Glory Cash And Cash Equivalents Ifrs

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

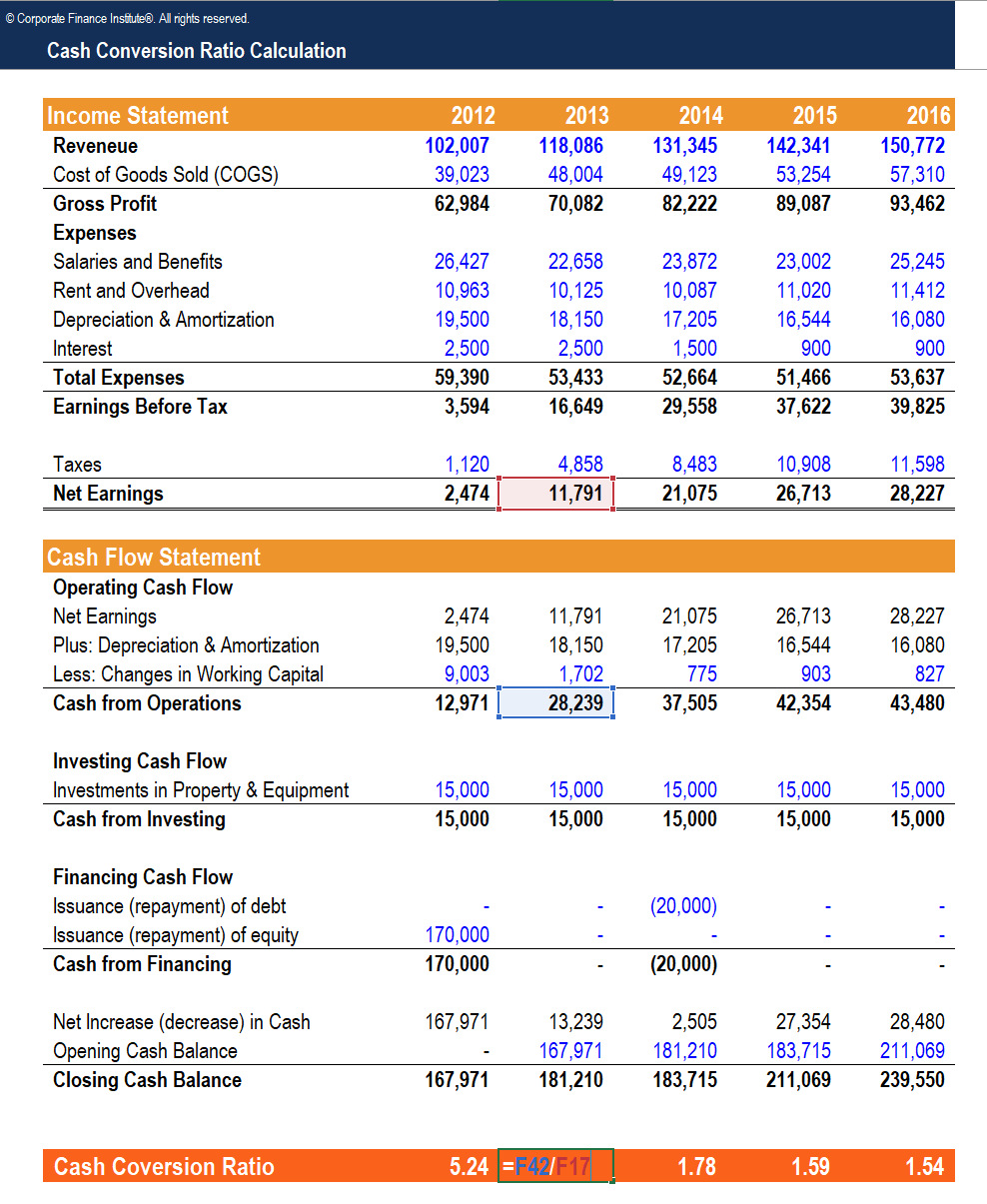

Cash and cash equivalents and debt instruments Measurement of cash and cash equivalents trade receivables and other short-term receivables remains unchanged.

