Stunning Segment Reporting And Interim Reporting

Segment reporting is required for publicly-held entities and is not required for privately held ones.

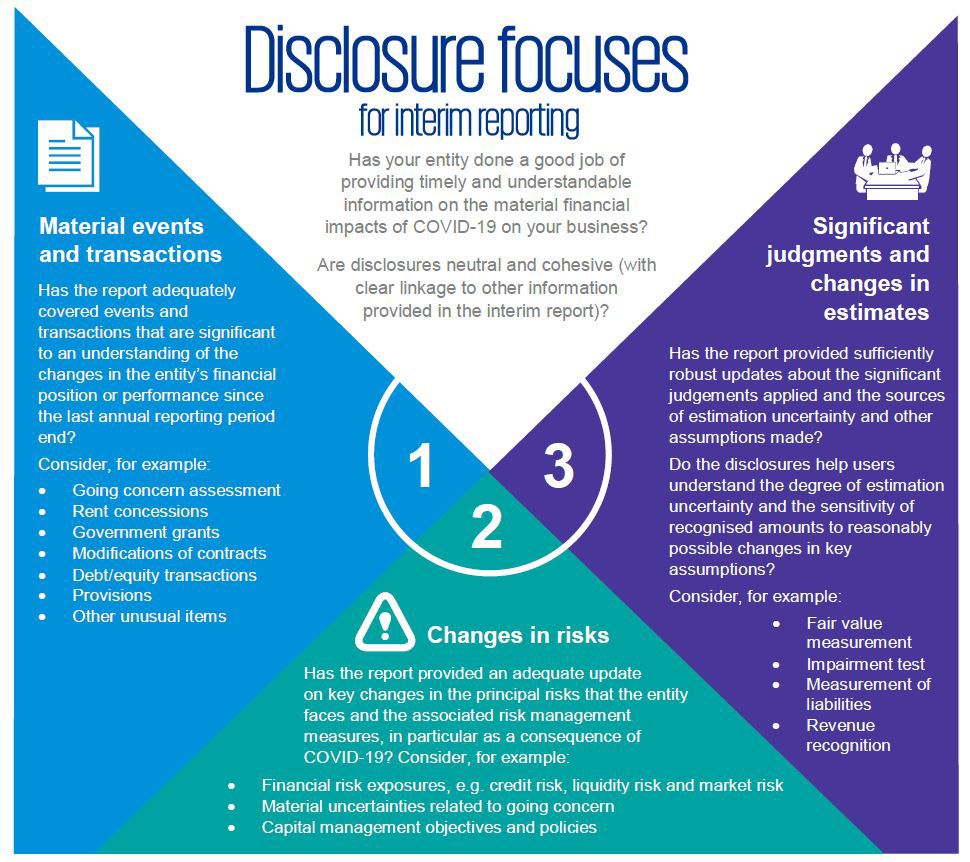

Segment reporting and interim reporting. Disclosures and User Groups of Segment Reporting. Segment reporting is the reporting of the operating segments of a company in the disclosures accompanying its financial statements. Segment Information in Interim Reports.

