Perfect Preparation Of Trial Balance Helps In Locating

Preparation of trial balance helps in locating the.

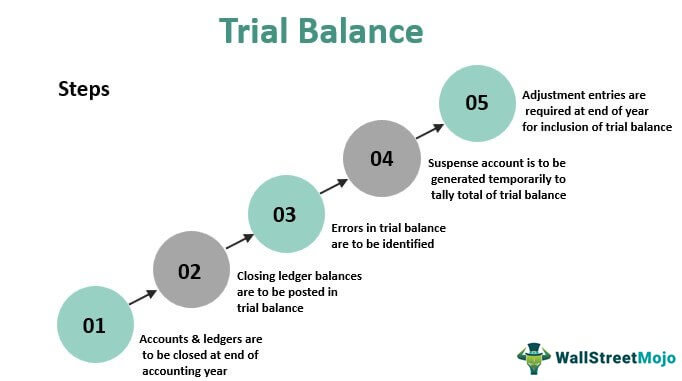

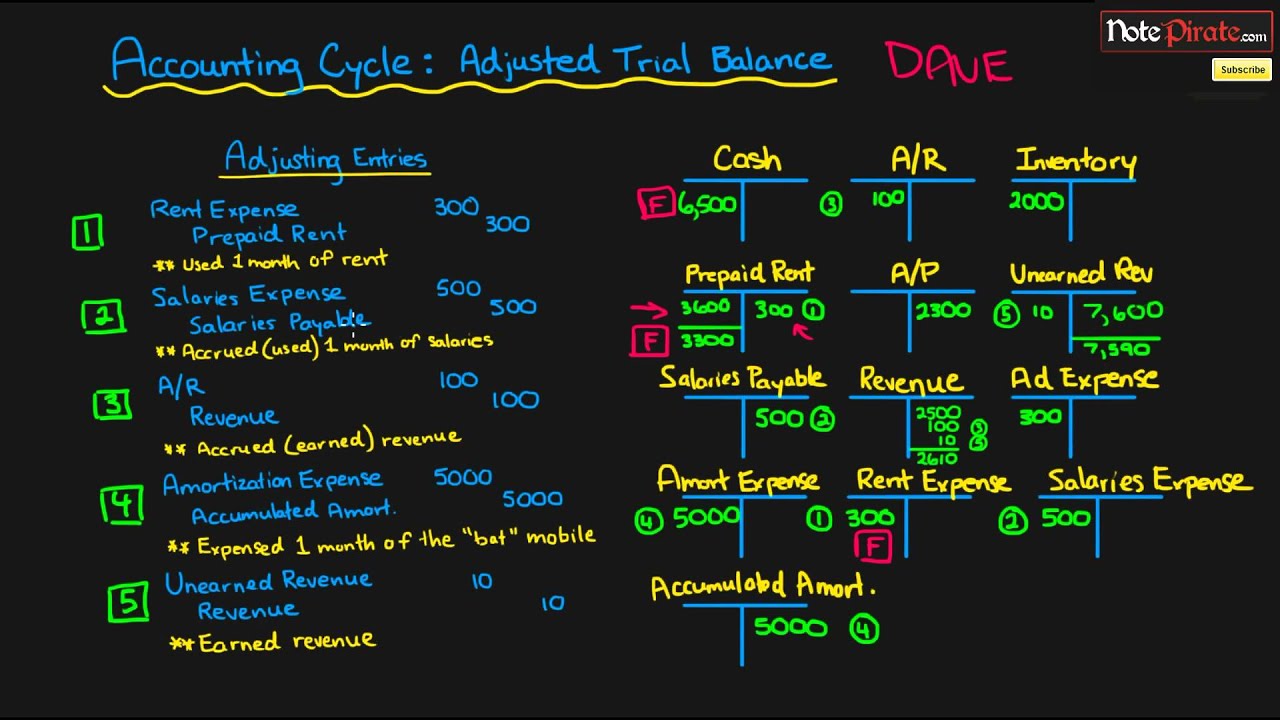

Preparation of trial balance helps in locating. Preparing trial balance is one of the first steps towards preparing final accounts and other financial statements. Trial balance is prepared at the end of the financial year to check the accuracy of the books of account. While there are other errors where the trial balance tallies but the result will be incorrect.

