Stunning Advance Tax Treatment In Balance Sheet

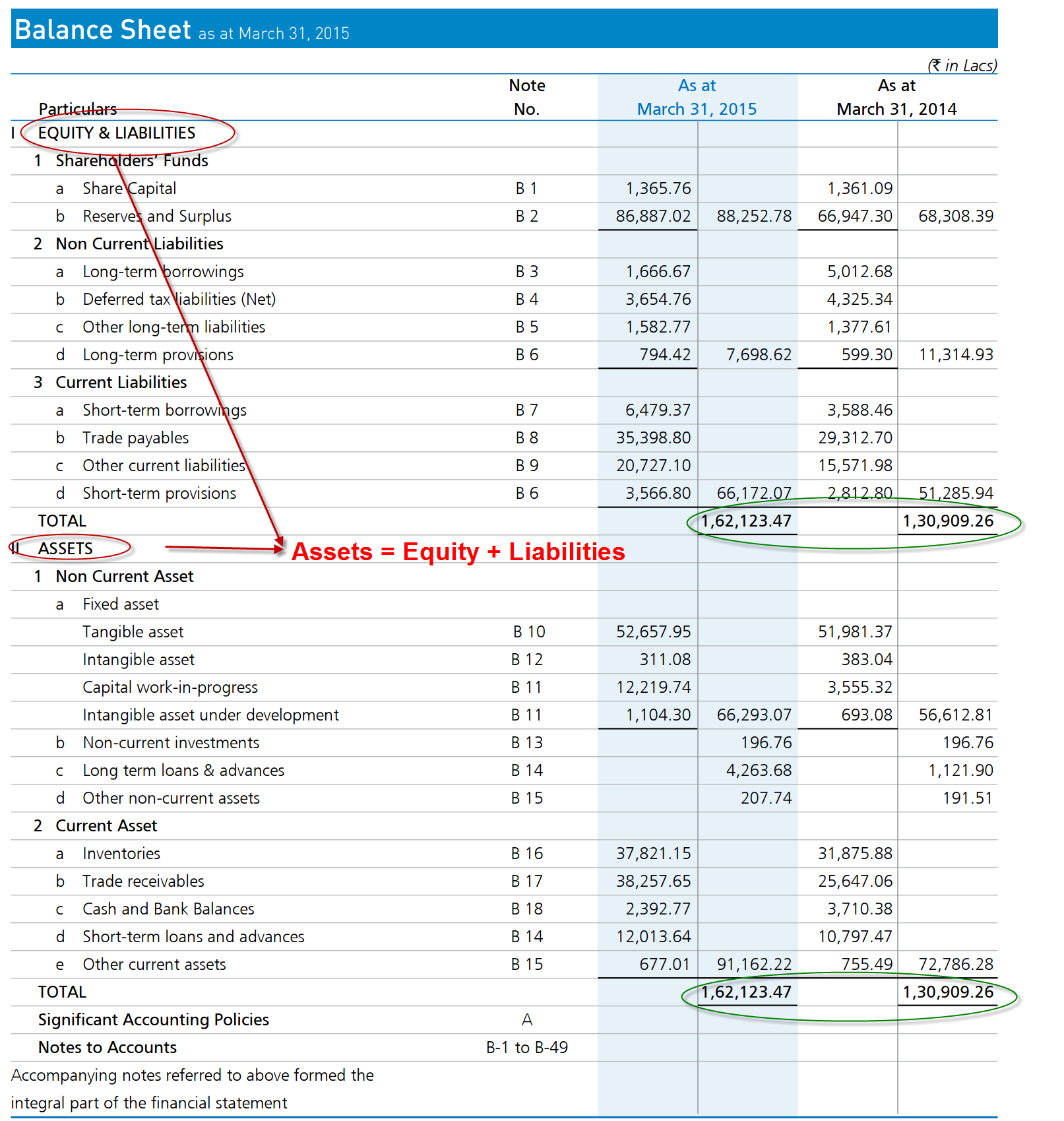

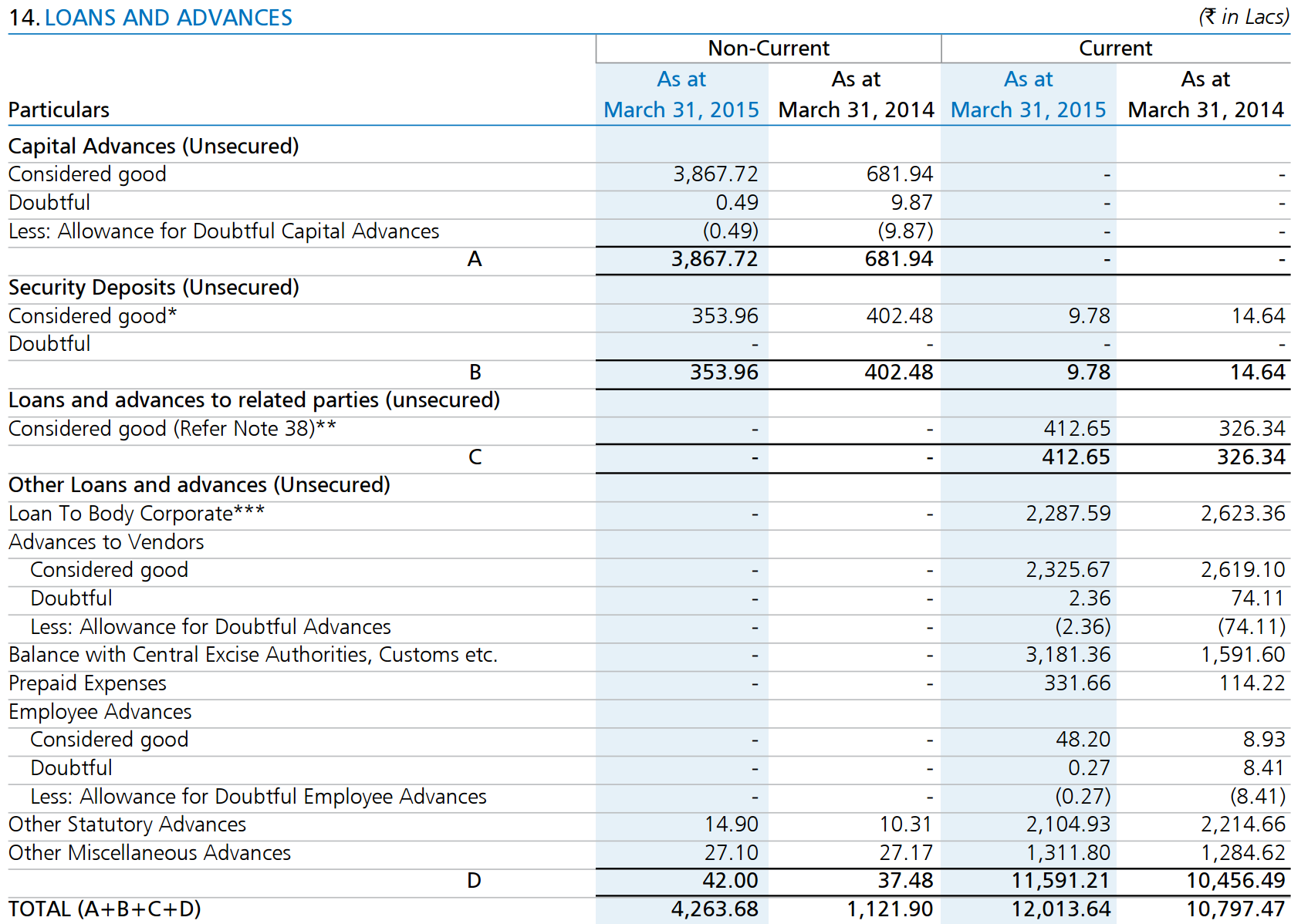

When you make prepayments for future expenses they are recognized as prepaid expenses on a separate line under current assets on the balance sheet.

Advance tax treatment in balance sheet. Profit Loss Ac Dr. So how do we treat revenues received in advance. To Bank Ac 2At the time of making provision for Income tax Liability.

Accounting entry will be as under. 1 At the time of paying advance tax. Now let us see the accounting entries.

