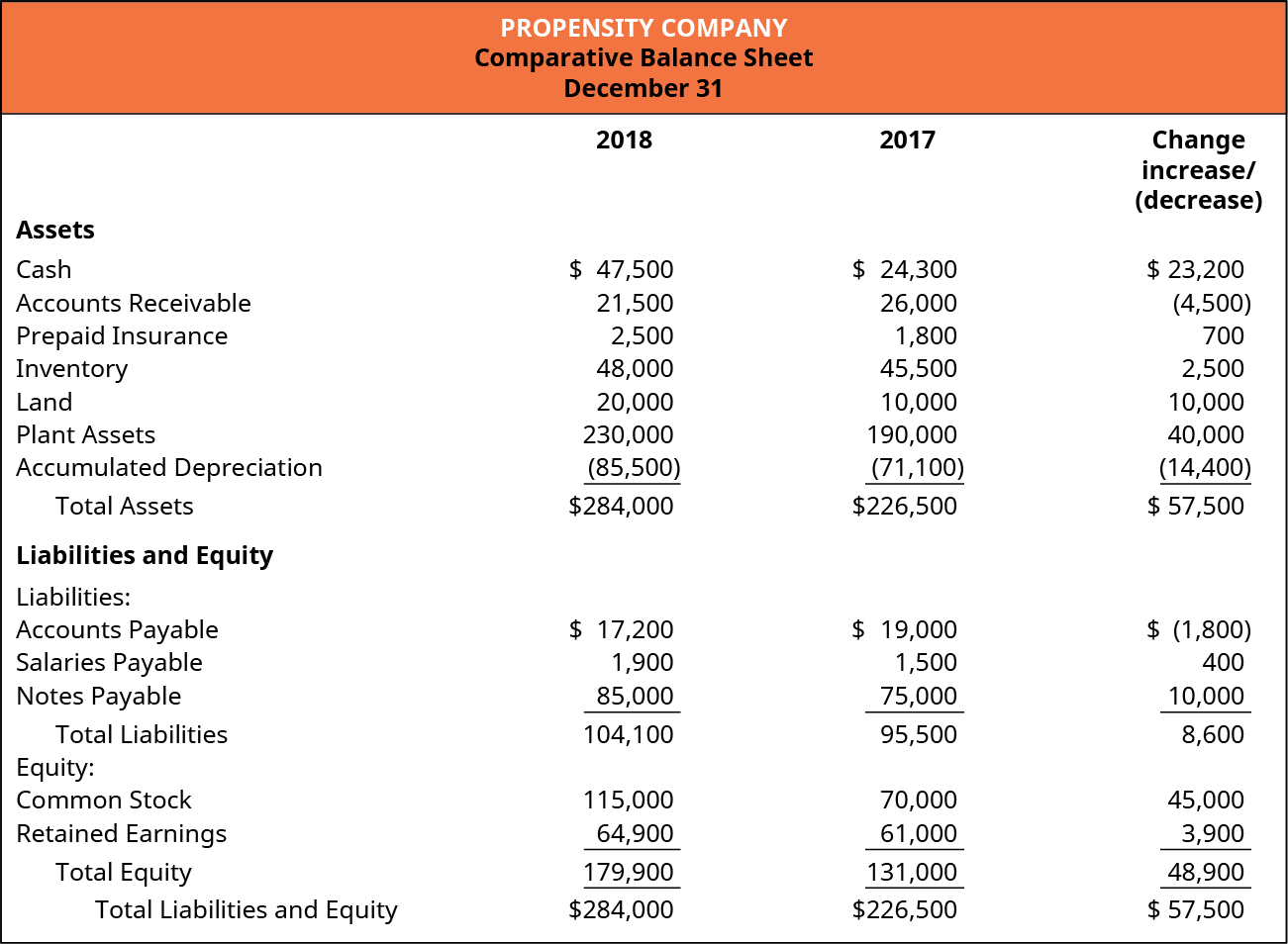

Due to conservative accounting principles loss contingencies are reported on the balance sheet and footnotes on the financial statements if they are probable and their quantity can be reasonably estimated. In other words revenue expenditure except that which has already figured in the Trading Account and losses will be debited to the Profit and Loss Account. Expenses Liabilities and Owners Equity.

Example of Contingent Asset. You can work out your businesss gross profit margin by dividing the gross profit by turnover and the net profit margin by dividing its net profit by its turnover. These are possible or probable liabilities or gains that have to either be provided for in the.

Every insurance company has to furnish a classified summary of fixed assets in India along with the Balance-sheet in Form AA. For example Wysocki Corporation recognized an estimated loss of 800000 in Year One because of a lawsuit involving environmental damage. C The assets purchased with cash contributed by the owner and the cash spent to operate the business.

An example of a contingent asset and its related contingent gain is a lawsuit filed by Company A against a competitor for infringing on Company As patent. GAAP allow for comprehensive income to be reported in either a Statement of Stockholders Equity or a. Refer to MCQs for Accountancy Class 11 with Answers Chapter 2 Theory Base of Accounting designed as per the latest syllabus issued by CBSEAll Multiple choice questions have been provided with solutions and have been prepared based on the expected pattern in upcoming board exams.

What happens when a figure is reported in a set of financial statements and the actual total is later found to be different. A businesss total income less all its day-to-day running costs is its net profit. This problem has been solved.

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)