Exemplary Income Statement Payment Summary

Changes to payment summaries income statements are here Posted on June 17 2019 June 17 2019 by Accounts NextGen How you get your end of financial year information from your employer showing your earnings for the year also known as a payment summary or income statement depends on how your employer reports your income tax and super information to us.

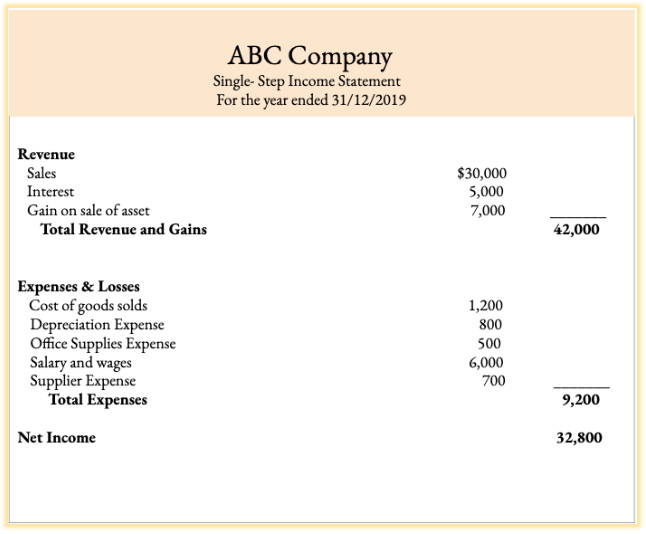

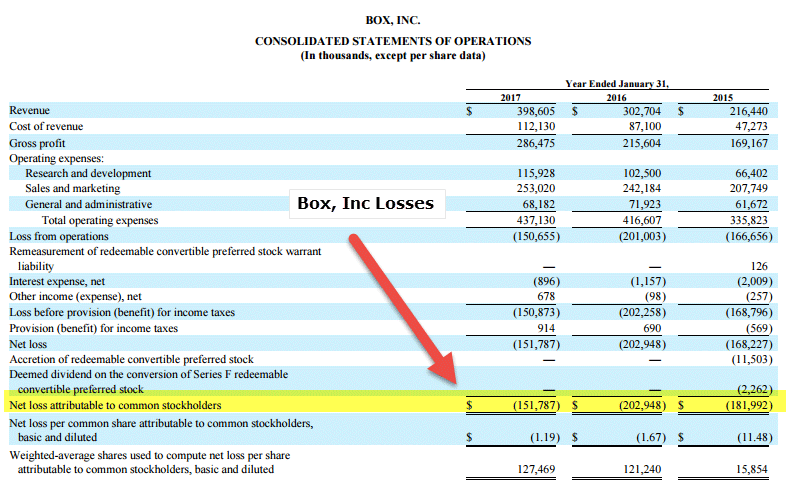

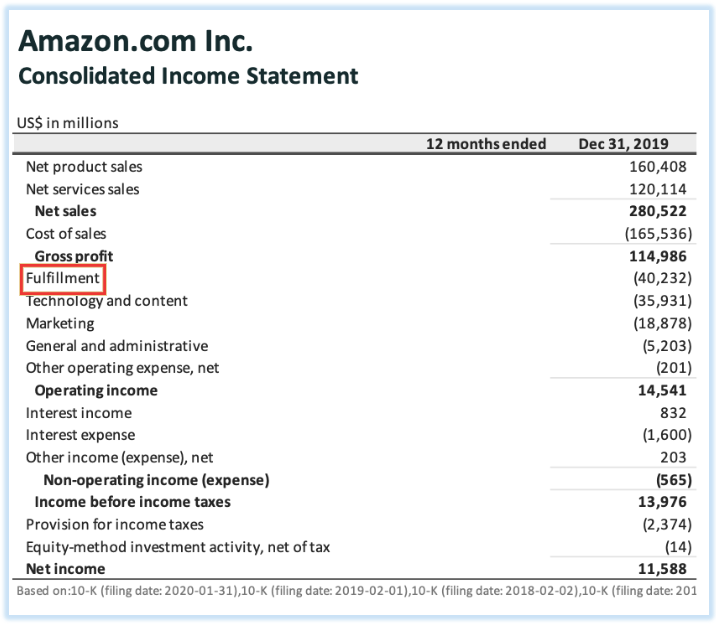

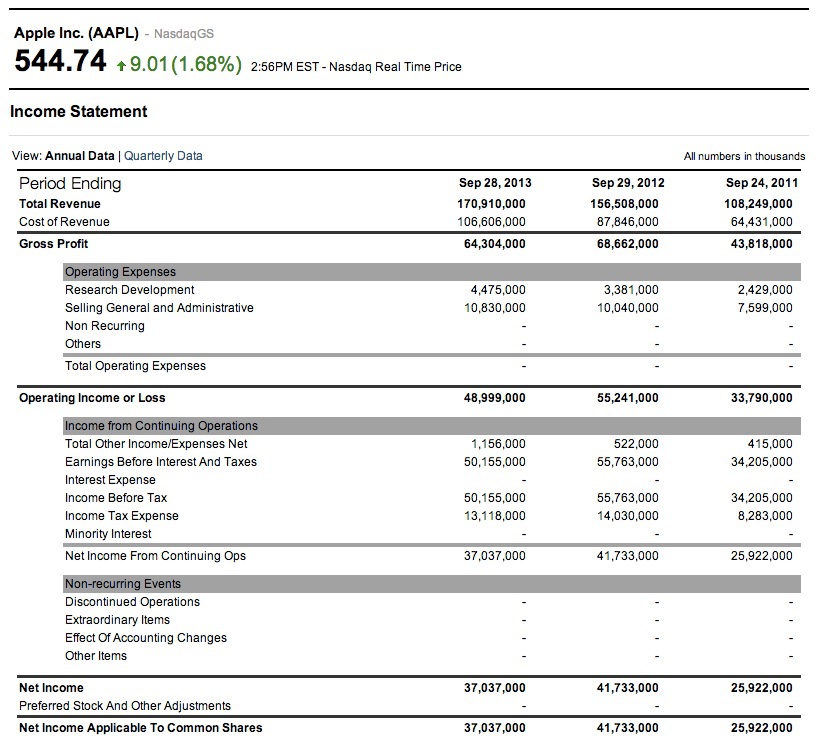

Income statement payment summary. If so all your employees will need to download their income statement from myGov. You will need to check that income from your payment summaries is included in your return. An income statement is a permanent account that tracks a business income and expenses.

ATO has decommissioned the Payment summary schedule PS and replaced it with Business Income Statements and Payment Summaries bip. Group Certificates Payment Summaries Income Statements Group certificate requirements for the 2020-21 year will be met by the Single Touch Payroll STP procedures for most employers which provide a Tax Ready Income Statement. Ad Find Pay Statement.

Both income statements and income summaries are important business accounting tools. An income statement if your employer reports to us through Single Touch Payroll STP a payment summary if your employer is not yet reporting through STP they will continue to provide you with a payment summary by 14 July. From 2021 there is a general deadline of 14 July for end-of-year finalisation.

The Income Statement is only available from your myGov account for both Department and School Local Payroll SLP employment. Income StatementPAYG Payment Summary From 2020 the PAYG - Payment Summary is now known as the Income Statement. Income Statements Payment Summaries for Financial Year 20192020.

Your employer should let you know if you will receive an income statement or payment summary but you should talk to them if you are unsure. Ad Find Pay Statement. Select your topic Manage my policy Manage my meincome account Manage my payments Download a brochure or form File a claim Purchase a policy Engage a service Enjoy your treats and benefits.

Your employer should let you know if you will receive an income statement or payment summary. For most of you this isnt necessary as youve already been reporting your employees income tax and super contributions to the ATO via STP. Historical PAYG Payment Summaries continue to be available for.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)