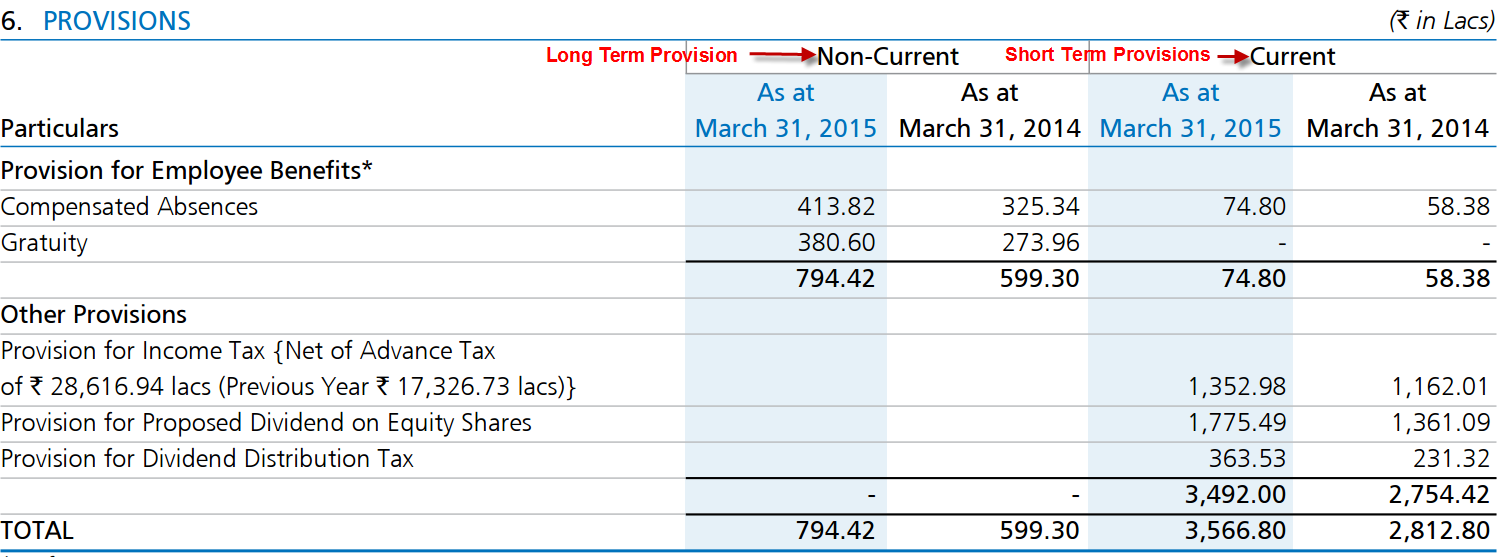

So on this advance guess company make his reserve or provision of income it may be the 5 or 10 or 15 or 30 on his estimated income. Advance Income Tax paid AC DR. 21 August 2013 A senior Citizen who is a pensioner and also owns a proprietor business deposits advance tax from his current account and TDs deducted is shown in the asset side of the balance sheet at the time of preparing balance sheet upto 31-3 --.

Shows it as a liability in the current balance sheet under the head Current Liabilities. Under the accrual basis of accounting revenues received in advance of being earned are reported as a liability. If you are preparing cash flow as per direct method then you need to show actual payment ie.

26 May 2009 Accounting Treatment relating to Income Tax is as follows. That 100k should stay on your balance sheet. This means the company has to pay Tax as per MAT Provisions since it is.

After posting the journal entry for income received in advance a business records it the final accounts as follows. As these are expensed they are recorded on the income statement for the period incurred. This is called provision for income tax.

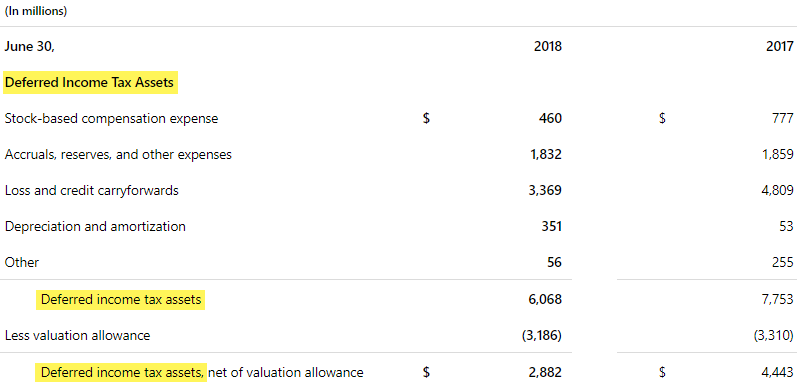

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)