Top Notch Accrued Interest In Balance Sheet Format Of Assets And Liabilities

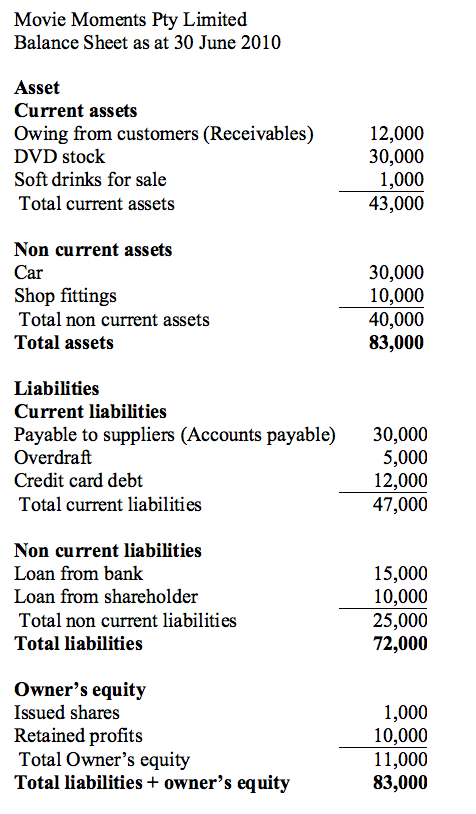

Presents the assets liabilities and equity of a company at a given point in time.

Accrued interest in balance sheet format of assets and liabilities. They appear on the balance sheet under current liabilities. Accrued liabilities are only reported under accrual accounting to represent the performance of a company regardless of their cash position. A lawsuit is an example of a contingent liability.

Here are examples of accrued expenses and the accounts in which you would record them. This should not include dividend declared by subsidiary companies after the date of the Balance Sheet. In this format the assets appear first followed by liabilities and equity of a company.

Assets are presented in order of liquidity and display current and long-term classification. Interest accrual is recorded with a credit to the interest payable account. Accrued expenses tend to be short-term so they are recorded within the current liabilities section of the balance sheet.

The journal entries of interest payable are the same as other payable or liabilities. These types of expenses. Balance sheet example.

The balance sheet provides a picture of the financial health of a business at a given moment in time. In the case of capital leases a company may have to infer the amount of interest payable based on a deconstruction of the underlying capital lease. It lists all of your businesss assets and liabilities.

Liabilities are presented in the order of date due. Accrued Interest Accrued interest is the amount of interest that is incurred but not yet paid for or received. A l ternating colors.