Formidable Section 199a Statement A

44 rows Sections 1040.

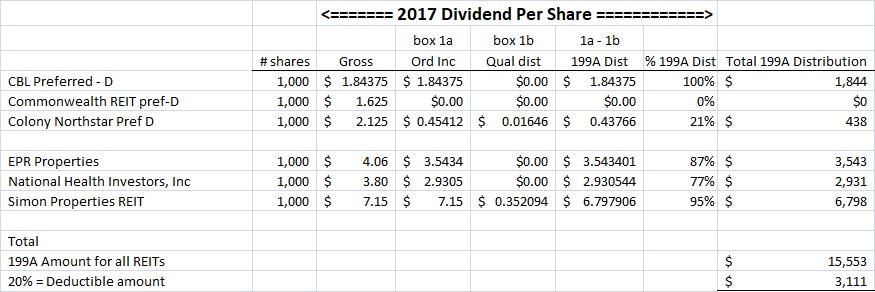

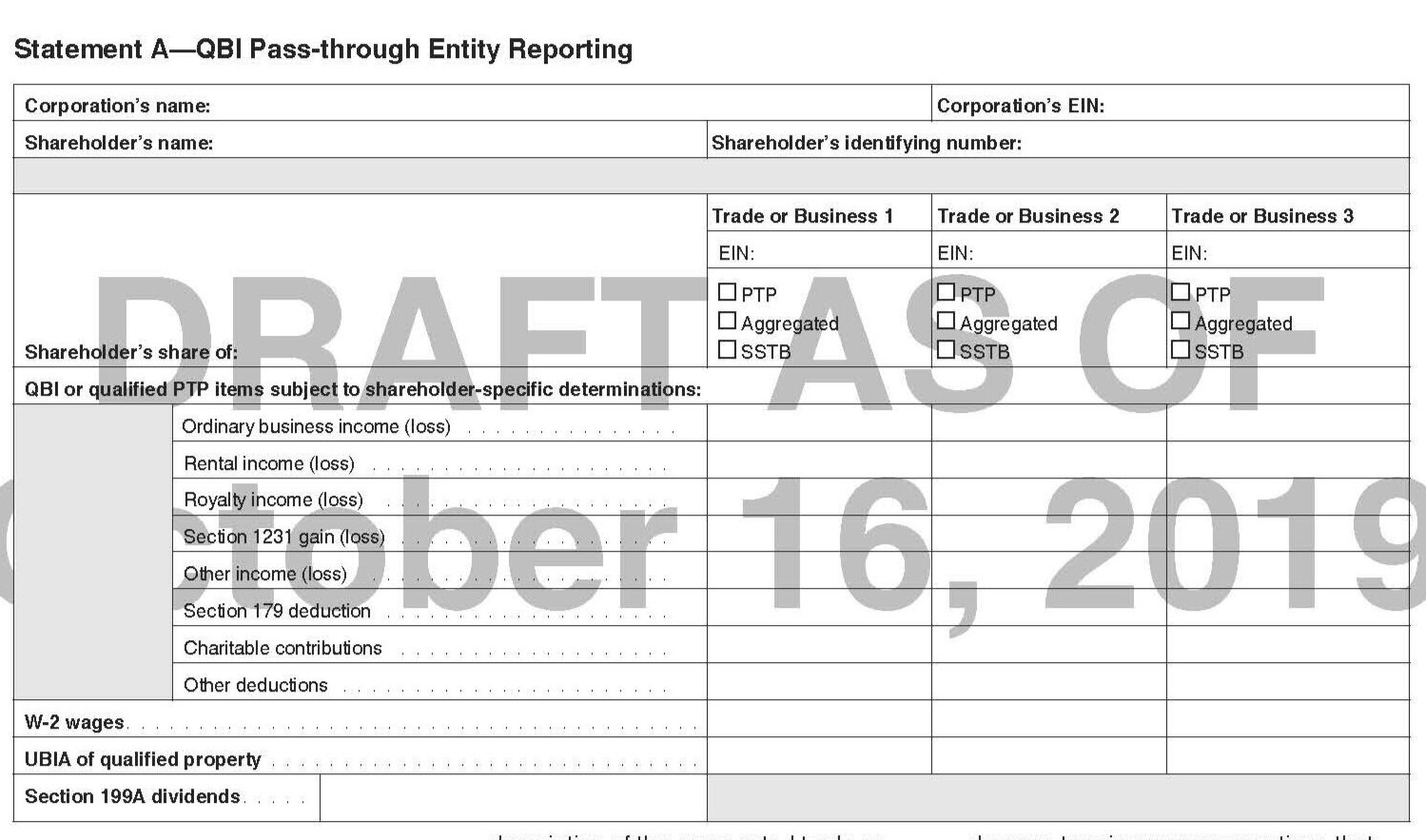

Section 199a statement a. Section 199A Income on K-1 If you received a K-1 you should have also received a statement or other document with some detail on the 199A income that should be input into the program. For taxpayers whose Section 199A deduction is limited by 20 of QBI contributions to traditional IRAs and HSAs should be favored over self-employment retirement plan contributions since the IRA and HSA deductions are 100 deductions while the self-employment retirement plan. Only income items connected with a 5 Other businesses are ineligible for the small business stock gains exclusion but they are not considered SSTBs under Section 199A.

There are nuances as to what counts as to qualified business income but one such qualification is that the income has to be from a trade or business. And they may be realizing it is both a tax benefit and a compliance challenge. IRS Statements and Announcements Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017.

17610 Section 199 of the SFA prohibits a person from knowingly or recklessly making or disseminating false or misleading information and statements that are likely to induce subscription of or the sale or purchase of securities securities-based derivatives contracts or CIS units or which are likely to affect the market price of these capital markets products. 469 aggregation under Sec. A taxpayer or RPE must include a statement attached to the return on which it claims the section 199A deduction or passes through section 199A information that the requirements in Section 303 of this revenue procedure have been satisfied.

199A - 4 c provides the reporting and consistency requirements for aggregation by both individuals and RPEs. It provides a deduction in the amount of 20 of qualified business income. 2019-38 to provide a safe harbor under which a rental real estate enterprise will be treated as a trade or business for purposes of section 199A and Reg.

If you are among the more than 20 million taxpayers who report rental income on your tax return having a clear strategy for figuring out your tax liability is a must before you begin 2019 tax preparation. Income from a specified service trade or business suffers an additional limitation. The section 199A deduction and its various limitations is computed at a trade or business level meaning it is important for taxpayers to understand what constitutes a trade or business.

Section 199A deduction Elusive new pass-through deduction demands an early start Individuals estates and trusts that are owners of pass-through businesses are starting to address whats required to qualify for the section 199A deduction. Page 3 of the Section 199A statements Tax Professional. 199A must be disclosed annually for both individuals and RPEs even if there is no change in the trades or businesses aggregated.