Awesome Income Tax Computation Statement Format

Summary of section 194Q and 206C1H GSTR 2B Matching.

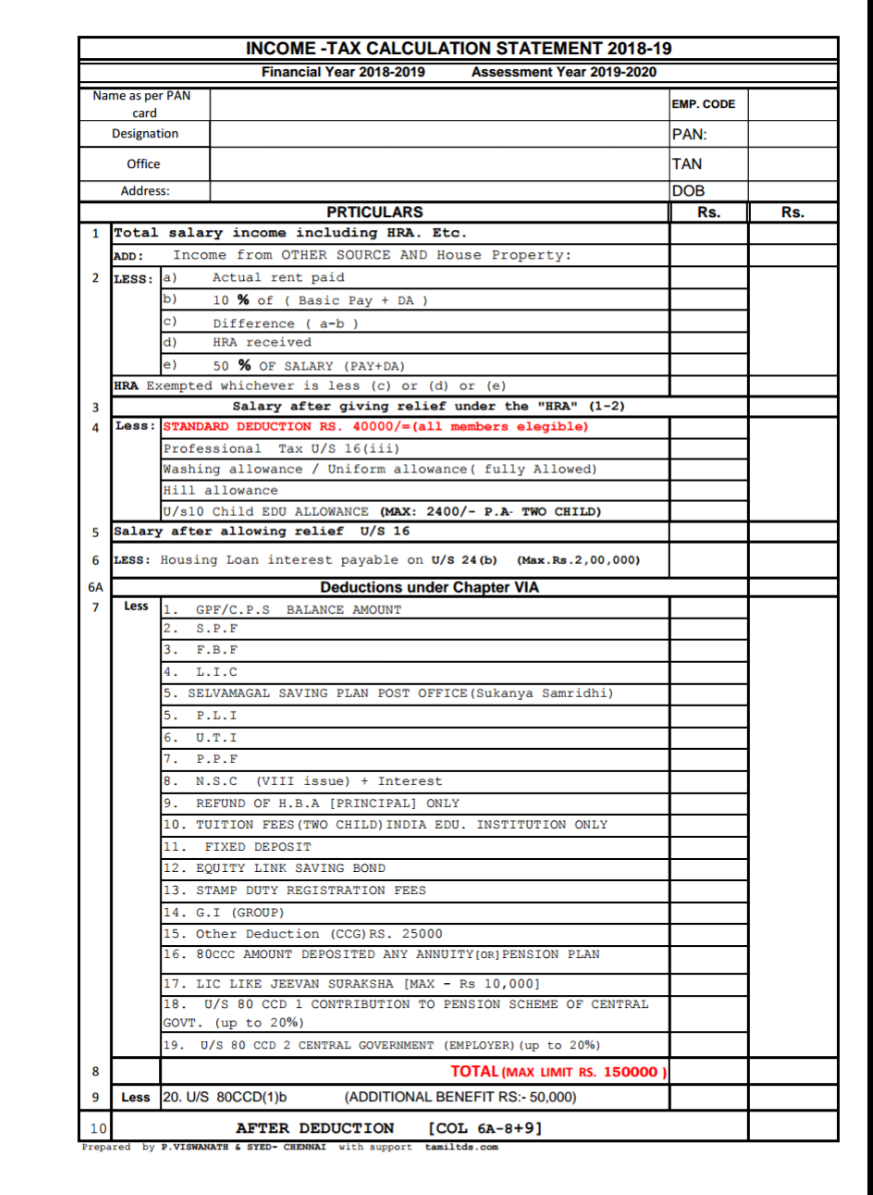

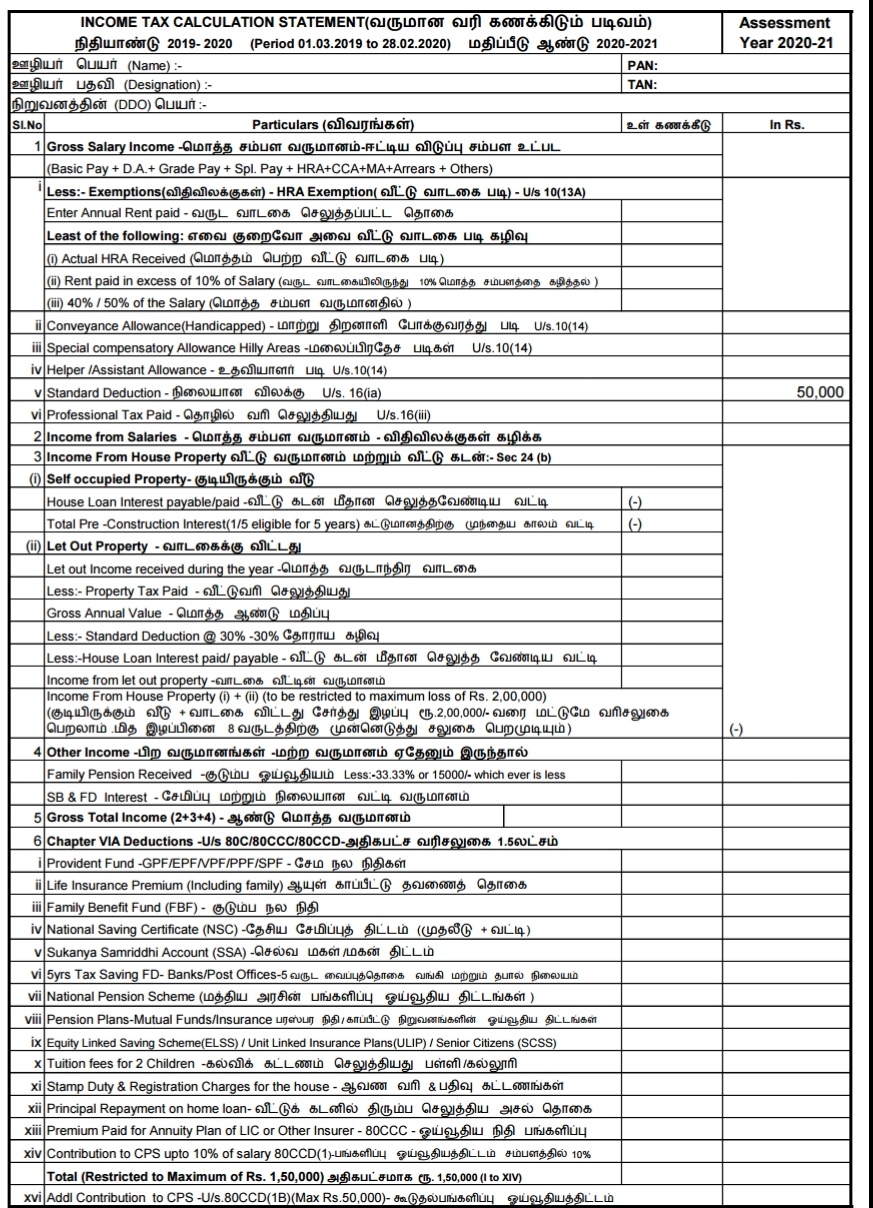

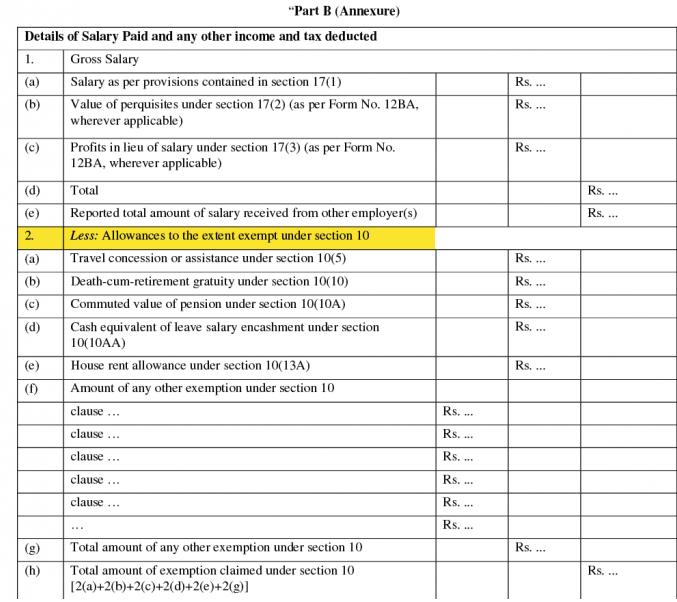

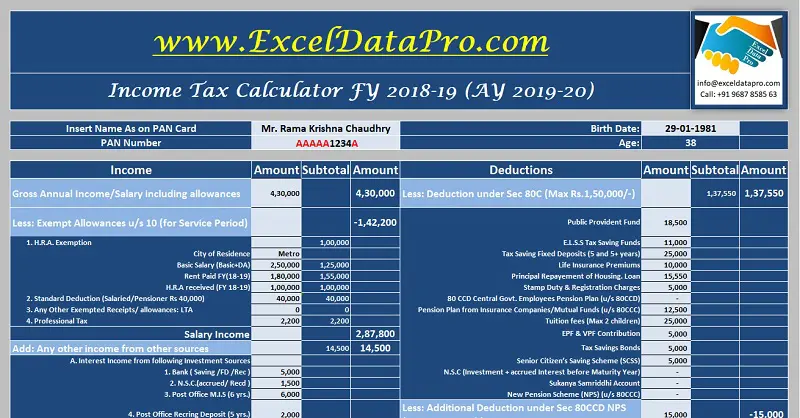

Income tax computation statement format. Download Income Tax Calculator FY 2020-21 AY 2021-22 in Excel Format. Statement of particulars required to be furnished under section 44AB of the Income-tax Act 1961 Revised Form 3CD. Income Tax Computation Calculator 2021.

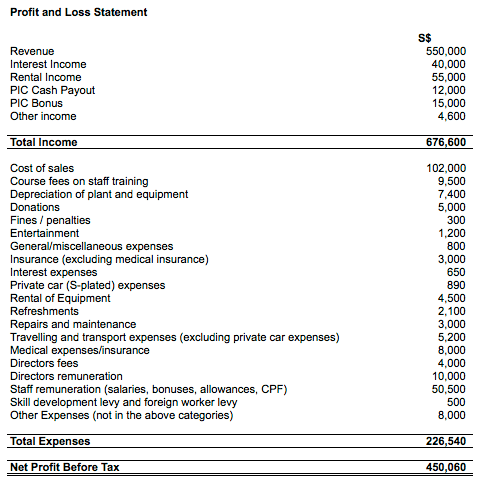

Updated Dates of Compliances. Companies should prepare their tax computations annually before completing the Form C-S C. It will help you to make an informed decision to opt for a suitable tax structure.

Attendance Sheet with Salary Slip. As a guide to work out the income that is chargeable to tax for your investment holding company you may refer to the following templates. Search a wide range of information from across the web with topsearchco.

Ad Find Visit Today and Find More Results. The total income before income tax. Ad Find Template Income Statement.

Ad Find Income Statement Template. Income Tax PAYE - the monthly income tax amount which is based on the tax payable monthly EQV and tax payable annual columns. Tax adjustments include non-deductible expenses non-taxable receipts further deductions and capital allowances.

Deduction under section 16 Professional Tax xxxxx Entertainment allowance Xxxxx. GetApp helps more than 18 million businesses find the best software for their needs. Ad See the Income Tools your competitors are already using - Start Now.