Fantastic Pre Operative Expenses In Balance Sheet

CADILA HEALTHCARE LIMITED Cash Flow Statement for the year ended March 31 2005.

Pre operative expenses in balance sheet. Preliminary expenses already shown in the balance sheet on the date the Standard is first applied would be required to be accounted for in accordance with the requirements laid down by paragraph99 of AS26. Pre opening expenses or preliminary expense are shown as intangible assets in balance sheet and amortized annually as per the rules and authorization of concerned government agencies over a specified period of time and that amortized cost also shown in income statement as an expense. For example in the case of a company preliminary expenses would normally include the following.

Preliminary expense are a sort of capital expenditure which may be written off over a period of years. The expenditure on preliminary expenses shall not be carried forward in the balance sheet to be written off in subsequent accounting periods. With reference to as 26 following is deduced.

HIGH COURT OF DELHI. At the time of computation of the taxable income the assese must add the preliminary expense written off in the balance sheet which is prepared by following the provisions of The Companies Act 2013 and deduct the preliminary expenses as 15th of the 5 of the capital employed. There is no scope for preliminary expense being carried forward in the balance sheet revised Sch VI.

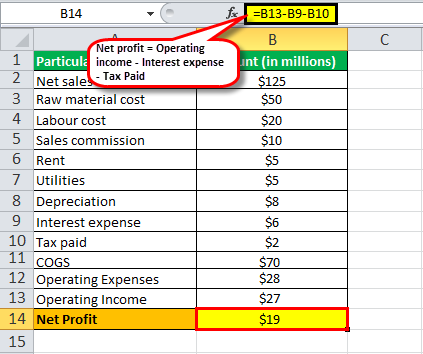

Whether the Preoperative Expenses are Revenue expenses if company expanded its existing business. Normally preliminary expense are treated as intangible asset and shown on the asset side of the balance sheet under the head Miscellaneous asset. Cost of goods sold includes all manufacturing expenses and the adjustments for opening and closing stock Cost of Goods sold Opening stock Purchases Manufacturing expenses - Closing stock Gross Profit is arrived deducting figure of cost of goods sold from the sales figure ie Gross profit Sales -.

These expenses are shown on the assets of the balance sheet under the head misceallenous. Till such time show them as Pre-operative expenses in the balance sheet Asset - Miscellaneous Expenditure. Shown in Financial Statements Also known as pre-operative expenses preliminary expenses are shown on the asset side of a balance sheet.

It commences a retail business dealing in hardware on 01082002 and closes its. These costs are reported as operating expenses on the income statement because they pertain to operating the main business during that accounting period. A division bench of the Bombay High Court recently held that pre-operative expenses incurred by the assesse-Companies are revenue in nature even if the same was shown as capital in the Books of Accounts by the Assessee.