Recommendation Nonbusiness Bad Debt Statement Example

Ad Find In debt solutions.

Nonbusiness bad debt statement example. First subtract 3000 of your capital loss from ordinary income leaving you with 5000 to carry forward into 2018 when the remaining loss unless offset against capital gains may be used to again reduce ordinary income by 3000. 6000 balance3000 from other income 3000. Scroll down to the Schedule D section.

Follow these steps to enter the nonbusiness bad debt. Maybe ProSeries wants you first to complete the required statement. For each bad debt attach a statement to your return that contains.

Nor can you take a bad debt deduction for unpaid salaries wages rents fees interest dividends and similar items. On the input screens go to Screen BD in the Income folder and open the Schedule for detail statement. You must have actually loaned cash to someone who does not repay it to have a nonbusiness bad debt deduction.

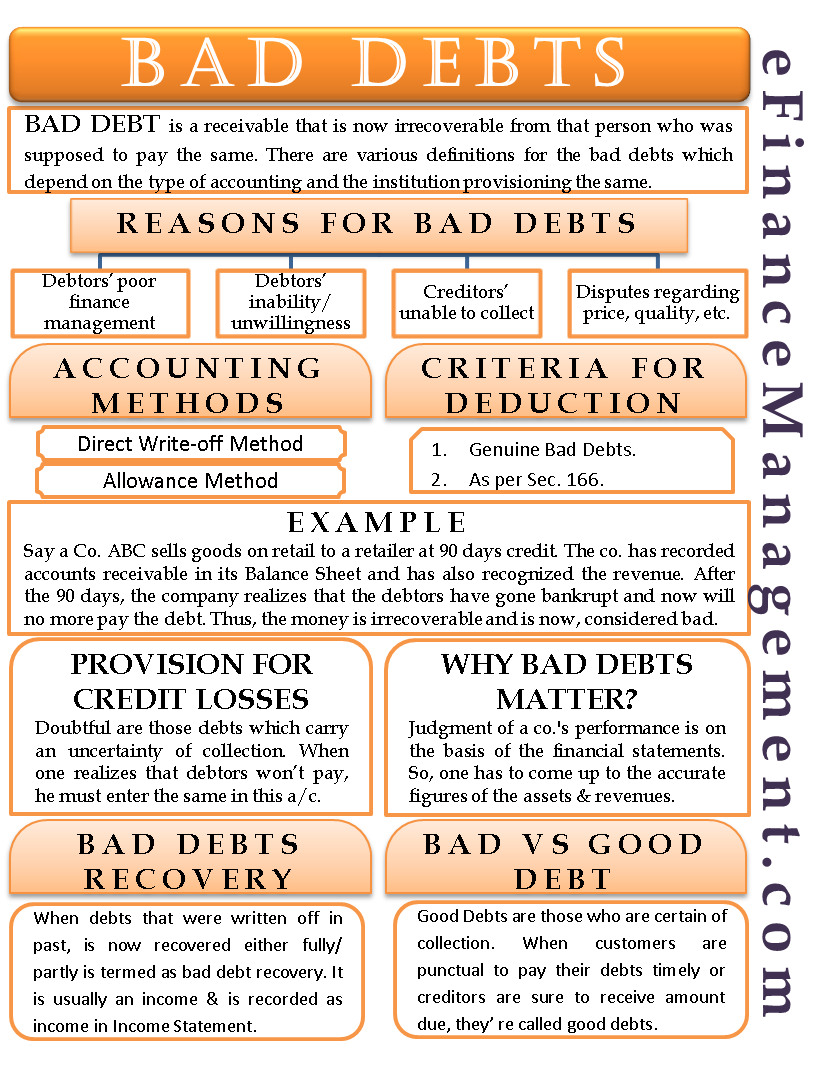

Noncorporate taxpayers cannot deduct a partially worthless nonbusiness bad debt. As loss is not controlled by the nonbusiness debt provisions since the original consideration has been advanced by A in his trade or business. 8000 balance2000 from long-term gains 6000.

Thus for example you cannot claim a bad debt deduction for court-ordered child support not paid to you by your former spouse. Ad Find In debt solutions. 10000 original debt2000 from short-term gains 8000.

In the 8949 box column choose 3 Box C or F - Not reported on 1099-B. Ad Find Debt Relief Solutions. The efforts you made to collect the debt.