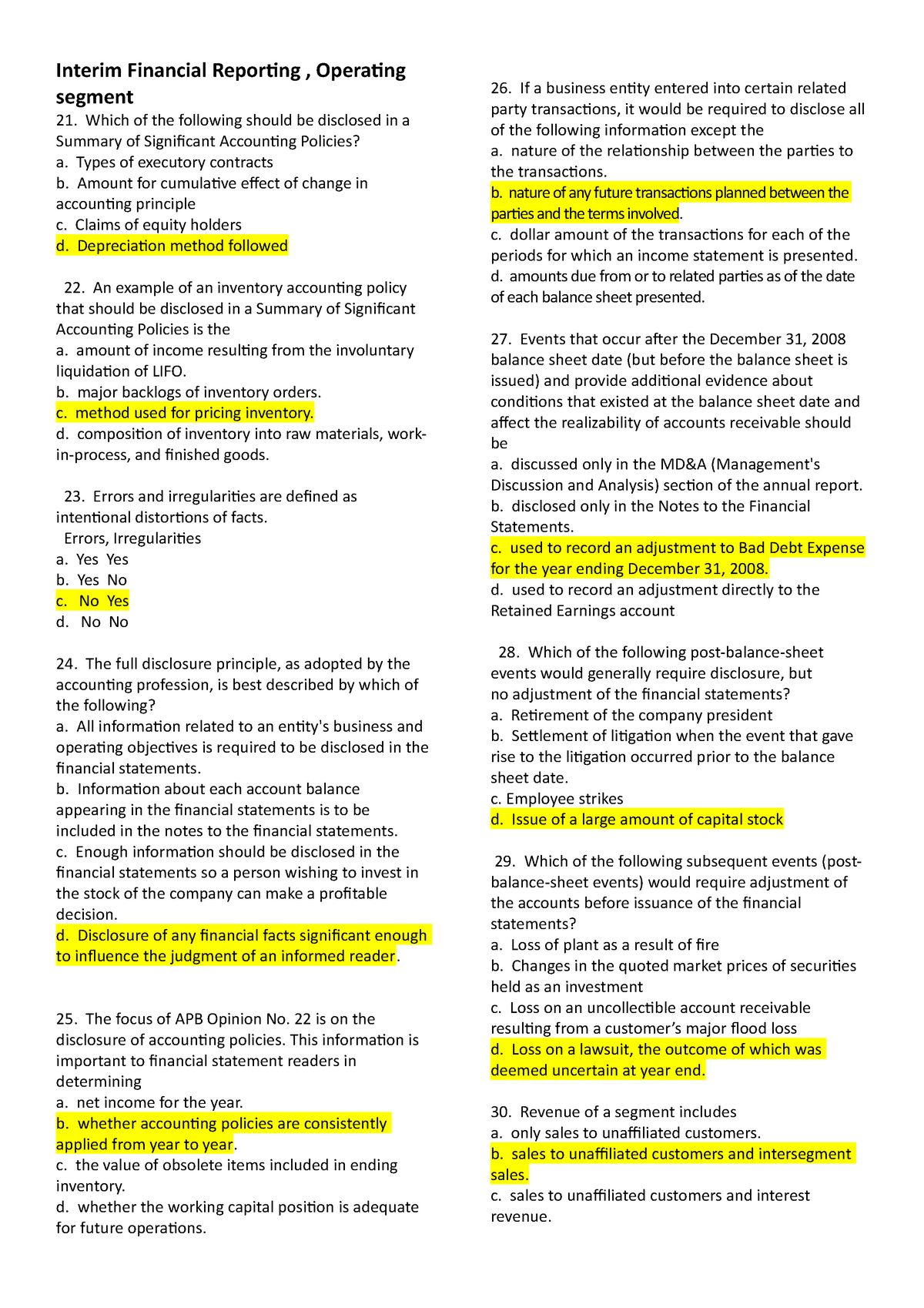

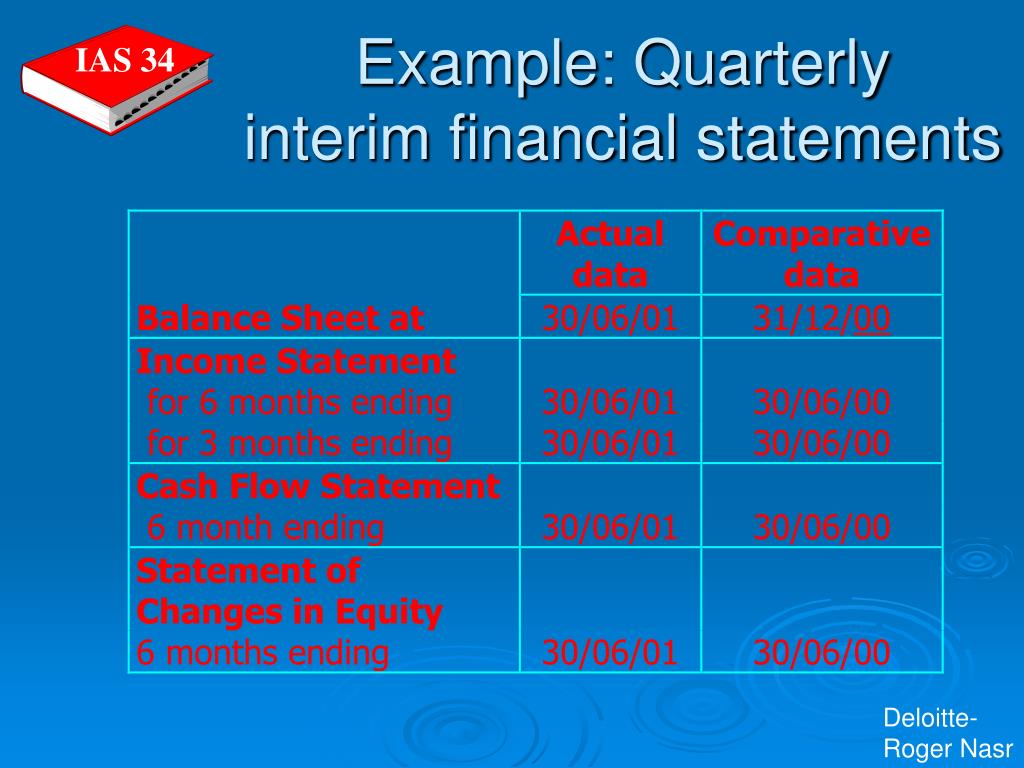

In August it sold 2000 units from its LIFO-base inventory which had originally cost 35 per unit. Requires reporting of four distinct aspects of a company Industry segments o For each segment report revenues operating profit or loss indentifiable assets aggregate amount of depreciation depletion and amortization capital expenditures equity in net income Domestic and foreign operations. Introduction to Interim Reporting.