Cash and cash equivalents ifrs. The IFRIC also decided that the criterion in the definition that cash equivalents must be convertible to known amounts of cash means that the amount of cash that will be received must be known at the time of the initial investment. 03 Apr 2020 ca PwC In depth INT2020-02 IAS 7 defines cash equivalents as short-term highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value. Under IFRS Standards bank overdrafts reduce the cash and cash equivalents balance in the statement of cash flows if they are repayable on demand and form an integral part of the companys cash management.

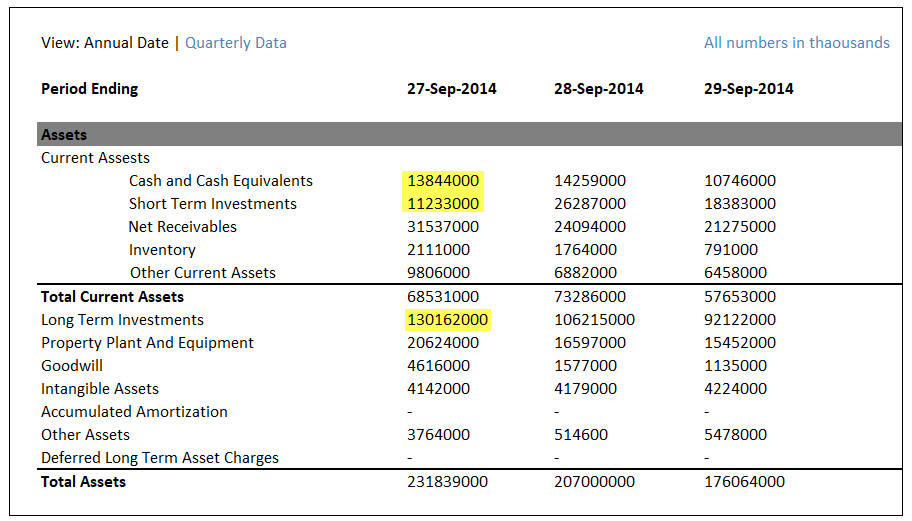

On the Balance Sheet cash and cash equivalents comprise cash and shortterm deposits with a maturity date of three months or less held with banks and liquidity funds. IFRS 5 Classification in conjunction with a planned IPO but where the prospectus has not been approved by the securities regulator. Registered users have up to 20 page views per month at no cost.

Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a companys assets that are cash or can be converted into cash immediately. IAS 19 Pre-tax or post-tax discount rate. Consequently the IFRIC decided that it needed to consider whether units in money market funds should be in-substance cash equivalents.

The definitions of these terms are therefore central to its proper preparation. These are measured at amortised cost. Money market funds and reverse repos used in cash management provided higher yields.

431 million subject to currency controls or other legal restrictions. Included in cash and cash equivalents at December 31 2020 were amounts totalling 65 million 2019. The classification and measurement of bonds and other receivables or debt instruments overall is driven by the entitys business model for managing the financial assets and the complexity of the contractual.

