Neat Convert Indirect Cash Flow To Direct

Two categories exist for direct cash flow cash coming from customers and cash disbursements.

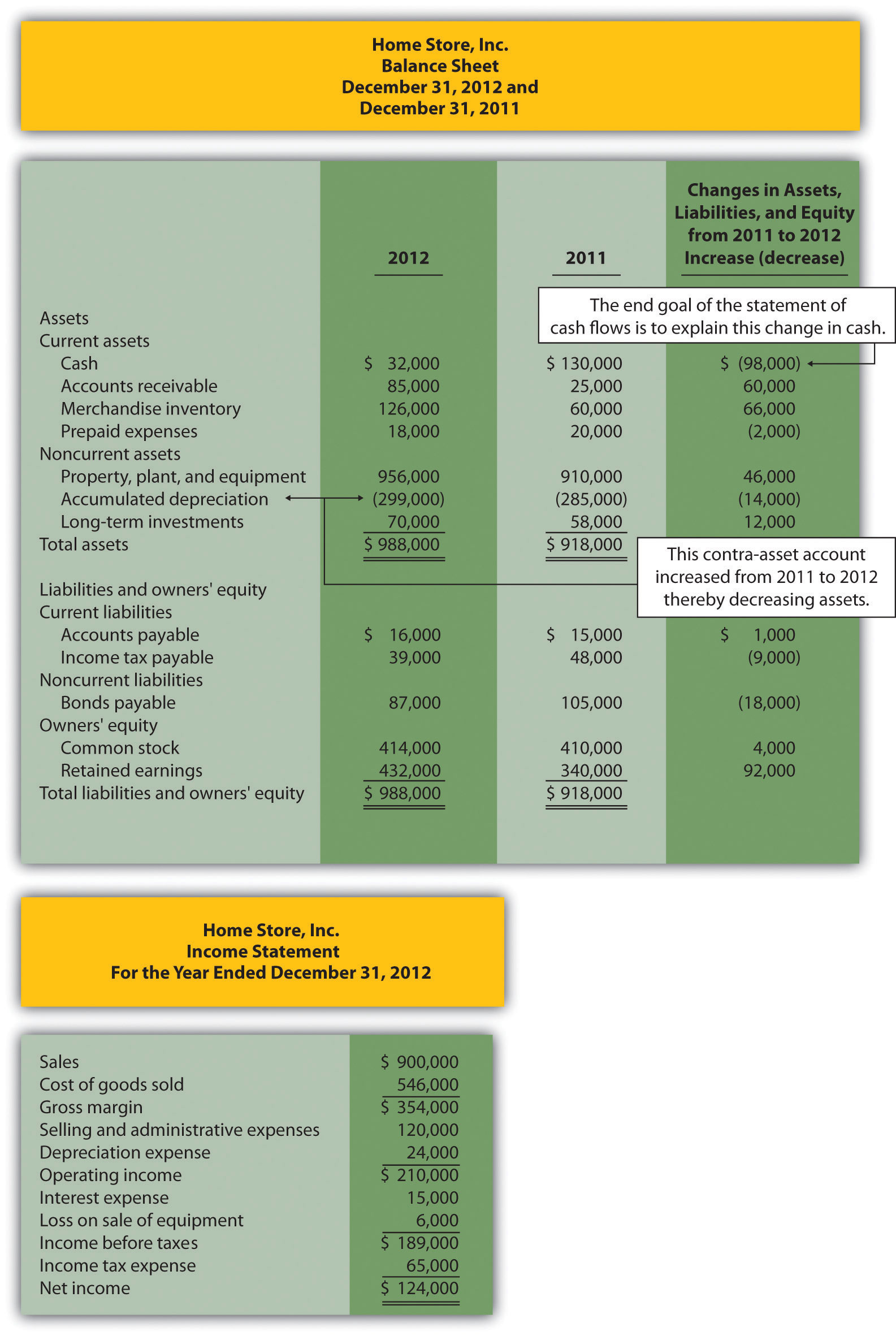

Convert indirect cash flow to direct. Indirect Cash Flow Method. Such adjustments include eliminating any deferrals or. A cash flow statement is a summary of your companys incoming and outgoing cash from operations investments and financing.

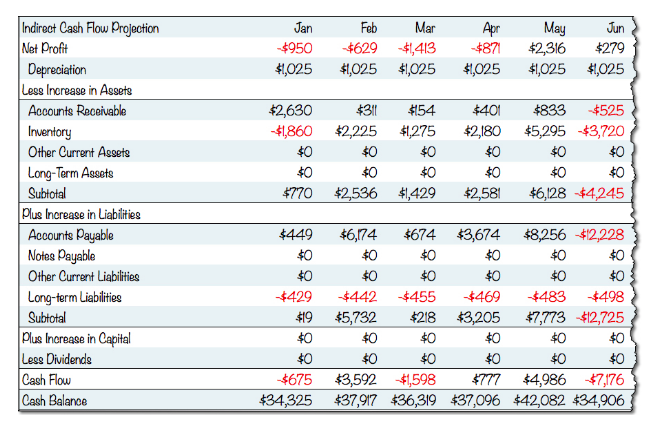

The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. The indirect-to-direct conversion process appears in Table 15The only inputs needed are. The direct method only takes the cash transactions into account and produces the cash flow from operations.

To convert these number into an indirect view of cashflow you simply adjust your net income to convert it from an accrual to a cash basis. The very first step in the three-step process for converting cash flows from the indirect method to the direct method is the disaggregation of net income into total revenues and total expenses. The direct method considers only cash transactions to produce a cash flow statement.

Question 2 Which of the following components of cash flow statements could be prepared using two different methods. The direct method for the. However even after youve made the necessary adjustments you wont have the precise overview of cash flows that the direct method provides.

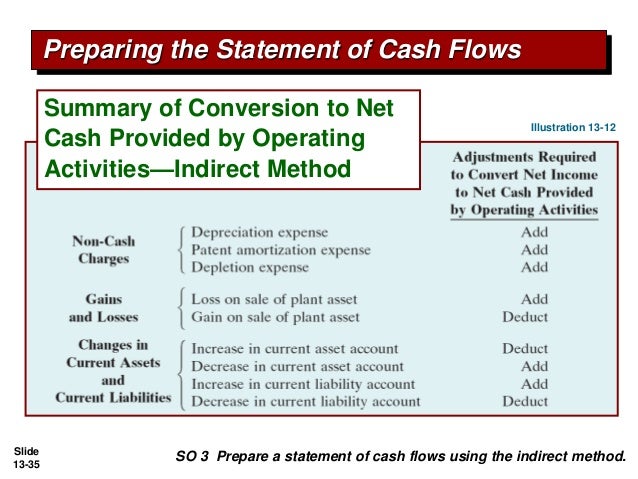

The net income is then followed by the adjustments needed to convert the accrual accounting net income to the cash flows. It also requires a completely separate reconciliation that looks very similar to the indirect method to prove the operating activities section is accurate. A convenient form is intuitive.

The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows. It can be calculated using either the direct method which finds out actual receipts from customer and payments to suppliers and others or the indirect method which adjusts net income to arrive at net cash flow from operations. The indirect method takes the net income generated in a period and adds or subtracts changes in the asset and liability accounts to determine the implied cash flow.