Great Provision For Doubtful Debts Meaning

Is the provision for doubtful debts an operating expense.

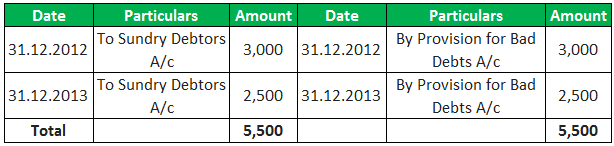

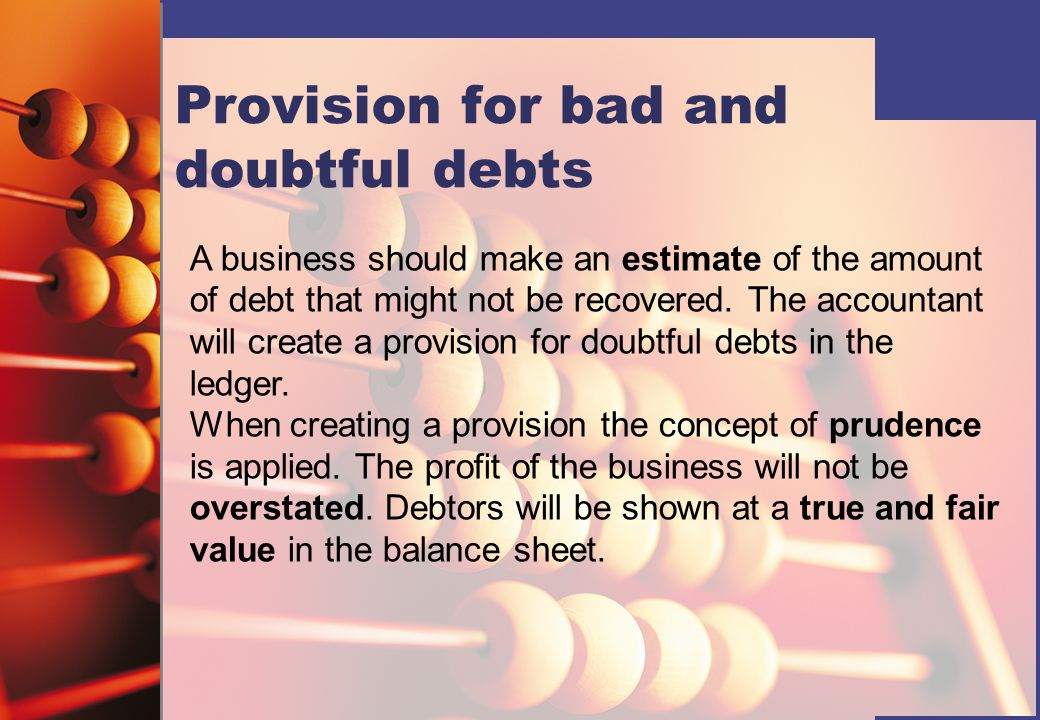

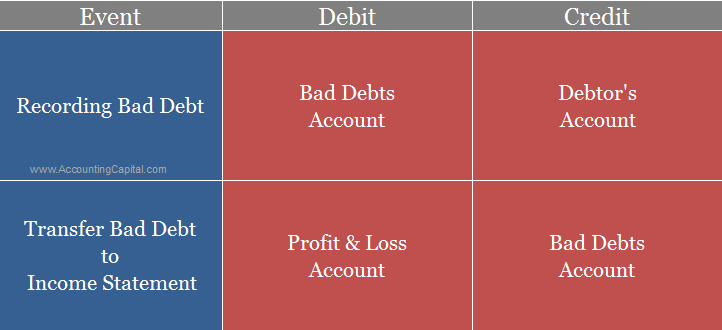

Provision for doubtful debts meaning. Provision for Bad Debts Meaning. Provision for bad debts is the estimated percentage of total doubtful debt that needs to be written off during the next year. It is similar to the allowance for doubtful accounts.