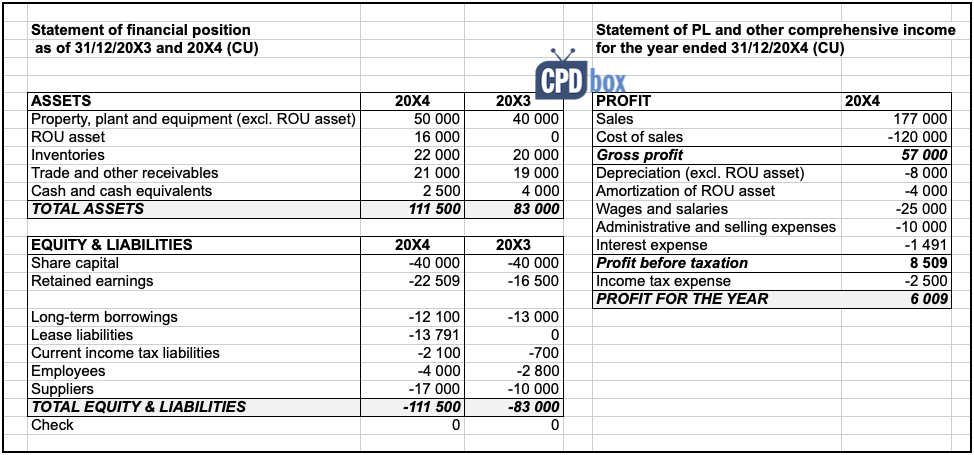

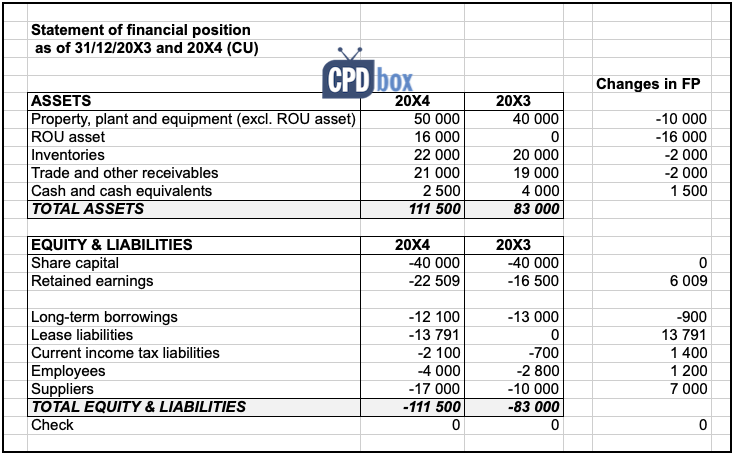

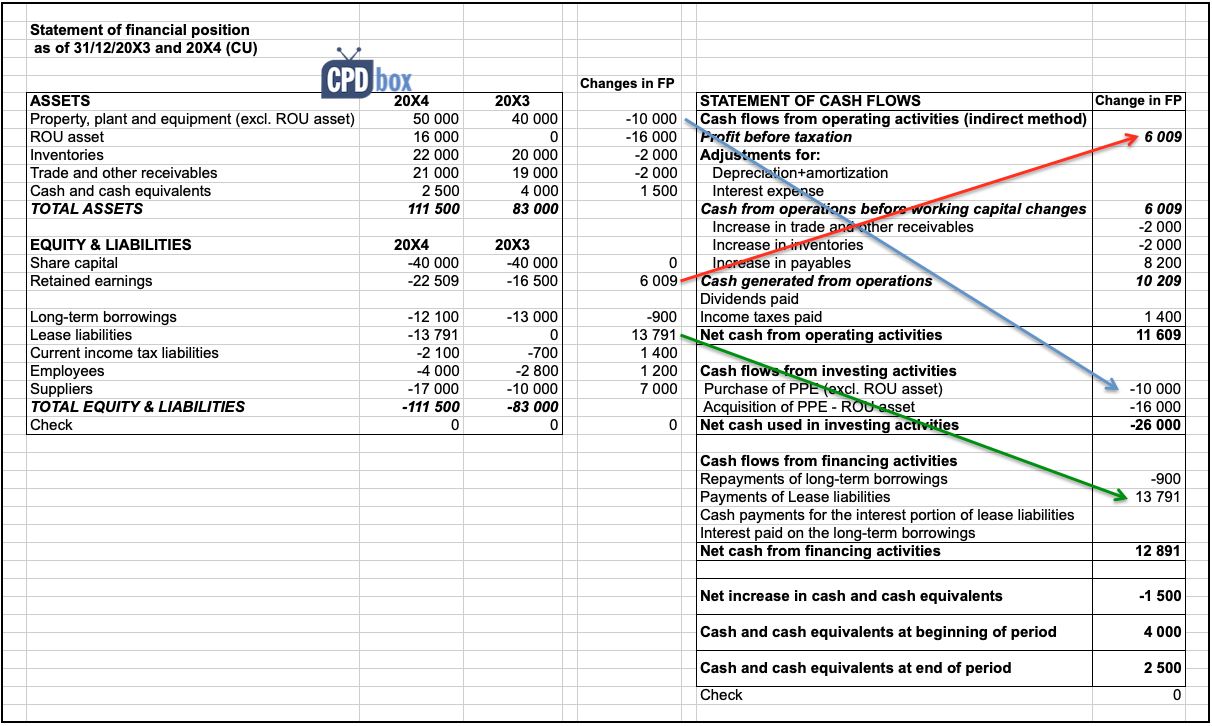

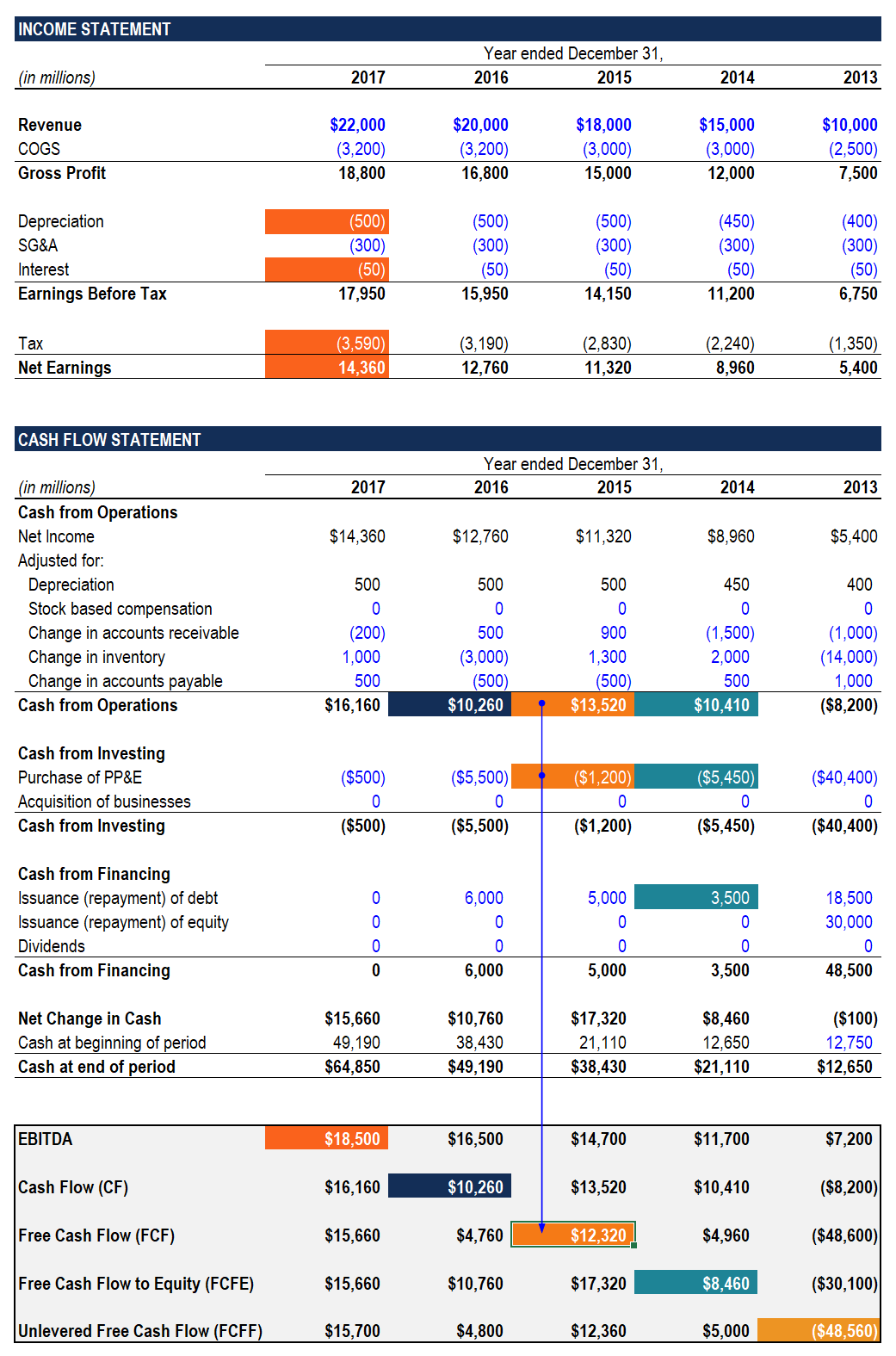

IAS 28 and IFRS 3 Associates and common control. IAS 7 Statement of Cashflows requires the reporting of movements of cash and cash equivalents which are classified as arising from three main activities. Operating investing and financing.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)