Glory Nature Of Provision For Doubtful Debts

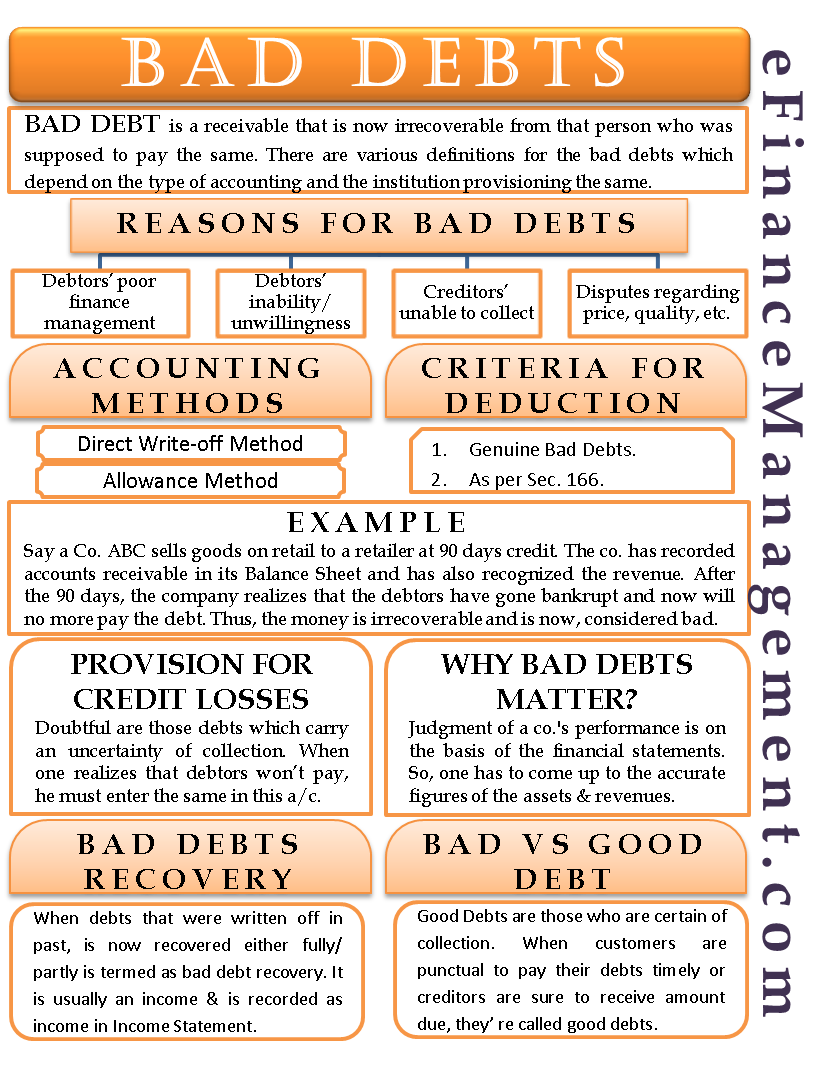

The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected.

Nature of provision for doubtful debts. Premises to its original condition prior to vacating. Provision for bad debts is the estimated percentage of total doubtful debt that needs to be written off during the next year. The provision for bad debts might refer to the balance sheet account also known as the Allowance for Bad Debts Allowance for Doubtful Accounts or Allowance for Uncollectible Accounts.

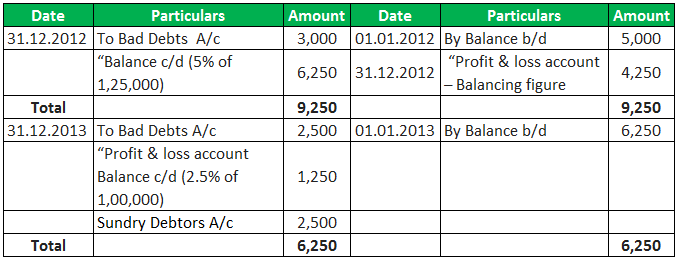

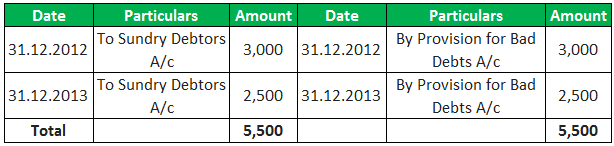

Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. Bad debts for the current year are to be set off and an additional amount of provision is to be added. Section 361viia One section which is very relevant for the banking industry is section 361viia.