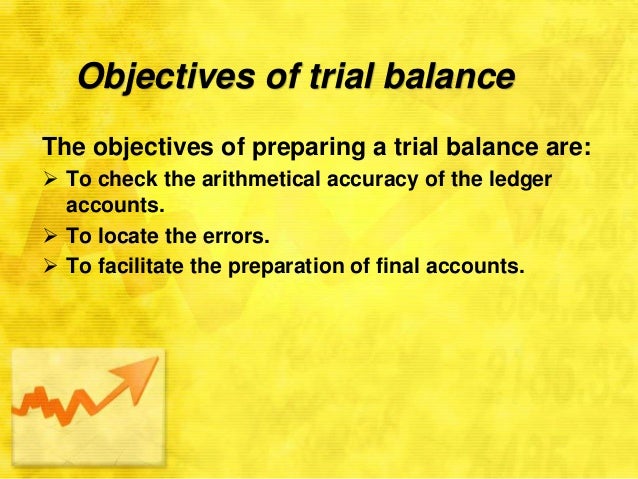

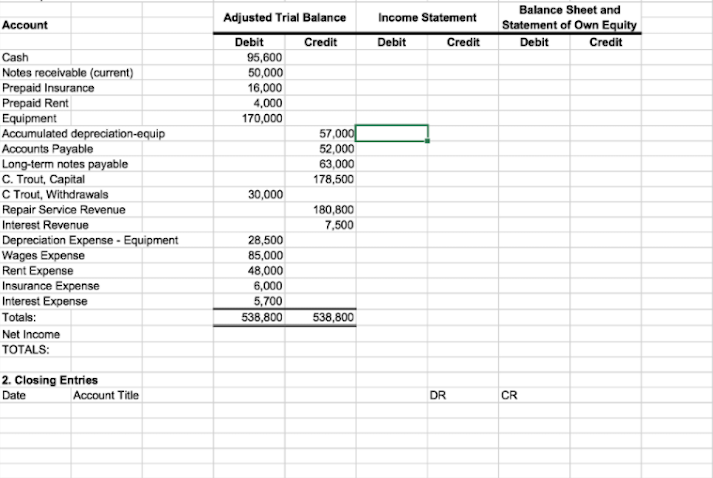

The main objective of the trial balance is to ascertain the accuracy of accounts and locating errors. 1 Re-total the debit and credit columns of the Trial Balance. Utilities a Trial Balance can Offer and its Interpretation.

Preparation Of Trial Balance Helps In Locating Preliminary Expenses Treatment Cash Flow This is oversimplified of course but explains in fundamental terms what a Profit and Loss statement is. Question - The preparation of trial balance helps in. The following steps should be taken to locate the errors and the step may be taken one after another until the errors that cause the difference are located.

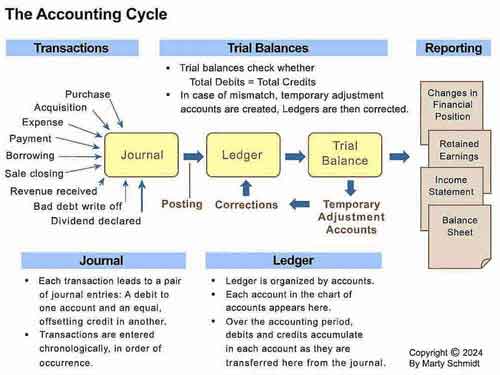

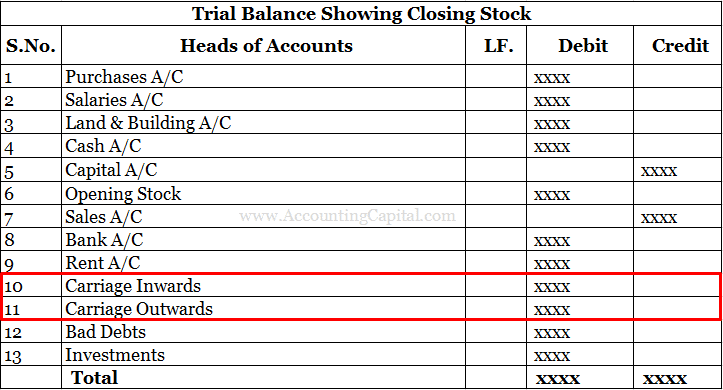

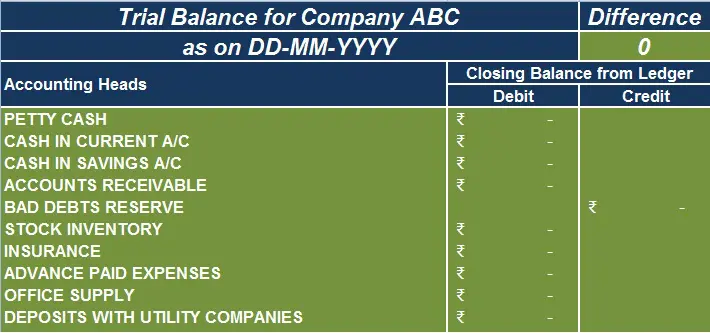

A self-balanced trial balance ensures the. The balances are usually listed to achieve equal values in the credit and debit account totals. The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements.

A trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first three steps in the cycle. Auditors are then able to comment on the preparation of financial statements in their audit. The benefits of Trial balance could be found in the following.

Post the ledger Accounts into trial balance and place the balance in the debit or credit column. The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. The preparation of trial balance helps in.