Favorite Preliminary Expenses Treatment In Cash Flow Statement

Examples of Preliminary Expenses are.

Preliminary expenses treatment in cash flow statement. The portion which is written off from the gross profit in the current year is shown on the income statement and the remaining balance is placed in the balance sheet. Is done on EduRev Study Group by Commerce Students. Most companies incur expenses prior to being fully formed and before they start their official business operations.

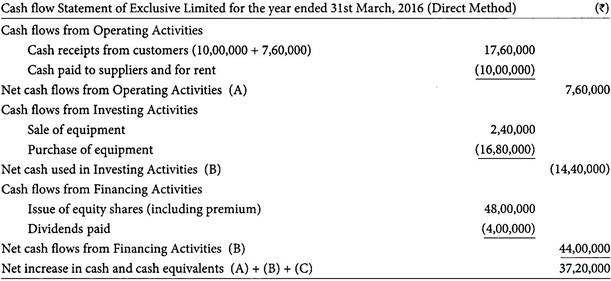

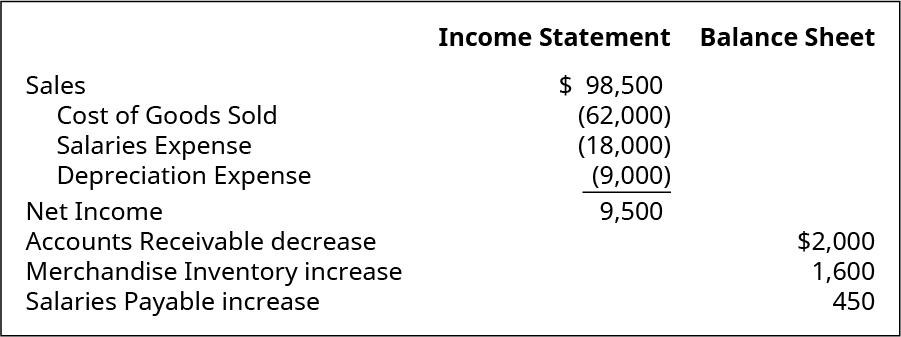

Payment of underwriting commission is treated as an outflow under financing activity. Year ended December 31 20XX Cash flows from operating activities Net income 40660000 Adjustments to reconcile net income to net cash provided by operating activities. Interest on debentures or other borrowings.

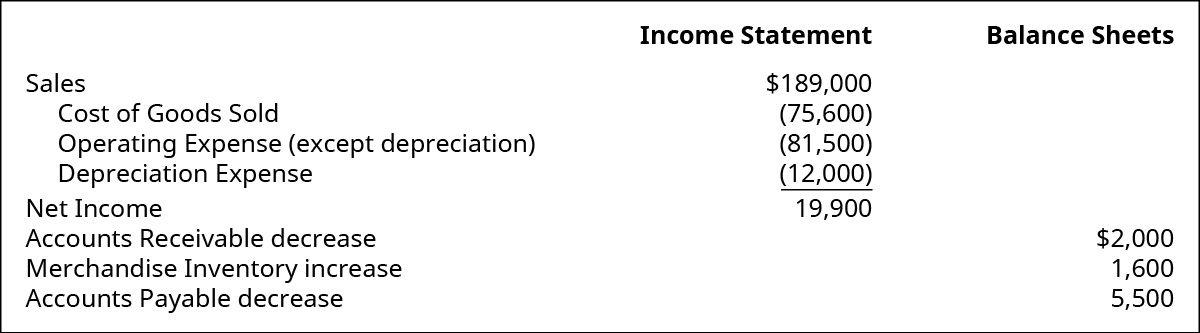

The Questions and Answers of What is the treatment of preliminary expenses while preparing cash flow statement. We know that writing off does not involve any cash outflow. Cash Paid for Operating Expenses Includes Research and Development Operating Expenses Increase or - decrease in prepaid expenses decrease or - increase in accrued liabilities.

Treatment in financial statements of company Only written off part preliminary expenses will show in expenses side of profit and loss account and balance sheet will show as balance part in asset side because it is a capital item so we will not whole preliminary expenses in profit and loss account. Preliminary expenses account Dr. Discount on issue of shares debentures or loss on issue of debentures written off.

Cash flow statement class 12 Notes Accountancy in PDF are available for free download in myCBSEguide mobile app. Net income is that for which all taxes and other costs have been deducted also known as. Goodwill patents trademarks etc written off.

Cash Interest Interest Expense - increase or decrease in interest payable amortization of bond premium or - discount. Underwriting commission is also an expense related to issue of shares. Prepare Cash Flow StatementSolution.