Accounting entry to record the allowance for receivable is as follows. Regarding issue of treating the provision for bad and doubtful debts and bad debts written off as non operating expenses for the purpose of margin computation of comparable companies as selected by the TPO the TPO observed that provision for doubtful debts are considered as operating expenses only when the same expenses are incurred every year for the last three years upto and including FY. This provision of doubtful debt is a contra asset and hence credit in nature as compared to the accounts receivable that are classified as assets and are debit in nature.

The term general is used when there is no clear evidence that which trade receivable will not clear his debt. Provision for bad and doubtful debts general Provision for obsolete stocks general Renovation or refurbishment works you may claim Section 14Q deduction for qualifying expenditure incurred Retrenchment payments Ex-gratia retrenchment payments and outplacement support costs where there is a complete cessation of business. Under the accounting standard FRS 39 which sets out the principles for recognising and measuring financial instruments general and specific provisions for bad and doubtful debts will no longer be made.

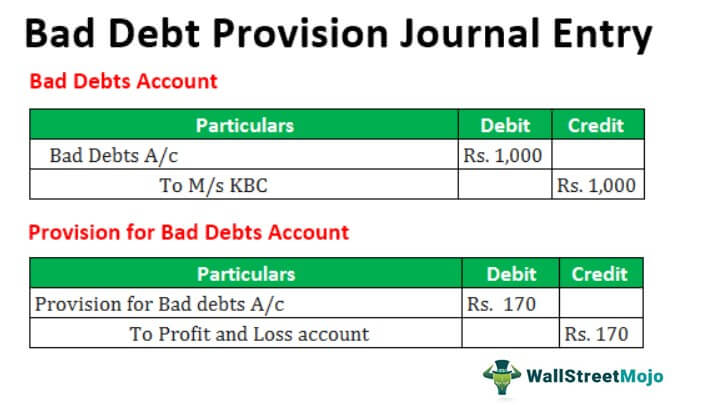

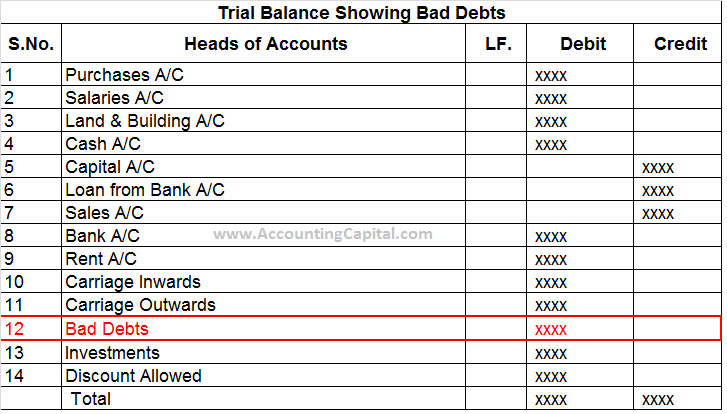

The journal entry is passed at the year-end by debiting profit and loss account bad debt expense and crediting provision for doubtful debt. If Provision for Doubtful Debts is the name of the account used for recording the current periods expense associated with the losses from normal credit sales it will appear as an operating expense on the companys income statement. There are a lot of litigations and disputes.

Provision for bad and doubtful debts general note impairment loss on trade debts Provision for obsolete stocks general Reinstatement costs expenses incurred to reinstate. Every year the amount gets changed due to the provision made in the current year. For income tax purposes impairment losses on trade debts that are revenue in nature will be allowed deduction.