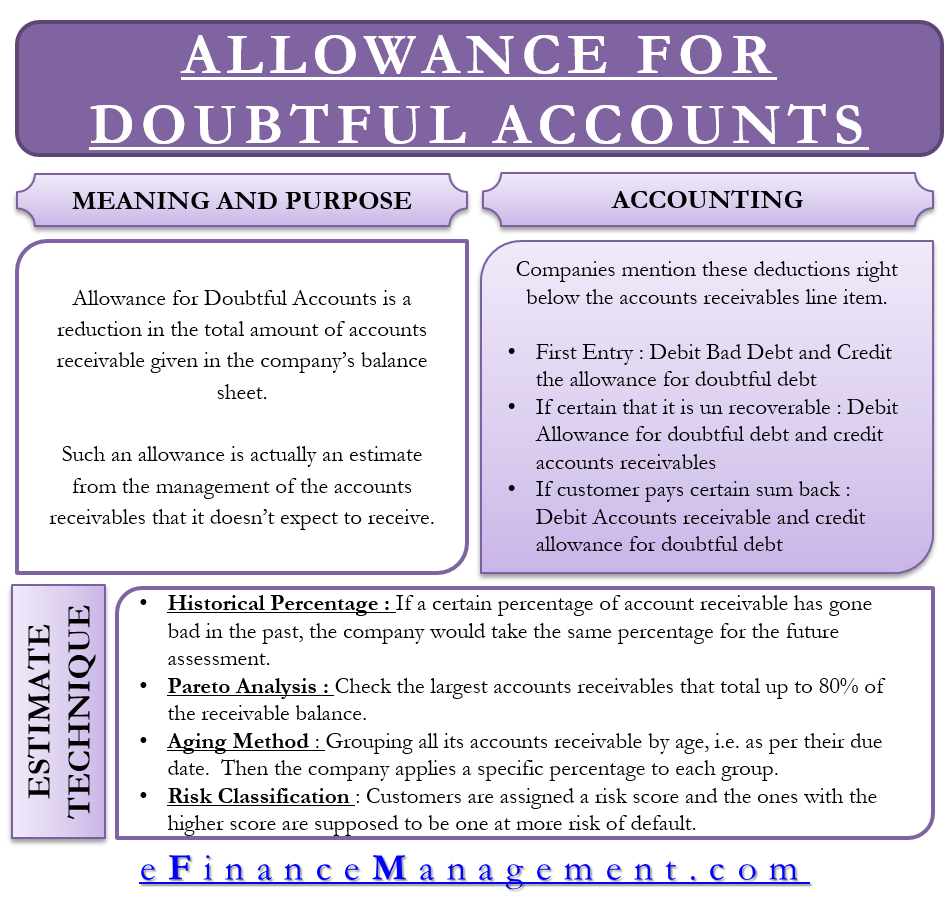

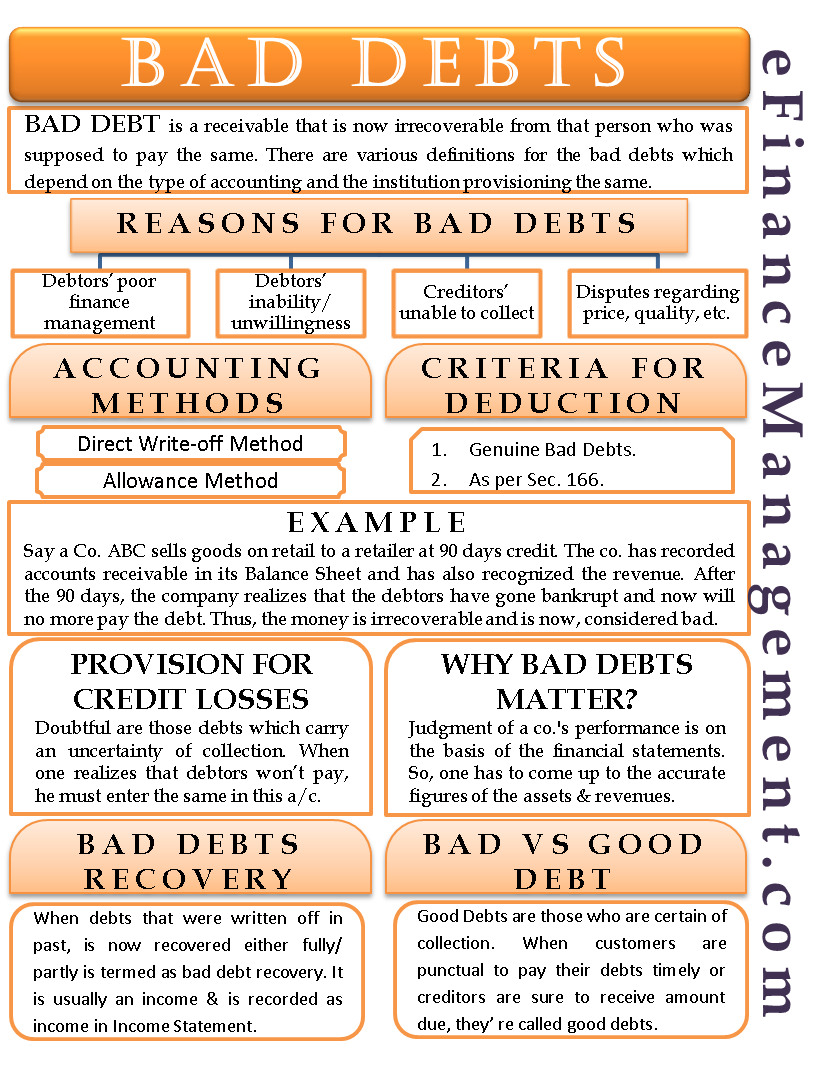

It may not be realised. Provision for doubtful debts or allowance for bad debts or un-collectible accounts state the proportion of trade receivables that the business expects but may not be recovered. Section 36 1 vii of the Income-tax Act 1961 deals with the allowability of bad debts and section 36 1 viia deals with the allowability of provision for bad and doubtful debts.

Amounts owed to a company by customers or borrowers which may possibly not be paid because the customers or borrowers are in financial difficulties. The provision for doubtful debts which is also referred to as the provision for bad debts or the provision for losses on accounts receivable is an estimation of the amount of doubtful debt that will need to be written off during a given period. According to section 36 1 vii bad debts written off are admissible deduction subject to the conditions prescribed under section 36 2 ie.

Provision for bad debts is the estimated percentage of total doubtful debt that needs to be written off during the next year. So it becomes bad debt at the same time as would any other line on your accounts receivable. Almost every business entity has some debtors of which recovery is doubtful.

According to ATO legislation this doesnt happen just because time has passed and its overdue but because you have tried your best to recover the debt and been unable to do so. What is the provision for bad debts. What is the difference between reserve and provision.

What is the entry for provision. Provision for doubtful accounts definition. Provision for doubtful debts is a liability for the business and it appears on the liability side of a balance sheet.