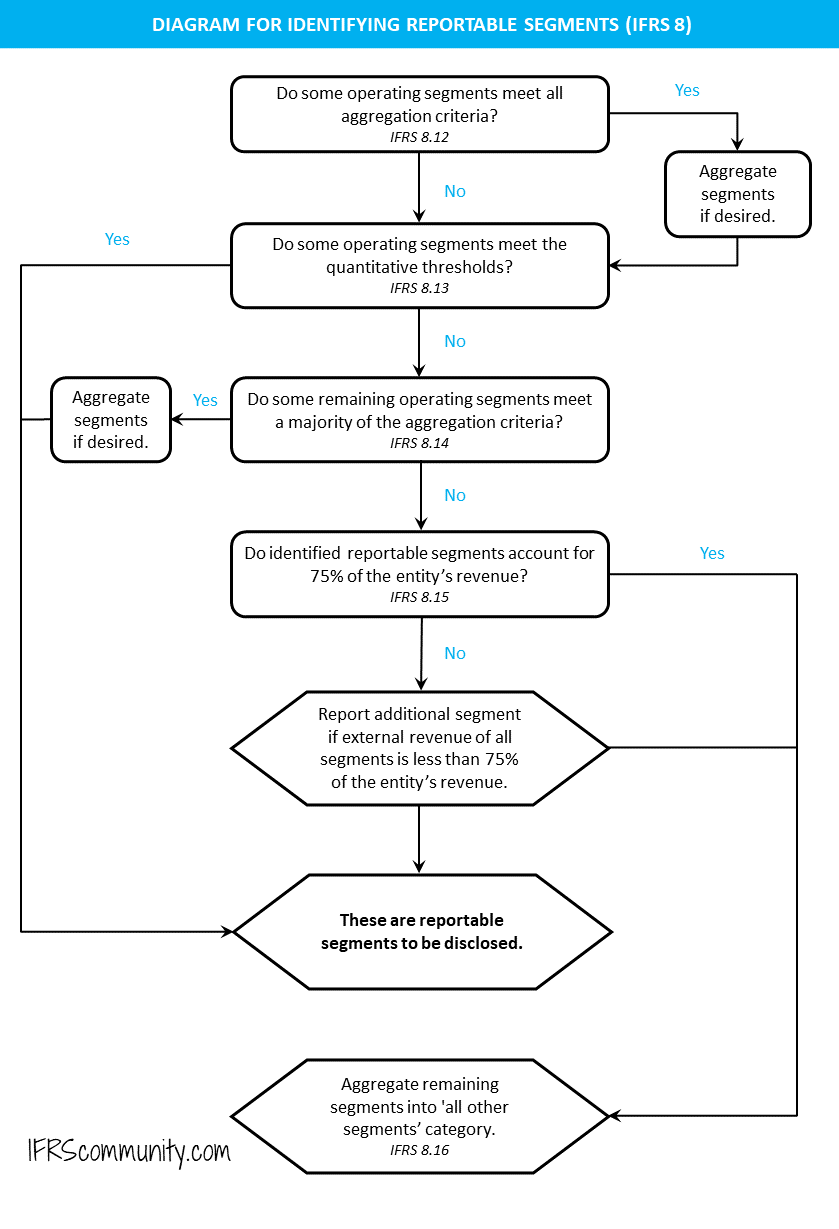

Segment reporting therefore includes a reconciliation of externally reported consolidated earnings before interest and tax EBIT including effects from purchase price allocations and non-recurring items to the adjusted EBIT for the segments. All publicly traded companies in the US are required to prepare interim reports on a quarterly basis The objective of segment reporting is to provide information about the different business activities in which an enterprise engages and the different economic environments in which it operates to help users of financial statements. Learning Objective 1 Understand the management approach to segment reporting.

Interim reporting is usually required of any company that is publicly held and it typically involves the issuance of three quarterly financial statements each. Interim reporting is the reporting of the financial results of any period that is shorter than a fiscal year. IAS 344 Interim financial report.

Segment and Interim Financial Reporting Chapter 14. Better understand the enterprises performance better assess its prospects for future net cash flows make more informed judgments An operating segment. Chapter 13 - Segment and Interim Reporting CHAPTER 13 SEGMENT AND INTERIM REPORTING ANSWERS TO QUESTIONS Q13-1 Information on a companys operations in different industries would be helpful to investors in their assessments concerning the different profit rates different degrees and types of risk and different opportunities for growth of each of the different industries.

Investors uncertainty about companys prospects will thus be reduced with the help of segment reporting. The KPIs used to manage the segments are order intake revenue and adjusted EBIT. It requires disclosures for primary and secondary segment reporting formats with the primary format based on whether the entitys risks and returns are affected predominantly by the products and services it produces or by the fact that it operates in different geographical areas.