Awesome Demat Account Statement For Income Tax

As per the Income Tax Act 1961 the gains that you derive from selling the shares that you hold in your demat account are liable to be taxed.

Demat account statement for income tax. The only problem arises when employers ask you to submit your tax saving plans a few months before the end of the financial year. This is how you can use your demat account to e-verify returns The Income Tax department has introduced many ways to e-verify returns. To understand your trading activity and for its income tax compliance you need documents like Tax PL Contract Note Ledger Account Statement.

3 in 1 account at ICICI refers to as an Individual opening a Bank account Demat account. Investors can avail of online access to their demat account or subscribe to SMS based alerts to get automatic alert for any debit or credit of shares. Yes you have to pay Capital Gain tax.

You should necessarily have a PAN card for opening such a account. Fees will increase based on volume of transactions. This service allows you to.

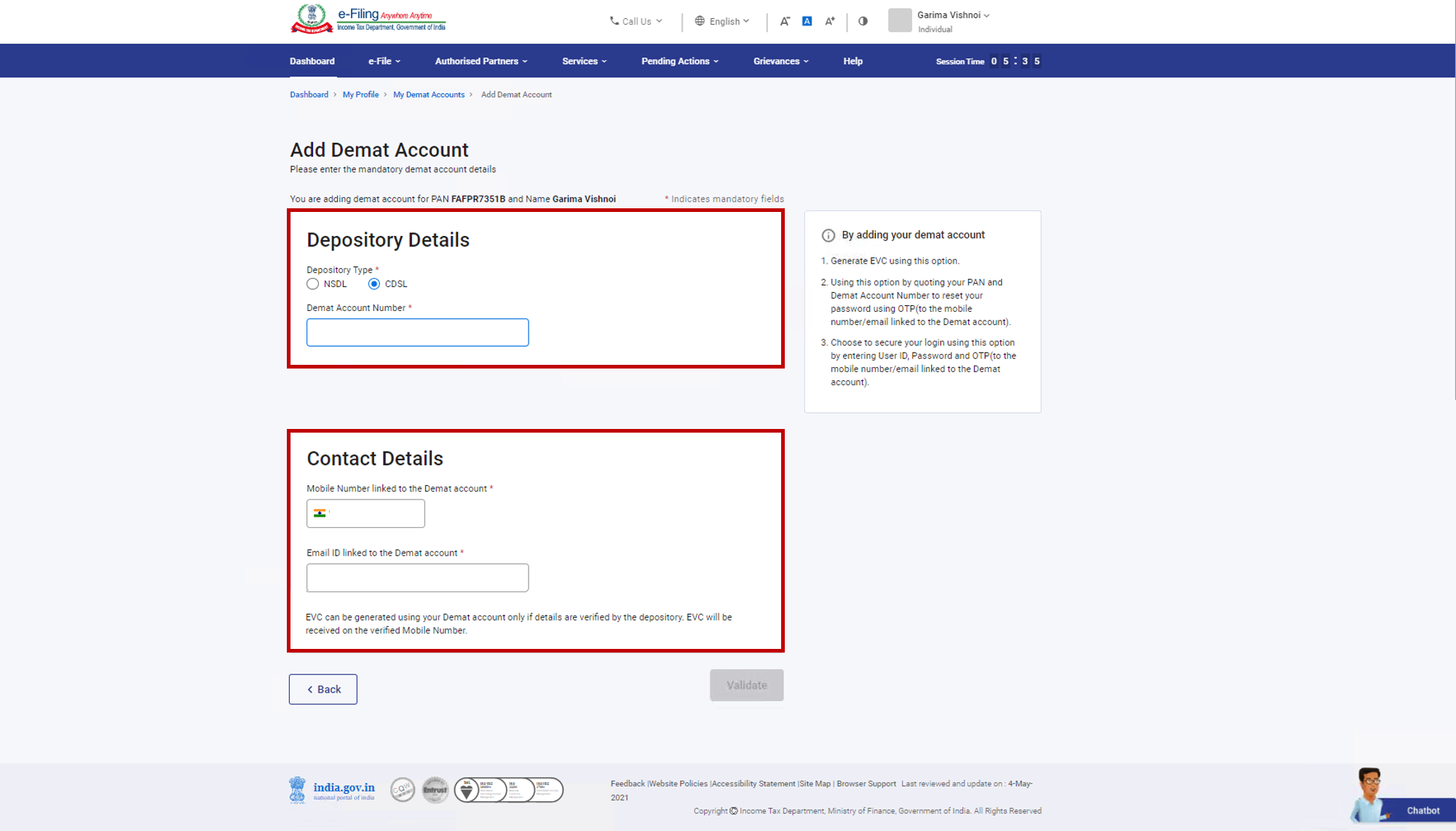

Hence before you get any of these documents you need to create your ICICIDirect Account and Login. Rs 6500 onward for traders with no audit and Rs 10000 in case of audit. You will be able to view the list of Added Failed and Removed Demat Account along with the option to Add Demat Account.

In a demat account. How To Start an SIP To Save Tax On Your Income. Income Tax Returns ITR filing.

Steps To Pre-Validate Demat Account. You can hold dematerialised securities such as stocks mutual funds bonds exchange-traded funds ETFs etc. While some of the DPs send the account holding statement on a periodic basis quarterly or monthly some of the DPs do not send the physical account holding statement.